Region:Global

Author(s):Shubham

Product Code:KRAB0534

Pages:84

Published On:August 2025

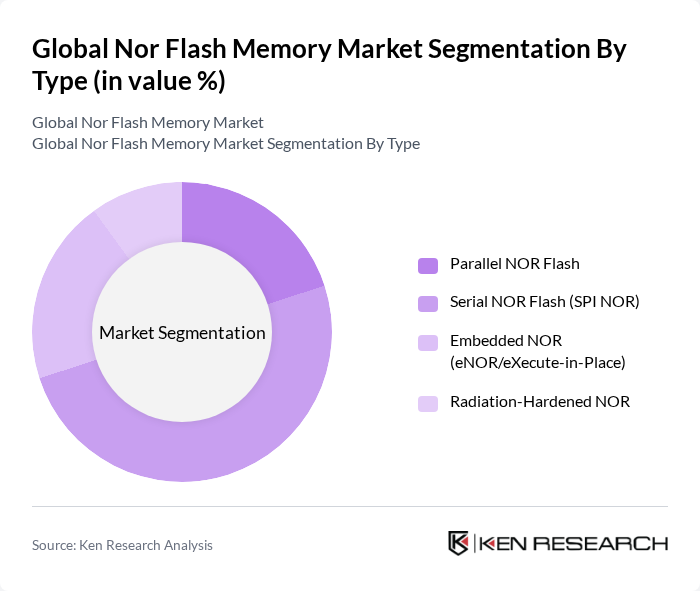

By Type:The market is segmented into various types of Nor Flash memory, including Parallel NOR Flash, Serial NOR Flash (SPI NOR), Embedded NOR (eNOR/eXecute-in-Place), and Radiation-Hardened NOR. Among these,Serial NOR Flashis currently the leading sub-segment due to its widespread use in consumer electronics and automotive systems needing fast reads, reliability, and execute?in?place for code storage; industry sources note Serial NOR’s dominance versus Parallel NOR in contemporary designs.

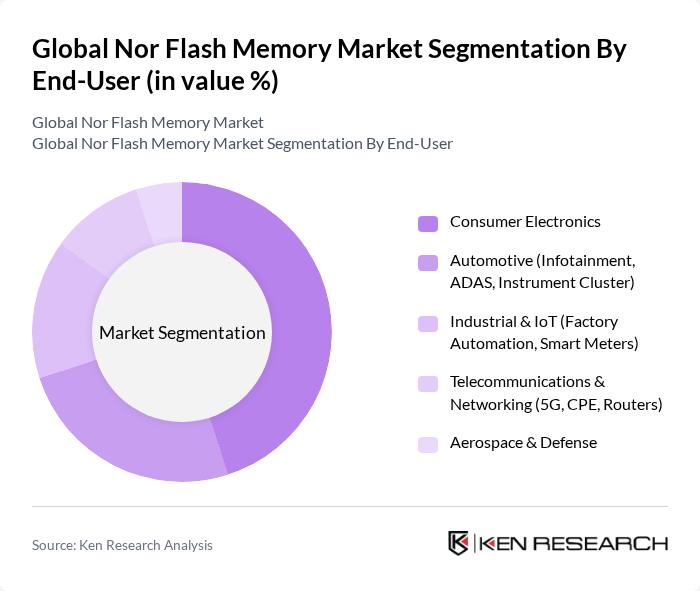

By End-User:The end-user segmentation includes Consumer Electronics, Automotive (Infotainment, ADAS, Instrument Cluster), Industrial & IoT (Factory Automation, Smart Meters), Telecommunications & Networking (5G, CPE, Routers), and Aerospace & Defense. TheConsumer Electronicssegment remains a leading demand center for NOR (embedded code storage/XIP in portable devices), closely followed by automotive use cases such as ADAS and infotainment; third?party analyses highlight consumer electronics’ significant share.

The Global Nor Flash Memory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Winbond Electronics Corporation, Macronix International Co., Ltd., GigaDevice Semiconductor Inc., Micron Technology, Inc., Infineon Technologies AG, Renesas Electronics Corporation, STMicroelectronics N.V., Microchip Technology Inc., Jiangsu Elite Semiconductor (ESMT), PUYA Semiconductor Co., Ltd., ISSI – Integrated Silicon Solution, Inc., Zetta Semiconductor Co., Ltd., Intel Corporation (legacy embedded NOR; divested NAND), Elite Semiconductor Microelectronics Technology Inc. (ESMT), Cypress Semiconductor (Infineon Technologies AG) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nor flash memory market appears promising, driven by technological advancements and increasing applications across various sectors. The shift towards 3D NAND technology is expected to enhance storage capacity and efficiency, while the integration of AI in memory solutions will optimize performance. Additionally, the rise of edge computing will create new opportunities for Nor flash memory, as data processing moves closer to the source, necessitating faster and more reliable storage solutions to meet growing demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Parallel NOR Flash Serial NOR Flash (SPI NOR) Embedded NOR (eNOR/eXecute-in-Place) Radiation-Hardened NOR |

| By End-User | Consumer Electronics Automotive (Infotainment, ADAS, Instrument Cluster) Industrial & IoT (Factory Automation, Smart Meters) Telecommunications & Networking (5G, CPE, Routers) Aerospace & Defense |

| By Application | Code Storage & Boot Memory (XIP) Firmware/BIOS & MCU External Memory Instrument Cluster & Infotainment Medical Electronics Smart Home & Wearables Others |

| By Distribution Channel | Direct Sales (OEM/ODM) Authorized Distributors Online B2B Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Density | ?16 Mb Mb–128 Mb ?256 Mb |

| By Technology | Floating-Gate NOR Charge-Trap NOR MRAM/Other Embedded Alternatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Device Manufacturers | 120 | Product Managers, Supply Chain Analysts |

| Automotive Electronics Suppliers | 90 | Engineering Managers, Procurement Specialists |

| Data Center Operators | 60 | IT Managers, Infrastructure Directors |

| Consumer Electronics Brands | 80 | Marketing Directors, R&D Managers |

| Flash Memory Technology Innovators | 50 | Research Scientists, Product Development Engineers |

The Global Nor Flash Memory Market is valued at approximately USD 5 billion, based on a five-year historical analysis. Recent estimates range from USD 2.7 billion to USD 5 billion, reflecting variations in methodology and scope across different industry sources.