Region:Global

Author(s):Dev

Product Code:KRAA2195

Pages:93

Published On:August 2025

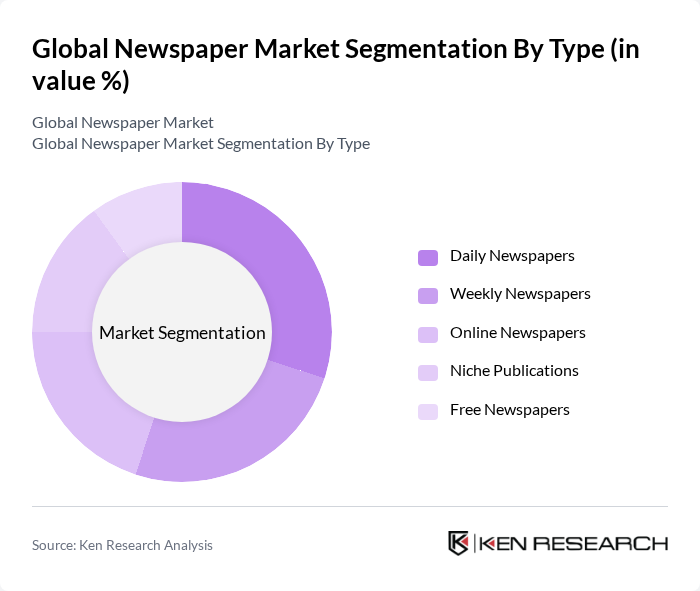

By Type:The newspaper market is segmented into Daily Newspapers, Weekly Newspapers, Online Newspapers, Niche Publications, and Free Newspapers. Daily newspapers focus on providing up-to-date news and analysis, while weekly newspapers often emphasize in-depth reporting and community news. Online newspapers have seen significant growth due to the rise of digital consumption, offering real-time updates and multimedia content. Niche publications cater to specialized interests or industries, and free newspapers are typically distributed in high-traffic urban areas, relying on advertising revenue rather than subscriptions .

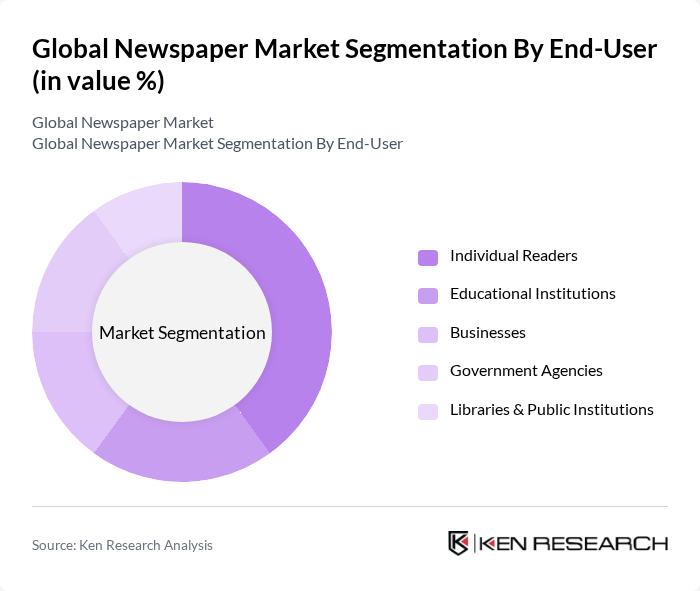

By End-User:The end-user segmentation includes Individual Readers, Educational Institutions, Businesses, Government Agencies, and Libraries & Public Institutions. Individual readers represent the largest segment, driven by both print and digital subscriptions. Educational institutions and libraries utilize newspapers for research and curriculum support, while businesses and government agencies rely on timely news for decision-making and public communication. Each segment exhibits distinct consumption patterns, influencing content delivery and monetization strategies .

The Global Newspaper Market is characterized by a dynamic mix of regional and international players. Leading participants such as The New York Times Company, News Corp, Gannett Co., Inc., Tribune Publishing Company, Hearst Communications, Inc., Axel Springer SE, Guardian Media Group, The Washington Post Company, The McClatchy Company, Bonnier AB, TEGNA Inc., Digital First Media (MNG Enterprises, Inc.), Advance Publications, Inc., The Economist Group, and Nikkei Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the newspaper industry is poised for transformation, driven by technological advancements and changing consumer preferences. As digital subscriptions continue to rise, newspapers will increasingly focus on enhancing their online presence and diversifying content offerings. Innovations in multimedia storytelling and the integration of artificial intelligence will play a crucial role in attracting and retaining readers. Furthermore, the emphasis on local news and community engagement will likely strengthen the bond between newspapers and their audiences, fostering a more sustainable business model.

| Segment | Sub-Segments |

|---|---|

| By Type | Daily Newspapers Weekly Newspapers Online Newspapers Niche Publications Free Newspapers |

| By End-User | Individual Readers Educational Institutions Businesses Government Agencies Libraries & Public Institutions |

| By Distribution Channel | Direct Sales Online Subscriptions Retail Outlets Newsstands Aggregator Platforms |

| By Content Type | News Articles Opinion Pieces Advertisements Special Reports Multimedia Content (Video/Audio) |

| By Format | Print Format Digital Format Mobile Format E-paper Format |

| By Subscription Model | Freemium Model Paid Subscriptions Ad-Supported Model Hybrid Model |

| By Geographic Reach | Local Newspapers Regional Newspapers National Newspapers International Newspapers Community Newspapers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| National Daily Newspapers | 60 | Editors, Circulation Managers |

| Local Community Newspapers | 50 | Publishers, Advertising Directors |

| Digital-First News Outlets | 40 | Content Strategists, Digital Marketing Managers |

| Advertising Agencies Focused on Print Media | 40 | Media Buyers, Account Executives |

| Readers of Print vs. Digital Newspapers | 100 | Regular Readers, Occasional Readers |

The Global Newspaper Market is valued at approximately USD 83 billion, reflecting a five-year historical analysis. This valuation is influenced by the demand for news and the growth of digital platforms that have transformed traditional publishing models.