Region:Global

Author(s):Shubham

Product Code:KRAA1726

Pages:94

Published On:August 2025

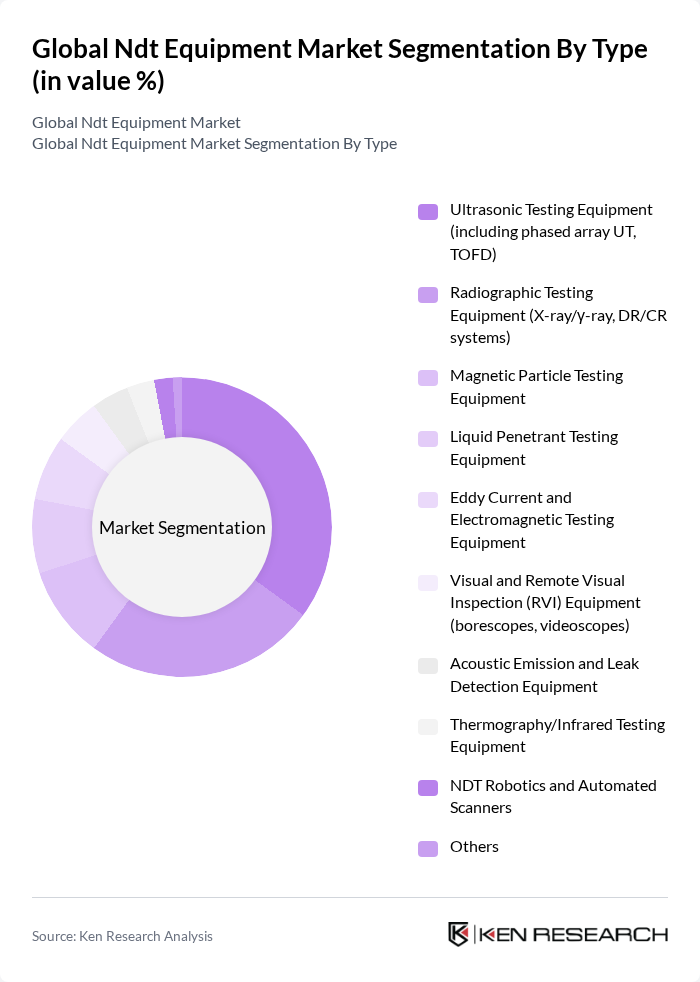

By Type:The NDT equipment market is segmented into various types, including Ultrasonic Testing Equipment, Radiographic Testing Equipment, Magnetic Particle Testing Equipment, Liquid Penetrant Testing Equipment, Eddy Current and Electromagnetic Testing Equipment, Visual and Remote Visual Inspection Equipment, Acoustic Emission and Leak Detection Equipment, Thermography/Infrared Testing Equipment, NDT Robotics and Automated Scanners, and Others. Among these, Ultrasonic Testing Equipment is the most dominant segment due to its versatility and effectiveness in detecting internal flaws in materials.

