Region:Global

Author(s):Dev

Product Code:KRAD0454

Pages:99

Published On:August 2025

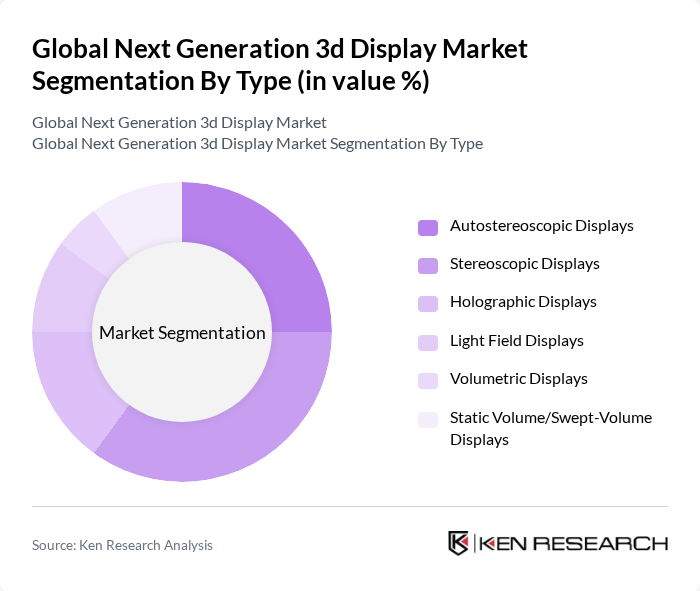

By Type:The market is segmented into various types of 3D displays, including Autostereoscopic Displays, Stereoscopic Displays, Holographic Displays, Light Field Displays, Volumetric Displays, and Static Volume/Swept-Volume Displays. Among these, Stereoscopic Displays are currently leading the market due to their widespread use in consumer electronics and gaming, driven by the demand for enhanced visual experiences . Autostereoscopic Displays are gaining traction as they offer glasses-free viewing, appealing to consumers seeking convenience and comfort, and are being advanced by improvements in rendering accuracy and real-time glasses-free visualization .

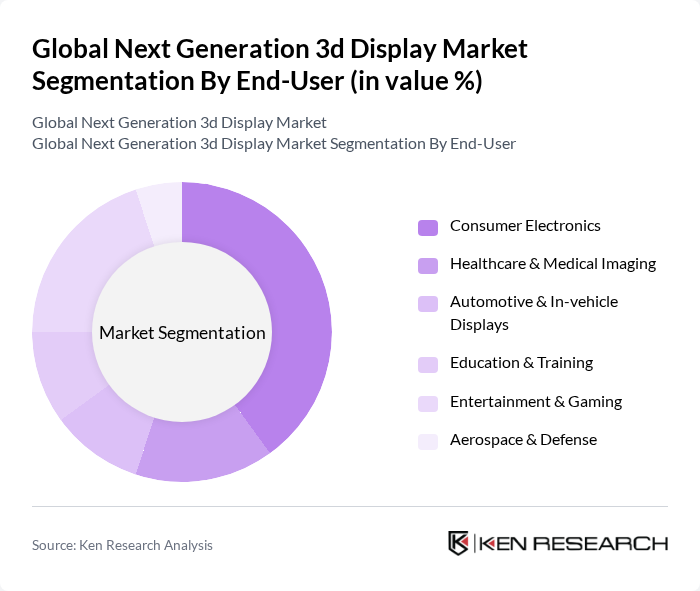

By End-User:The end-user segmentation includes Consumer Electronics, Healthcare & Medical Imaging, Automotive & In-vehicle Displays, Education & Training, Entertainment & Gaming, and Aerospace & Defense. The Consumer Electronics segment is the most significant contributor to the market, driven by the increasing demand for 3D televisions and gaming consoles, as well as adoption in AR/VR head-mounted displays and mobile devices featuring 3D/immersive display capabilities . The Entertainment & Gaming sector is also witnessing rapid growth, as immersive experiences become a priority for consumers and as advancements in graphics, microdisplays, and content ecosystems expand use cases .

The Global Next Generation 3D Display Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Display Co., Ltd., Sony Group Corporation, Panasonic Holdings Corporation, Sharp Corporation, Toshiba Corporation, AUO Corporation, Japan Display Inc. (JDI), BOE Technology Group Co., Ltd., Innolux Corporation, Himax Technologies, Inc., NVIDIA Corporation, Intel Corporation, Leia Inc., Light Field Lab, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the next-generation 3D display market appears promising, driven by technological advancements and increasing consumer interest. As immersive experiences become more mainstream, the demand for high-quality 3D displays is expected to rise significantly. Additionally, the integration of 3D displays in various sectors, including education and advertising, will further enhance market growth. Companies are likely to focus on developing affordable solutions and collaborating with content creators to expand the ecosystem, ensuring a vibrant future for the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Autostereoscopic Displays Stereoscopic Displays Holographic Displays Light Field Displays Volumetric Displays Static Volume/Swept-Volume Displays |

| By End-User | Consumer Electronics Healthcare & Medical Imaging Automotive & In-vehicle Displays Education & Training Entertainment & Gaming Aerospace & Defense |

| By Application | Gaming & eSports Virtual Reality (VR) Augmented/Mixed Reality (AR/MR) Digital Signage & Advertising Surgical Planning & Diagnostics Industrial Design & Simulation |

| By Distribution Channel | Online Retail Offline Retail Direct Sales (B2B/Enterprise) Distributors & System Integrators OEM Partnerships |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Rest of World |

| By Price Range | Entry-Level Mid-Range Premium/High-End Enterprise/Professional Custom/Integrated Solutions |

| By Technology | LCD OLED (AMOLED/microOLED) DLP & LCoS Laser/Projection MicroLED |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Market | 140 | Product Managers, Marketing Directors |

| Healthcare Imaging Solutions | 90 | Radiologists, Medical Device Managers |

| Gaming Industry Applications | 110 | Game Developers, UX Designers |

| Automotive Display Technologies | 80 | Automotive Engineers, Product Development Leads |

| Education and Training Tools | 60 | Educational Technologists, Curriculum Developers |

The Global Next Generation 3D Display Market is valued at approximately USD 1.5 billion, reflecting a specialized segment within the broader 3D display category, which includes advanced technologies like light field and holographic displays.