Region:Global

Author(s):Shubham

Product Code:KRAA1876

Pages:100

Published On:August 2025

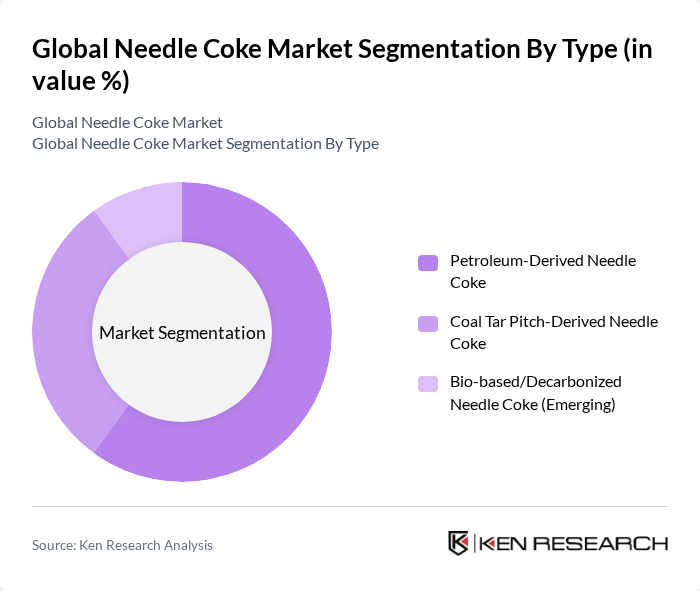

By Type:The needle coke market is segmented into three main types: Petroleum-Derived Needle Coke, Coal Tar Pitch-Derived Needle Coke, and Bio-based/Decarbonized Needle Coke (Emerging). Petroleum-derived needle coke is widely used for premium graphite electrodes due to consistency and performance requirements in EAF steelmaking. Coal tar pitch-derived needle coke remains important in select electrode and specialty carbon applications. Bio-based or decarbonized routes are at an early stage, reflecting R&D and pilot activity aligned with sustainability objectives in steel and battery supply chains .

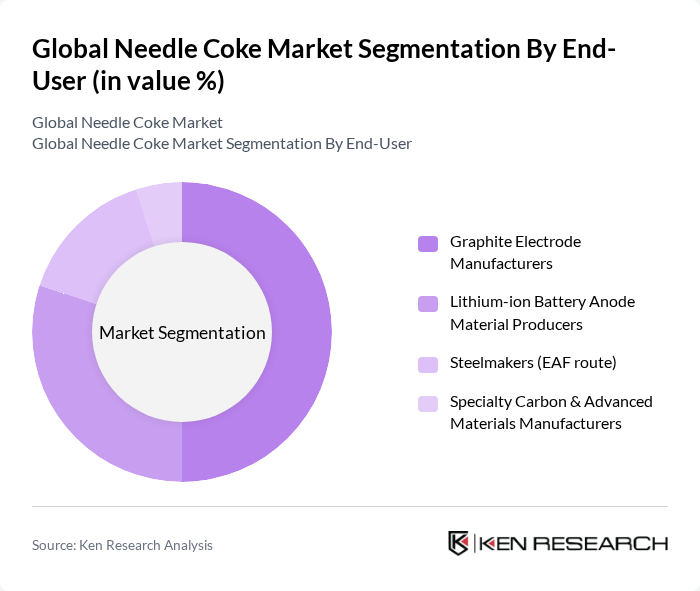

By End-User:The end-user segmentation includes Graphite Electrode Manufacturers, Lithium-ion Battery Anode Material Producers, Steelmakers (EAF route), and Specialty Carbon & Advanced Materials Manufacturers. Graphite electrode manufacturers dominate demand given the criticality of electrodes for EAF steelmaking. Battery anode materials represent a growing outlet as EV and energy storage production expands. Steelmakers and specialty carbon users contribute steady demand relative to the faster?rising battery sector .

The Global Needle Coke Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsubishi Chemical Group Corporation (formerly Mitsubishi Chemical Corporation), Phillips 66 Company, Seadrift Coke L.P. (a GrafTech company), GrafTech International Ltd., C-Chem Co., Ltd. (OCI Company Ltd. subsidiary), Asbury Carbons, Inc., JXTG Nippon Oil & Gas Exploration Corporation (ENEOS Group) – needle coke operations, Tokai Carbon Co., Ltd., Sinosteel Corporation, Carbone Savoie S.A.S., Koppers Inc., Resonac Holdings Corporation (formerly Showa Denko K.K.), Danyang Shuguang Carbon Co., Ltd., Jiangxi Black Cat Carbon Black Co., Ltd., Hubei Xinyang Carbon Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The needle coke market is poised for significant transformation as sustainability becomes a central focus in production practices. Innovations in production technologies are expected to enhance efficiency and reduce environmental impact, aligning with global sustainability goals. Additionally, the increasing integration of needle coke in advanced applications, such as energy storage and high-performance materials, will drive demand. As industries adapt to these trends, the market is likely to witness robust growth, supported by strategic partnerships and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Petroleum-Derived Needle Coke Coal Tar Pitch-Derived Needle Coke Bio-based/Decarbonized Needle Coke (Emerging) |

| By End-User | Graphite Electrode Manufacturers Lithium-ion Battery Anode Material Producers Steelmakers (EAF route) Specialty Carbon & Advanced Materials Manufacturers |

| By Application | Graphite Electrode Production (UHP/HP) Lithium-ion Battery Anode (Synthetic Graphite) Specialty Carbon Products (e.g., carbon fiber, nuclear graphite) Others |

| By Distribution Channel | Direct (Producer-to-OEM) Distributors/Traders Long-term Offtake/Contract Sales Spot/Short-term Sales |

| By Region | North America (U.S., Canada) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Standard Grade Premium Grade Super Premium/UHP Grade |

| By Quality Grade | Intermediate Premium Super Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electrode Manufacturing Sector | 120 | Production Managers, Quality Control Supervisors |

| Battery Production Facilities | 95 | R&D Managers, Procurement Specialists |

| Steel Industry Applications | 110 | Operations Directors, Supply Chain Analysts |

| Carbon Material Research Institutions | 60 | Research Scientists, Technical Directors |

| Petroleum Refining Companies | 55 | Process Engineers, Product Development Managers |

The Global Needle Coke Market is valued at approximately USD 4.7 billion, reflecting significant growth driven by demand for graphite electrodes in electric arc furnaces and the rising production of lithium-ion batteries for electric vehicles and energy storage solutions.