Region:Global

Author(s):Shubham

Product Code:KRAD6781

Pages:81

Published On:December 2025

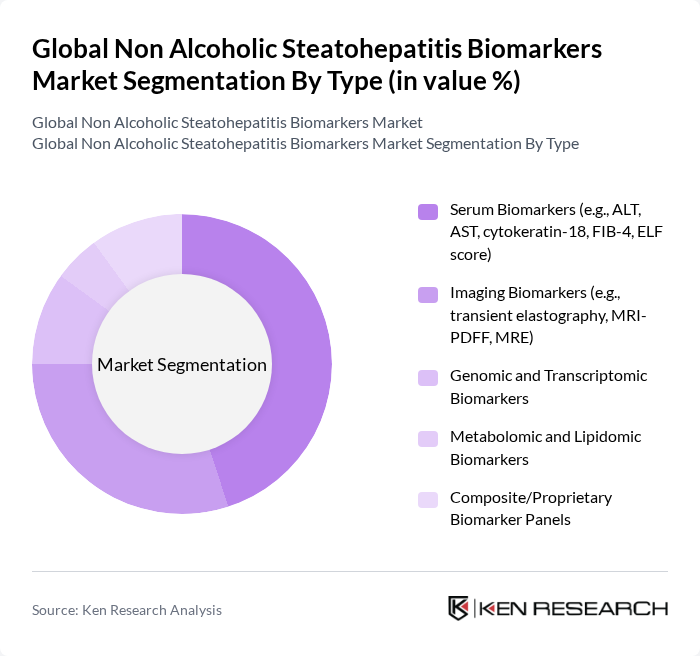

By Type:The market is segmented into various types of biomarkers, including serum biomarkers, imaging biomarkers, genomic and transcriptomic biomarkers, metabolomic and lipidomic biomarkers, and composite/proprietary biomarker panels. Among these, serum biomarkers are currently leading the market due to their widespread use in clinical settings for diagnosing and monitoring NASH, as they are relatively low-cost, easily repeatable, and compatible with high-throughput laboratory workflows. Imaging biomarkers are also gaining traction as they provide non-invasive assessment options for liver fat, inflammation, and fibrosis, which are increasingly preferred by both clinicians and patients and are being integrated into clinical trials and routine practice.

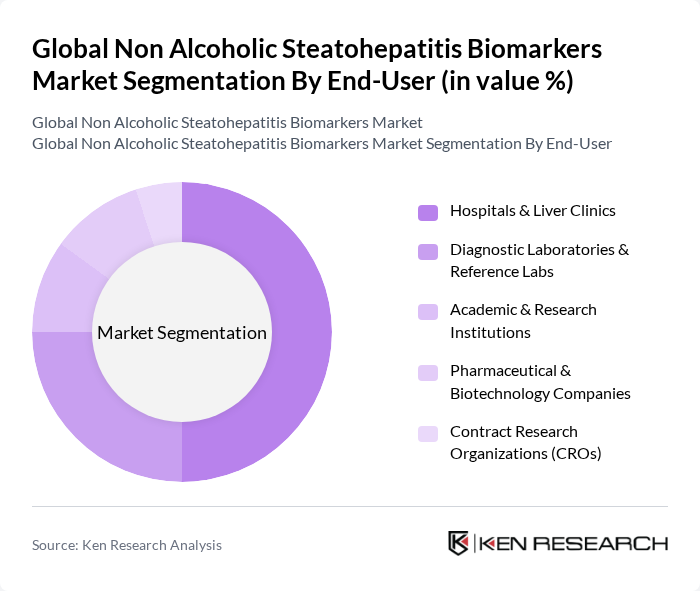

By End-User:The end-user segmentation includes hospitals & liver clinics, diagnostic laboratories & reference labs, academic & research institutions, pharmaceutical & biotechnology companies, and contract research organizations (CROs). Hospitals and liver clinics dominate this segment as they are the primary settings for patient diagnosis and treatment, and they are increasingly incorporating non-invasive NASH biomarker panels and imaging-based assessments into routine care pathways. The increasing number of patients seeking medical attention for liver-related issues, combined with a higher burden of obesity, type 2 diabetes, and metabolic syndrome, has led to a higher demand for diagnostic services in these facilities and stimulated collaboration with diagnostic laboratories and CROs for advanced biomarker testing and clinical research.

The Global Non Alcoholic Steatohepatitis Biomarkers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Echosens, Siemens Healthineers, Roche Diagnostics, Abbott Laboratories, Quest Diagnostics, Laboratory Corporation of America Holdings (Labcorp), GENFIT, Gilead Sciences, Novo Nordisk, Madrigal Pharmaceuticals, Intercept Pharmaceuticals, Perspectum, Siemens Healthineers (Imaging & In-Vitro Diagnostics Divisions), Fujifilm Wako Pure Chemical Corporation, NGM Biopharmaceuticals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Non Alcoholic Steatohepatitis biomarkers market appears promising, driven by ongoing research and technological advancements. As the prevalence of NAFLD continues to rise, the demand for effective diagnostic solutions will likely increase. Furthermore, the integration of artificial intelligence in biomarker discovery is expected to enhance the efficiency and accuracy of diagnostics. Collaborative efforts between academia and industry will also play a crucial role in accelerating the development of innovative biomarkers, ensuring that the market remains dynamic and responsive to emerging healthcare needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Serum Biomarkers (e.g., ALT, AST, cytokeratin-18, FIB-4, ELF score) Imaging Biomarkers (e.g., transient elastography, MRI-PDFF, MRE) Genomic and Transcriptomic Biomarkers Metabolomic and Lipidomic Biomarkers Composite/Proprietary Biomarker Panels |

| By End-User | Hospitals & Liver Clinics Diagnostic Laboratories & Reference Labs Academic & Research Institutions Pharmaceutical & Biotechnology Companies Contract Research Organizations (CROs) |

| By Application | Clinical Diagnosis & Staging of NASH Patient Stratification & Screening in Clinical Trials Drug Development & Companion Diagnostics Disease Monitoring, Prognosis & Treatment Response |

| By Biomarker Class | Inflammatory Biomarkers (e.g., TNF-?, IL-6, CRP) Fibrosis Biomarkers (e.g., PIIINP, hyaluronic acid, PRO-C3) Steatosis and Metabolic Biomarkers (e.g., liver fat fraction, lipid profiles) Apoptosis and Oxidative Stress Biomarkers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Immunoassays (ELISA, CLIA, etc.) Mass Spectrometry & Chromatography-Based Assays Molecular Diagnostics (PCR, NGS and related platforms) Imaging Technologies (Ultrasound Elastography, MRI, CT) Others (Point-of-Care Tests, Digital Biomarker Platforms) |

| By Research Type | Clinical Research (Observational and Interventional Studies) Preclinical and Translational Research Real-World Evidence and Registry-Based Studies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 120 | Laboratory Managers, Clinical Pathologists |

| Healthcare Providers | 90 | Hepatologists, Gastroenterologists |

| Biotechnology Firms | 70 | Product Development Managers, R&D Directors |

| Patient Advocacy Groups | 50 | Patient Representatives, Health Educators |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Policy Makers |

The Global Non Alcoholic Steatohepatitis Biomarkers Market is valued at approximately USD 1.6 billion, reflecting significant growth driven by the increasing prevalence of non-alcoholic fatty liver disease (NAFLD) and advancements in biomarker research and technology.