Region:Global

Author(s):Rebecca

Product Code:KRAD0208

Pages:89

Published On:August 2025

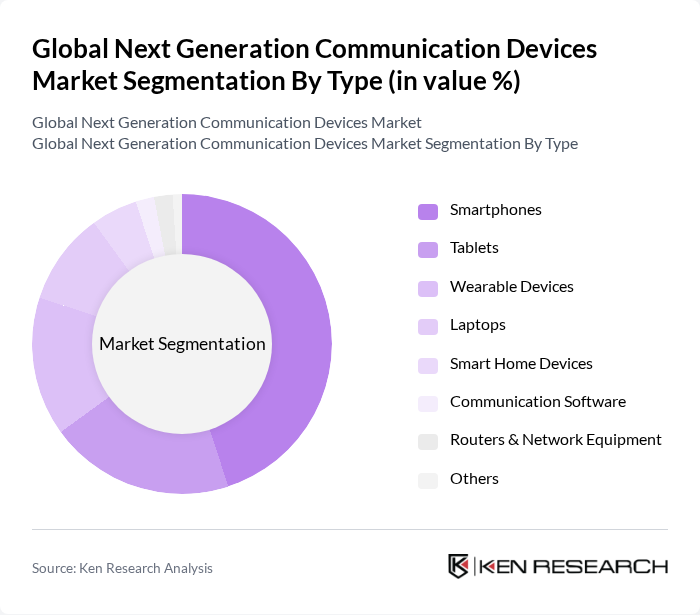

By Type:The market is segmented into various types, including smartphones, tablets, wearable devices, laptops, smart home devices, communication software, routers & network equipment, and others. Among these, smartphones are the leading sub-segment, driven by the increasing reliance on mobile communication and the integration of advanced features such as AI and IoT capabilities. Tablets and wearable devices are also gaining traction, particularly in the education and health sectors, respectively.

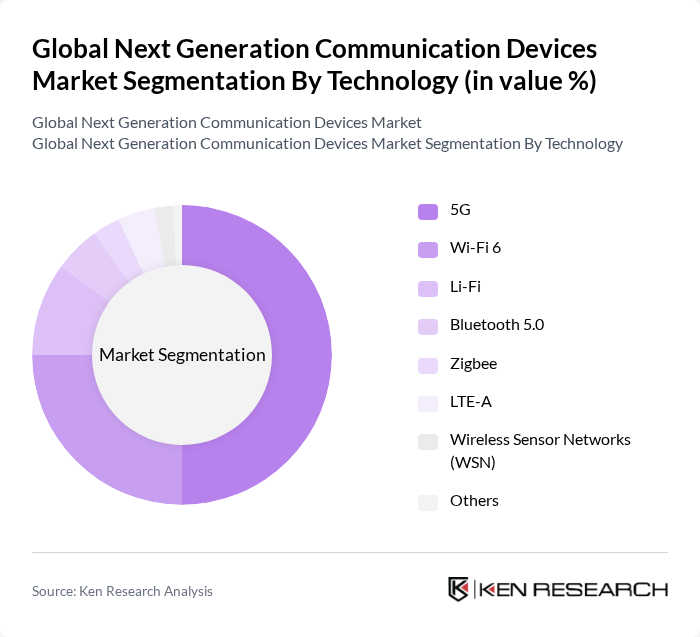

By Technology:This segment includes 5G, Wi-Fi 6, Li-Fi, Bluetooth 5.0, Zigbee, LTE-A, Wireless Sensor Networks (WSN), and others. The 5G technology sub-segment is currently leading the market, as it offers significantly faster data speeds and lower latency, which are crucial for the growing demand for high-performance communication devices. Wi-Fi 6 is also gaining popularity due to its enhanced capacity and efficiency, catering to the increasing number of connected devices in homes and businesses.

The Global Next Generation Communication Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Xiaomi Corporation, Cisco Systems, Inc., Ericsson AB, Nokia Corporation, Microsoft Corporation, Google LLC (Alphabet Inc.), Sony Corporation, LG Electronics Inc., ZTE Corporation, Motorola Solutions, Inc., Qualcomm Incorporated, Intel Corporation, Netgear Inc., China Mobile Limited, Verizon Communications Inc., AT&T Inc., Deutsche Telekom AG, Panasonic Corporation, IBM Corporation, Vodafone Group plc, Broadcom Corporation, NEC Corporation, MediaTek Inc., Bharti Airtel Limited, Telenor ASA, Telefónica S.A., Koninklijke Philips N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the next-generation communication devices market appears promising, driven by ongoing technological advancements and increasing consumer demand for connectivity. As 5G technology becomes more widespread, it will facilitate the development of innovative applications, enhancing user experiences. Additionally, the integration of artificial intelligence in communication devices is expected to streamline operations and improve efficiency, positioning the market for substantial growth. Companies that adapt to these trends will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartphones Tablets Wearable Devices Laptops Smart Home Devices Communication Software Routers & Network Equipment Others |

| By Technology | G Wi-Fi 6 Li-Fi Bluetooth 5.0 Zigbee LTE-A Wireless Sensor Networks (WSN) Others |

| By End-User Industry | Consumer Electronics Telecommunication Healthcare Automotive Manufacturing Military & Defense Retail Government Agencies Others |

| By Application | Personal Communication Business Communication Emergency Services Education Security & Surveillance Industrial Automation Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales |

| By Price Range | Budget Devices Mid-Range Devices Premium Devices |

| By Brand | Established Brands Emerging Brands |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Market | 120 | Product Managers, Marketing Directors |

| Enterprise Communication Solutions | 90 | IT Managers, Procurement Officers |

| Telecom Infrastructure Providers | 60 | Network Engineers, Operations Managers |

| Smart Device Manufacturers | 50 | R&D Managers, Product Development Leads |

| Telecommunications Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Managers |

The Global Next Generation Communication Devices Market is valued at approximately USD 273 billion, reflecting significant growth driven by the demand for high-speed internet, smart devices, and advancements in communication technologies, particularly the adoption of 5G technology.