Region:Global

Author(s):Shubham

Product Code:KRAA3193

Pages:82

Published On:August 2025

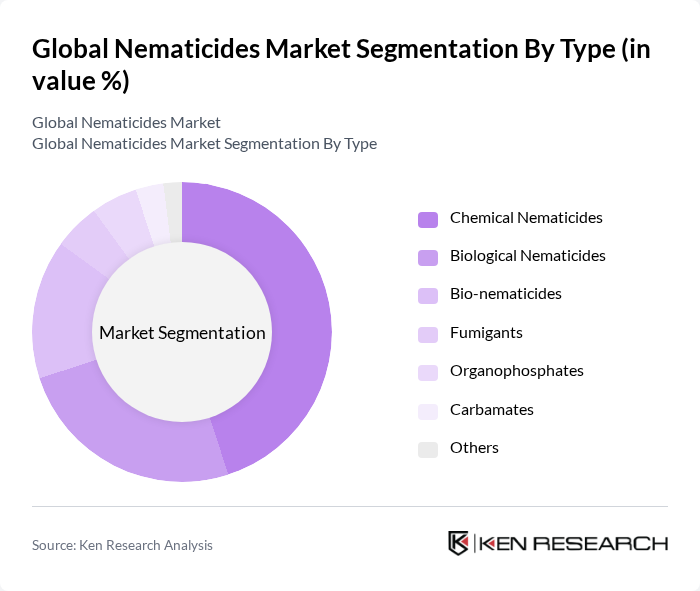

By Type:The market is segmented into Chemical Nematicides, Biological Nematicides, Bio-nematicides, Fumigants, Organophosphates, Carbamates, and Others. Chemical Nematicides remain the most widely used due to their rapid and effective action against nematodes. However, there is a clear trend toward increased adoption of Biological and Bio-nematicides, as growers seek environmentally responsible and residue-free crop protection solutions in response to regulatory pressures and consumer demand .

By Application:Nematicides are applied across Crop Protection, Soil Treatment, Seed Treatment, Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, and Others. Crop Protection is the dominant application segment, driven by the need to prevent yield and quality losses from nematode infestations. Soil and seed treatments are also gaining traction as integrated pest management practices become more widespread .

The Global Nematicides Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, FMC Corporation, Bayer AG, Corteva Agriscience, ADAMA Agricultural Solutions Ltd., UPL Limited, Nufarm Limited, Marrone Bio Innovations, Inc., Certis Biologicals, Isagro S.p.A., Sumitomo Chemical Co., Ltd., Arysta LifeScience Corporation, BioWorks, Inc., Valent BioSciences LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nematicides market appears promising, driven by the increasing adoption of integrated pest management (IPM) practices and precision agriculture technologies. As farmers seek to optimize yields while minimizing environmental impact, the demand for innovative and eco-friendly nematicides is expected to rise. Additionally, the expansion of e-commerce platforms for agricultural products will facilitate easier access to these solutions, enhancing market penetration and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Nematicides Biological Nematicides Bio-nematicides Fumigants Organophosphates Carbamates Others |

| By Application | Crop Protection Soil Treatment Seed Treatment Grains and Cereals Pulses and Oilseeds Commercial Crops Fruits and Vegetables Others |

| By Crop Type | Fruits and Vegetables Cereals and Grains Oilseeds Pulses Commercial Crops Others |

| By Formulation | Granules Liquids Emulsifiable Concentrates Soluble Powders Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | North America (United States, Canada) Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others) Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others) Latin America (Brazil, Mexico, Others) Middle East & Africa |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Producers | 100 | Farm Owners, Agronomists |

| Vegetable Growers | 80 | Crop Managers, Agricultural Advisors |

| Fruit Orchard Operators | 60 | Farm Managers, Pest Control Specialists |

| Agrochemical Distributors | 50 | Sales Representatives, Supply Chain Managers |

| Research Institutions | 40 | Research Scientists, Policy Analysts |

The Global Nematicides Market is valued at approximately USD 1.8 billion, driven by increasing food production demands, agricultural expansion, and the need for effective pest management solutions. This market is expected to grow further due to innovations and sustainable farming practices.