Region:Global

Author(s):Rebecca

Product Code:KRAA1439

Pages:80

Published On:August 2025

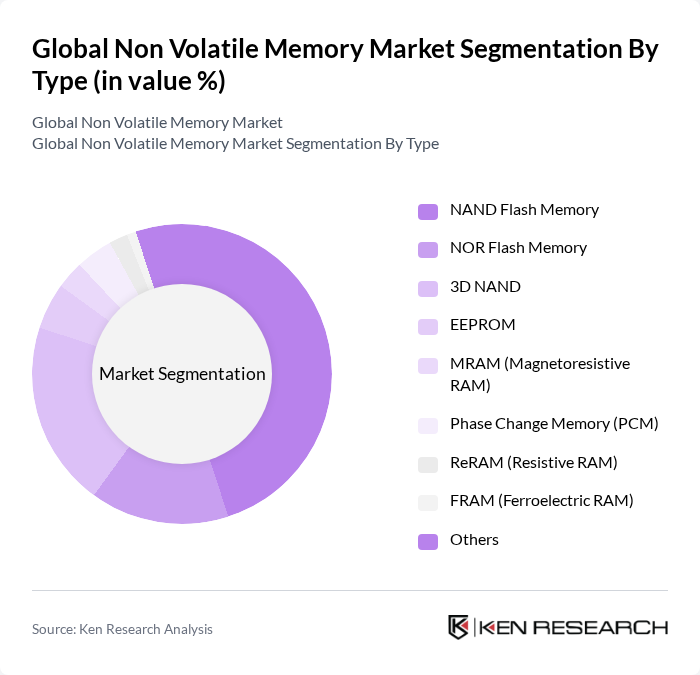

By Type:

The non-volatile memory market is segmented into various types, including NAND Flash Memory, NOR Flash Memory, 3D NAND, EEPROM, MRAM (Magnetoresistive RAM), Phase Change Memory (PCM), ReRAM (Resistive RAM), FRAM (Ferroelectric RAM), and Others. Among these, NAND Flash Memory is the dominant sub-segment, primarily due to its widespread use in consumer electronics such as smartphones, tablets, and SSDs. The increasing demand for high-capacity storage solutions, the trend towards mobile computing, and the adoption of advanced memory technologies in automotive and industrial applications have significantly boosted the adoption of NAND Flash technology .

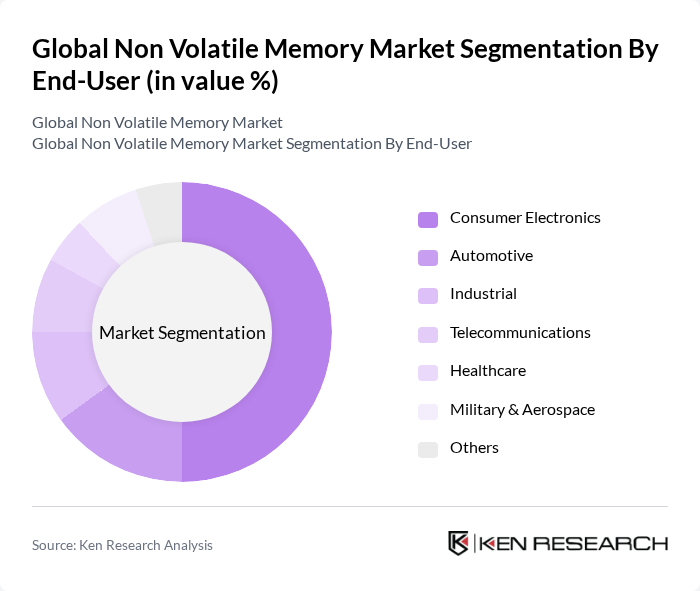

By End-User:

The end-user segmentation of the non-volatile memory market includes Consumer Electronics, Automotive, Industrial, Telecommunications, Healthcare, Military & Aerospace, and Others. The Consumer Electronics segment leads the market, driven by the increasing demand for smartphones, tablets, laptops, and other connected devices. Rapid technological advancements, the proliferation of IoT-enabled products, and the growing trend of smart devices have significantly contributed to the expansion of this segment, making it a key driver of market growth .

The Global Non Volatile Memory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., Micron Technology, Inc., SK hynix Inc., Western Digital Corporation, Intel Corporation, Kioxia Holdings Corporation, NXP Semiconductors N.V., STMicroelectronics N.V., Cypress Semiconductor Corporation (now part of Infineon Technologies AG), Kingston Technology Company, Inc., SanDisk Corporation (now part of Western Digital Corporation), Renesas Electronics Corporation, Infineon Technologies AG, Analog Devices, Inc., Microchip Technology Inc., Everspin Technologies, Inc., and Macronix International Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the non-volatile memory market appears promising, driven by the increasing integration of advanced technologies such as artificial intelligence and machine learning. As these technologies evolve, they will require more sophisticated memory solutions to handle vast datasets efficiently. Additionally, the automotive sector's growing demand for reliable memory solutions for electric and autonomous vehicles will further stimulate market growth. Companies that invest in innovative memory technologies and strategic partnerships are likely to gain a competitive edge in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | NAND Flash Memory NOR Flash Memory D NAND EEPROM MRAM (Magnetoresistive RAM) Phase Change Memory (PCM) ReRAM (Resistive RAM) FRAM (Ferroelectric RAM) Others |

| By End-User | Consumer Electronics Automotive Industrial Telecommunications Healthcare Military & Aerospace Others |

| By Application | Data Centers Mobile Devices Embedded Systems Personal Computers Smart Cards & IoT Devices Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Value-Added Resellers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Technology | Flash Memory Technology Magnetic Memory Technology Phase Change Memory Technology Resistive Memory Technology Ferroelectric Memory Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Development Managers, Supply Chain Analysts |

| Automotive Sector Memory Solutions | 70 | Engineering Managers, Procurement Specialists |

| Data Center Infrastructure Providers | 80 | IT Managers, Data Center Operations Managers |

| Mobile Device Manufacturers | 60 | R&D Directors, Quality Assurance Managers |

| Embedded Systems Developers | 50 | Software Engineers, Hardware Designers |

The Global Non Volatile Memory Market is valued at approximately USD 85 billion, reflecting a significant growth driven by the increasing demand for data storage solutions across various sectors, including consumer electronics, automotive, and data centers.