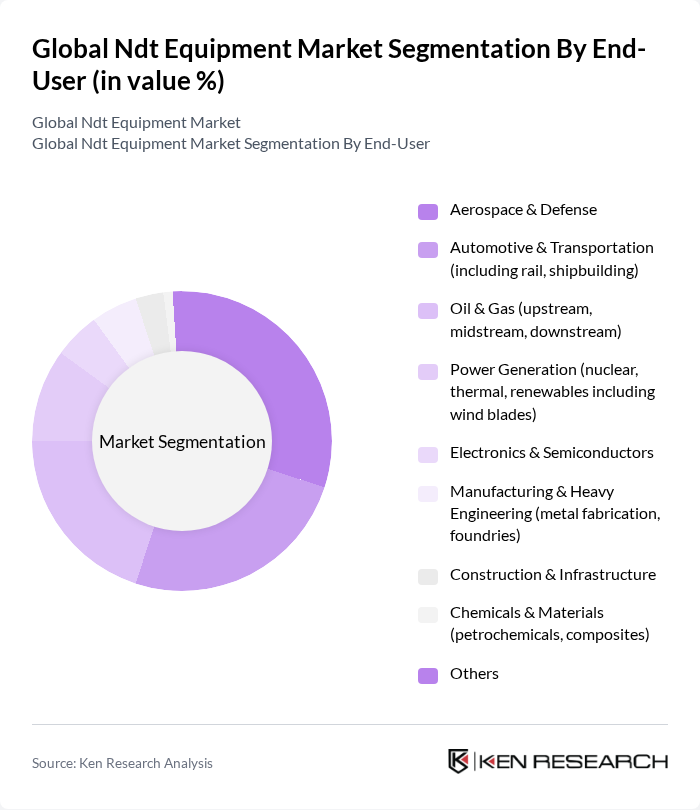

By End-User:The end-user segmentation includes Aerospace & Defense, Automotive & Transportation, Oil & Gas, Power Generation, Electronics & Semiconductors, Manufacturing & Heavy Engineering, Construction & Infrastructure, Chemicals & Materials, and Others. The Aerospace & Defense sector is the leading end-user, driven by stringent safety regulations and the need for high-quality assurance in aircraft manufacturing and maintenance.

The Global NDT Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Waygate Technologies (Baker Hughes), Evident Corporation (formerly Olympus Scientific Solutions), Zetec, Inc. (Eddyfi/NDT), Sonatest Ltd., Eddyfi Technologies, Rohmann GmbH, YXLON International (Comet Yxlon), Teledyne ICM/Teledyne FLIR, Nikon Industrial Metrology (X-ray CT & inspection), Magnaflux (Illinois Tool Works), Fischer Technology, Inc. (Helmut Fischer), Baker Hughes – Panametrics (ultrasonic thickness/flow), Mistras Group, Inc., Intertek Group plc, SGS S.A., Acuren Group Inc., TWI Ltd., Applus+, Bureau Veritas S.A., Element Materials Technology, TÜV Rheinland AG, FOERSTER Group (Institut Dr. Foerster), NDT Systems, Inc., Sonotron NDT, ibg NDT Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the NDT equipment market appears promising, driven by technological advancements and increasing regulatory demands. As industries continue to prioritize safety and quality assurance, the integration of AI and machine learning into NDT processes is expected to enhance efficiency and accuracy. Furthermore, the growing emphasis on sustainability will likely lead to the development of eco-friendly NDT solutions, aligning with global environmental goals and fostering innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Ultrasonic Testing Equipment (including phased array UT, TOFD) Radiographic Testing Equipment (X-ray/?-ray, DR/CR systems) Magnetic Particle Testing Equipment Liquid Penetrant Testing Equipment Eddy Current and Electromagnetic Testing Equipment Visual and Remote Visual Inspection (RVI) Equipment (borescopes, videoscopes) Acoustic Emission and Leak Detection Equipment Thermography/Infrared Testing Equipment NDT Robotics and Automated Scanners Others |

| By End-User | Aerospace & Defense Automotive & Transportation (including rail, shipbuilding) Oil & Gas (upstream, midstream, downstream) Power Generation (nuclear, thermal, renewables including wind blades) Electronics & Semiconductors Manufacturing & Heavy Engineering (metal fabrication, foundries) Construction & Infrastructure Chemicals & Materials (petrochemicals, composites) Others |

| By Application | Quality Control & Production Inspection In-service Maintenance & Asset Integrity Research & Development and Failure Analysis Safety and Regulatory Compliance Inspections Corrosion/Wall Thickness Monitoring Weld Inspection and Pipeline Integrity Others |

| By Distribution Channel | Direct Sales (OEM to end user) Authorized Distributors & System Integrators Online Sales (OEM e-commerce, marketplaces) Rental & Leasing Channels Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Range (handheld gauges, basic flaw detectors) Mid Range (portable phased array, RVI systems) High Range (industrial DR/CT, automated scanners, robotics) |

| By Technology | Conventional NDT Advanced NDT (PAUT, TOFD, DR/CR, CT, IR, AE) Automated & Digital NDT (robotics, scanners, software/AI-enabled) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace NDT Applications | 120 | Quality Assurance Managers, NDT Technicians |

| Automotive Industry Inspections | 90 | Production Engineers, Safety Compliance Officers |

| Construction Sector Quality Control | 60 | Site Managers, Structural Engineers |

| Oil & Gas Pipeline Inspections | 100 | Maintenance Supervisors, Safety Inspectors |

| Manufacturing Process Monitoring | 80 | Process Engineers, Operations Managers |

The Global NDT Equipment Market is valued at approximately USD 3.9 billion, reflecting a significant growth trend driven by increasing demand for non-destructive testing across various industries, including aerospace, automotive, and oil & gas.