Region:Global

Author(s):Geetanshi

Product Code:KRAA1235

Pages:86

Published On:August 2025

By Type:The market is segmented into various types of memory technologies, including DRAM, NAND Flash, 3D XPoint, MRAM, FRAM, ReRAM, PCM, and others. Among these, DRAM and NAND Flash are the most prominent due to their widespread use in consumer electronics and data centers. The demand for high-speed and efficient memory solutions drives the growth of these segments, with DRAM being favored for its speed and performance in computing applications. Emerging technologies such as MRAM and ReRAM are gaining traction for their low power consumption and non-volatility, addressing the needs of AI, IoT, and automotive applications .

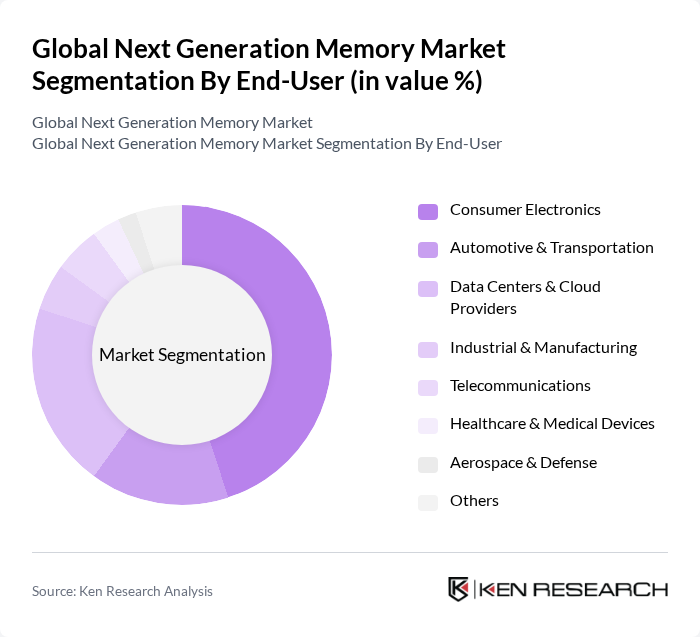

By End-User:The end-user segmentation includes various industries such as consumer electronics, automotive and transportation, data centers and cloud providers, industrial and manufacturing, telecommunications, healthcare and medical devices, aerospace and defense, and others. The consumer electronics segment leads the market, driven by the increasing adoption of smartphones, tablets, and laptops, which require advanced memory solutions for enhanced performance and user experience. Data centers and cloud providers are also significant contributors, fueled by the expansion of cloud computing and the need for high-speed, energy-efficient memory in large-scale data processing environments .

The Global Next Generation Memory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Micron Technology, Inc., Samsung Electronics Co., Ltd., SK Hynix Inc., Western Digital Corporation, Intel Corporation, Kioxia Holdings Corporation, NXP Semiconductors N.V., Infineon Technologies AG, STMicroelectronics N.V., Renesas Electronics Corporation, Cypress Semiconductor Corporation (now part of Infineon Technologies AG), Rambus Inc., Everspin Technologies, Inc., Avalanche Technology, Inc., Crossbar, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the next-generation memory market is poised for significant transformation, driven by technological advancements and evolving consumer demands. As cloud computing continues to gain traction, the integration of memory with processing units will become increasingly prevalent, enhancing performance and efficiency. Additionally, the focus on energy-efficient memory technologies will likely lead to innovations that reduce power consumption, aligning with global sustainability goals. These trends will shape the market landscape, fostering growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | DRAM (Dynamic Random Access Memory) NAND Flash D XPoint MRAM (Magnetoresistive RAM) FRAM (Ferroelectric RAM) ReRAM (Resistive RAM) PCM (Phase Change Memory) Others (e.g., NRAM, CBRAM) |

| By End-User | Consumer Electronics Automotive & Transportation Data Centers & Cloud Providers Industrial & Manufacturing Telecommunications Healthcare & Medical Devices Aerospace & Defense Others |

| By Application | Mobile Devices & Smartphones Computing Systems (PCs, Laptops, Servers) Embedded Systems & IoT Devices Networking Equipment Gaming Consoles & Entertainment Systems Enterprise Storage Solutions Others |

| By Distribution Channel | Direct Sales (OEMs, ODMs) Online Retail Distributors & Wholesalers Value-Added Resellers (VARs) Others |

| By Component | Memory Chips Controllers & Interface ICs Memory Modules (DIMMs, SSDs) Others |

| By Price Range | Low-End Mid-Range High-End Others |

| By Technology | Volatile Memory Technologies (e.g., DRAM, SRAM) Non-Volatile Memory Technologies (e.g., NAND, 3D XPoint, MRAM, ReRAM, PCM, FRAM) Emerging Memory Technologies (e.g., NRAM, CBRAM, FeRAM) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Development Managers, Supply Chain Analysts |

| Automotive Memory Solutions | 60 | Engineering Managers, Procurement Specialists |

| Data Center Operators | 80 | IT Managers, Infrastructure Architects |

| Research Institutions in Memory Technology | 50 | Research Scientists, Technology Analysts |

| Telecommunications Equipment Providers | 70 | Product Managers, Technical Directors |

The Global Next Generation Memory Market is valued at approximately USD 10 billion, driven by the increasing demand for high-performance computing, advancements in artificial intelligence, and the proliferation of smart devices across various industries.