Region:Global

Author(s):Dev

Product Code:KRAA1650

Pages:95

Published On:August 2025

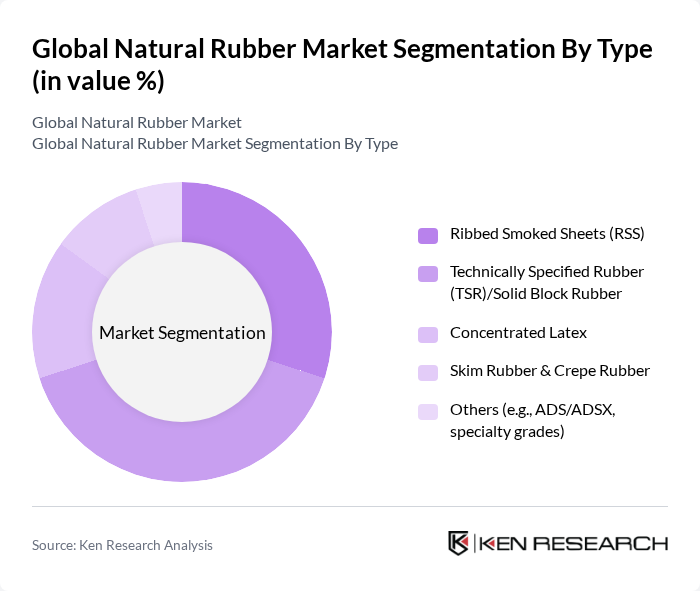

By Type:The market is segmented into various types of natural rubber, including Ribbed Smoked Sheets (RSS), Technically Specified Rubber (TSR)/Solid Block Rubber, Concentrated Latex, Skim Rubber & Crepe Rubber, and Others (e.g., ADS/ADSX, specialty grades). Each type serves different applications and industries, influencing their market dynamics.

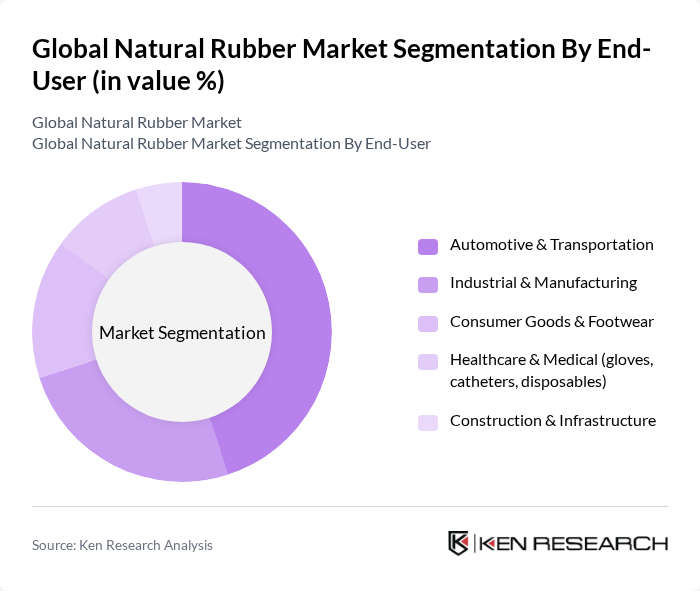

By End-User:The end-user segmentation includes Automotive & Transportation, Industrial & Manufacturing, Consumer Goods & Footwear, Healthcare & Medical (gloves, catheters, disposables), and Construction & Infrastructure. Each sector has unique requirements and contributes differently to the overall demand for natural rubber.

The Global Natural Rubber Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sri Trang Agro-Industry Public Company Limited, Halcyon Agri Corporation Limited, Von Bundit Co., Ltd., Southland Rubber Group, Thai Rubber Latex Corporation (Thailand) Public Company Limited, Tradewinds Plantation Berhad, Sinochem International (including Halcyon Agri), China Hainan Rubber Industry Group Co., Ltd. (Hainan Rubber), Corrie MacColl (a member of HL Hutchison group), Kun Rubber Co., Ltd., Lee Rubber Company (Pte) Ltd, Bridgestone Corporation, Michelin Group, Goodyear Tire & Rubber Company, Yokohama Rubber Company, Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the natural rubber market is poised for transformation, driven by technological advancements and a shift towards sustainability. Innovations in rubber processing technologies are expected to enhance production efficiency and reduce environmental impact. Additionally, the growing emphasis on eco-friendly products will likely lead to increased demand for natural rubber in various applications, including medical and biodegradable products, aligning with global sustainability goals and consumer preferences for greener alternatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Ribbed Smoked Sheets (RSS) Technically Specified Rubber (TSR)/Solid Block Rubber Concentrated Latex Skim Rubber & Crepe Rubber Others (e.g., ADS/ADSX, specialty grades) |

| By End-User | Automotive & Transportation Industrial & Manufacturing Consumer Goods & Footwear Healthcare & Medical (gloves, catheters, disposables) Construction & Infrastructure |

| By Application | Tires & Tire Components Gloves (medical and industrial) Footwear Belts, Hoses & Seals Adhesives & Latex Products (foam, dipped goods) Others |

| By Distribution Channel | Direct Sales (producers to OEMs/end users) Traders/Distributors Commodity Exchanges & Brokers Online/B2B Platforms Retail/Secondary Markets |

| By Region | Asia-Pacific North America Europe Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Quality Grade | Standard Grade (e.g., RSS3, TSR20) Premium Grade (e.g., RSS1, TSR10, latex HA) Industrial Grade/Off-spec |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tire Manufacturing Sector | 120 | Production Managers, Supply Chain Analysts |

| Footwear Industry | 100 | Product Development Managers, Procurement Specialists |

| Rubber Goods Manufacturing | 80 | Operations Managers, Quality Control Supervisors |

| Automotive Parts Suppliers | 70 | Sales Directors, Logistics Coordinators |

| Research Institutions and NGOs | 60 | Environmental Scientists, Policy Analysts |

The Global Natural Rubber Market is valued at approximately USD 32 billion, driven by increasing demand in industries such as automotive and manufacturing, along with a growing consumer preference for eco-friendly products.