Region:Global

Author(s):Dev

Product Code:KRAB0593

Pages:84

Published On:August 2025

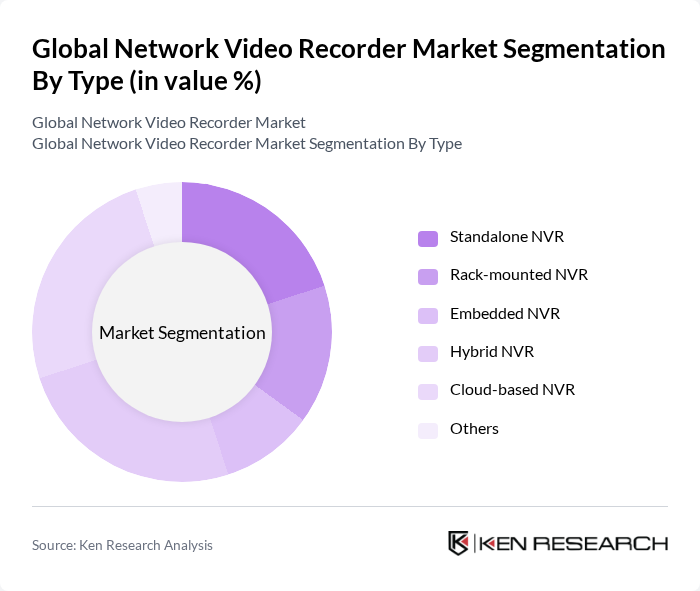

By Type:The market is segmented into Standalone NVR, Rack-mounted NVR, Embedded NVR, Hybrid NVR, Cloud-based NVR, and Others. The Cloud-based NVR segment is gaining significant traction due to its scalability, remote accessibility, and lower upfront costs, making it attractive for both small businesses and large enterprises. Hybrid NVR solutions, which combine on-premises and cloud capabilities, are increasingly sought after for their flexibility, enhanced data redundancy, and improved security management.

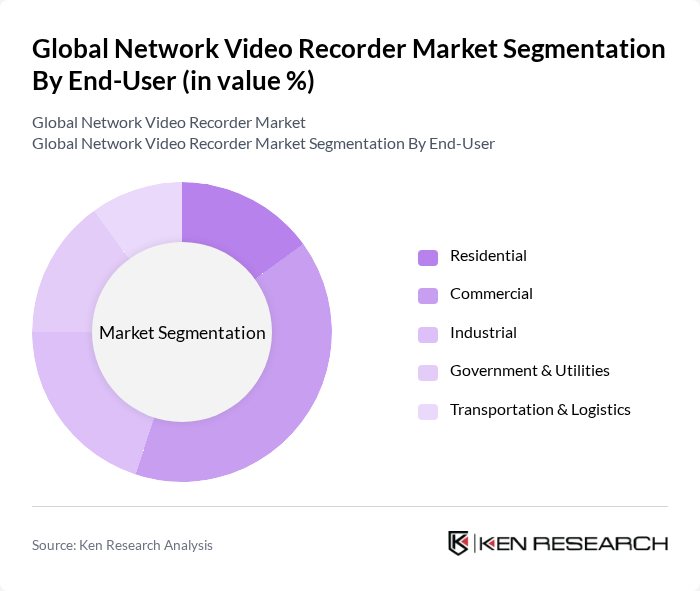

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Transportation & Logistics. The Commercial segment leads the market, driven by the increasing need for advanced security in retail, offices, and hospitality environments. The Transportation & Logistics sector is experiencing notable growth due to the rising adoption of surveillance for fleet management, warehouse security, and supply chain monitoring. Industrial and government sectors are also expanding their NVR deployments to address compliance and safety requirements.

The Global Network Video Recorder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications AB, Bosch Security Systems GmbH, Hanwha Vision Co., Ltd., FLIR Systems, Inc. (Teledyne FLIR LLC), Panasonic Holdings Corporation, Honeywell International Inc., Avigilon Corporation (Motorola Solutions), Genetec Inc., Milestone Systems A/S, Verint Systems Inc., QNAP Systems, Inc., NETGEAR, Inc., and D-Link Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the NVR market is poised for significant transformation, driven by technological advancements and evolving consumer needs. As organizations increasingly prioritize cybersecurity, NVR systems will likely incorporate robust security features to protect sensitive data. Additionally, the integration of AI and machine learning will enhance video analytics capabilities, enabling smarter surveillance solutions. The trend towards hybrid cloud solutions will also gain traction, offering flexibility and scalability to meet diverse operational requirements in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Standalone NVR Rack-mounted NVR Embedded NVR Hybrid NVR Cloud-based NVR Others |

| By End-User | Residential Commercial Industrial Government & Utilities Transportation & Logistics |

| By Application | Retail Security Traffic Monitoring Building Management Home Automation Critical Infrastructure Protection Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Value-Added Resellers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End NVR Mid-Range NVR High-End NVR |

| By Technology | IP-based NVR Cloud-based NVR On-premises NVR Edge-based NVR AI-enabled NVR Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Security Systems | 100 | Security Managers, IT Directors |

| Transportation Surveillance Solutions | 60 | Operations Managers, Fleet Supervisors |

| Public Safety Applications | 50 | City Planners, Law Enforcement Officials |

| Corporate Security Installations | 40 | Facility Managers, Risk Assessment Officers |

| Smart Home Security Systems | 45 | Homeowners, Technology Enthusiasts |

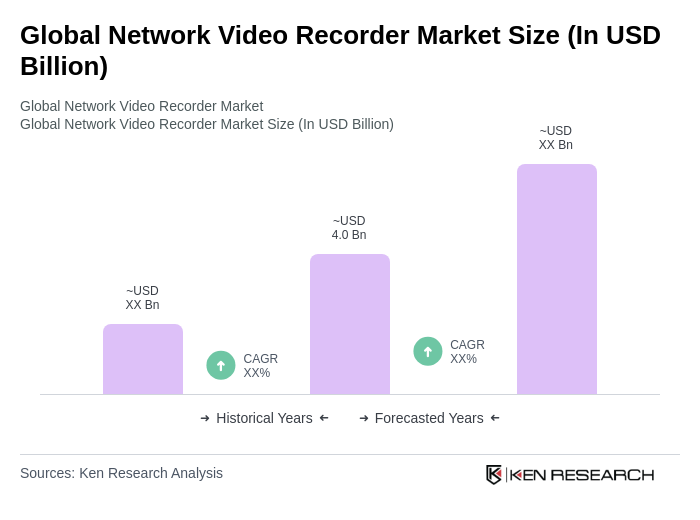

The Global Network Video Recorder Market is valued at approximately USD 4.0 billion, driven by the increasing demand for surveillance systems across various sectors, including residential, commercial, and industrial applications.