Region:Global

Author(s):Dev

Product Code:KRAB0420

Pages:90

Published On:August 2025

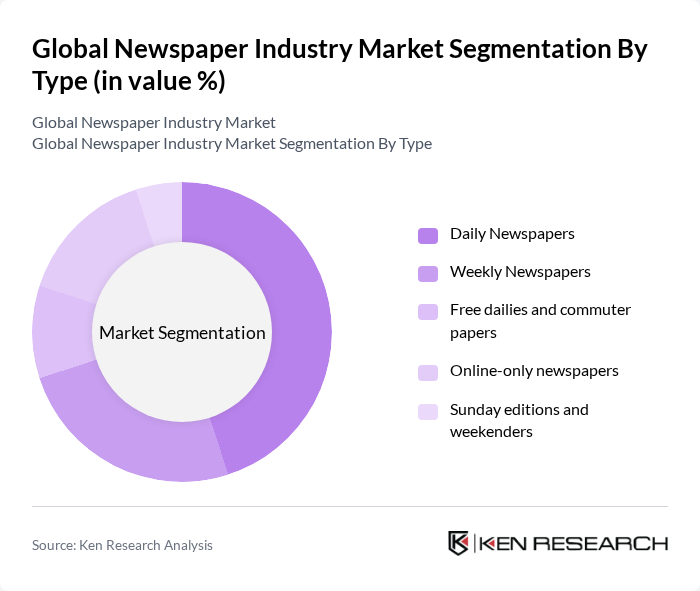

By Type:The newspaper industry is segmented into daily newspapers, weekly newspapers, free dailies and commuter papers, online-only newspapers, and Sunday editions and weekenders. Daily newspapers remain central to publisher operations in many markets, but audience time has shifted materially to digital formats. Online-only newspapers and digital editions continue to expand due to convenience, mobile access, and paywalled premium content strategies; free dailies/commuter titles have generally contracted alongside changing commuting patterns and print economics .

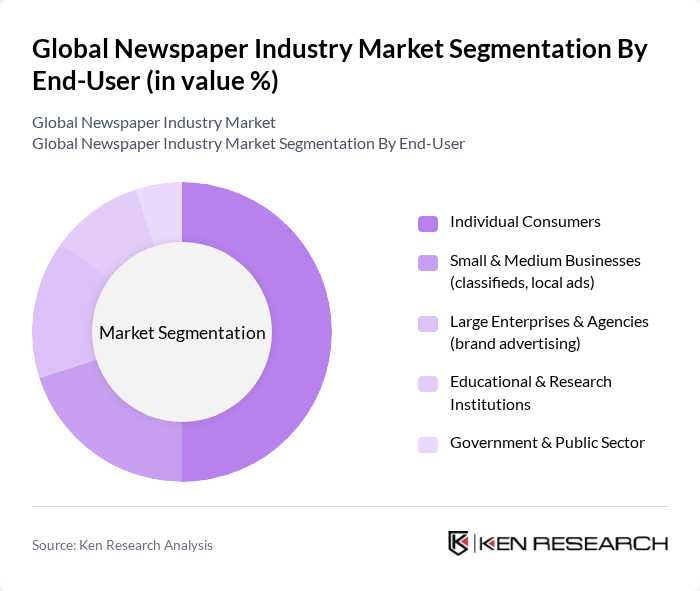

By End-User:The end-user segmentation of the newspaper industry includes individual consumers, small and medium businesses, large enterprises and agencies, educational and research institutions, and government and public sector entities. Individual consumers dominate through direct subscriptions and retail purchases. Small and medium businesses rely on newspapers (increasingly digital) for local and targeted advertising, while large enterprises focus on brand campaigns and sponsorships. Educational institutions use newspapers for research and curriculum content access, and government entities employ them for public notices and outreach, complemented by digital dissemination .

The Global Newspaper Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as The New York Times Company, News Corp (Dow Jones, The Wall Street Journal, The Times), Gannett Co., Inc. (USA Today Network), Tribune Publishing Company (Chicago Tribune, others), Hearst Communications, Inc. (Houston Chronicle, San Francisco Chronicle), Axel Springer SE (Die Welt, Bild), Guardian Media Group (The Guardian, The Observer), The Washington Post (Nash Holdings), The McClatchy Company, Bonnier AB (Dagens Nyheter via Bonnier News), Mediahuis NV (The Independent, Irish Independent), Reach plc (The Mirror, Daily Express), Schibsted ASA (Aftenposten, VG), Nikkei Inc. (Financial Times, Nikkei), Grupo Clarín S.A. (Clarín) contribute to innovation, geographic expansion, and service delivery through digital subscription growth, first?party data advertising, and international content licensing .

The future of the newspaper industry is poised for transformation, driven by technological advancements and evolving consumer preferences. As digital consumption continues to rise, newspapers will increasingly leverage data analytics to tailor content and enhance user engagement. Additionally, the integration of artificial intelligence in content creation and distribution will streamline operations, allowing for more personalized news experiences. This evolution will enable newspapers to adapt to market demands while exploring innovative revenue models that align with changing consumer behaviors.

| Segment | Sub-Segments |

|---|---|

| By Type | Daily Newspapers Weekly Newspapers Free dailies and commuter papers Online-only newspapers Sunday editions and weekenders |

| By End-User | Individual Consumers Small & Medium Businesses (classifieds, local ads) Large Enterprises & Agencies (brand advertising) Educational & Research Institutions Government & Public Sector |

| By Distribution Channel | Home delivery & direct sales Digital subscriptions & paywalls Retail outlets & supermarkets Newsstands & kiosks Aggregators & third-party platforms |

| By Content Type | General news & politics Business & finance Sports & entertainment Investigations & special reports Classifieds & notices |

| By Revenue Model | Subscription-based (print and digital) Advertising-based (display, programmatic, classifieds) Hybrid (bundled subs + ads + memberships) Licensing & syndication |

| By Format | Print (broadsheet, tabloid) Digital (web, app, e-paper) Mobile-first formats Audio & newsletters |

| By Geographic Reach | Local & regional newspapers National newspapers International & global titles Diaspora & language editions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| National Newspaper Publishers | 100 | CEOs, CFOs, and Editorial Heads |

| Local Newspaper Circulation Managers | 80 | Circulation Directors, Marketing Managers |

| Digital Advertising Executives | 75 | Digital Marketing Directors, Ad Sales Managers |

| Reader Engagement Specialists | 60 | Audience Development Managers, Content Strategists |

| Media Analysts and Researchers | 50 | Market Analysts, Research Directors |

The Global Newspaper Industry Market is valued at approximately USD 90 billion, reflecting a decline in print revenues while digital subscriptions and licensing are on the rise. The market is projected to remain within the USD 8090 billion range in the coming years.