Region:Global

Author(s):Shubham

Product Code:KRAD0761

Pages:90

Published On:August 2025

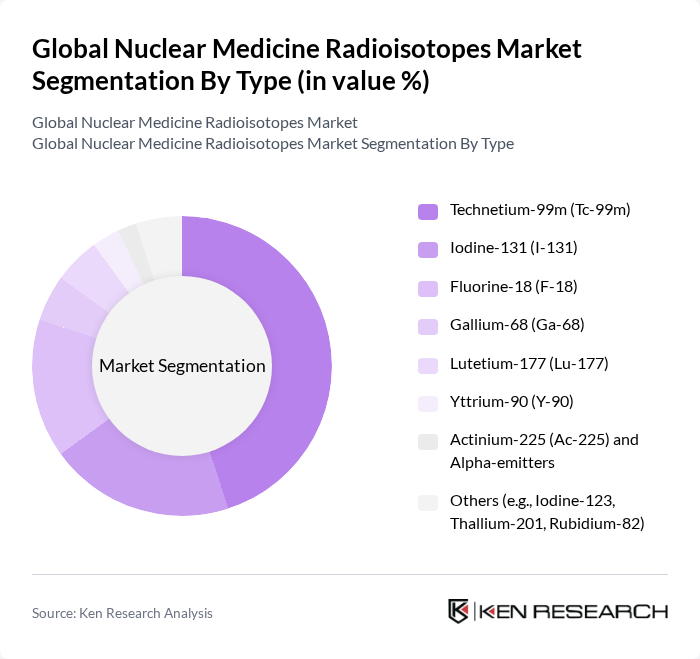

By Type:The market is segmented into various types of radioisotopes, each serving distinct purposes in diagnostics and therapeutics. The leading sub-segment is Technetium-99m (Tc-99m), widely used in diagnostic imaging due to favorable properties, including short half-life and broad generator-based availability across SPECT procedures. Other significant types include Iodine-131 (I-131) for thyroid ablation and therapy and Fluorine-18 (F-18) for PET imaging, especially in oncology. Gallium-68 (Ga-68) is growing for PET imaging of neuroendocrine tumors and prostate cancer targeting, while Lutetium-177 (Lu-177) is increasingly adopted for radioligand therapy. Yttrium-90 (Y-90) is used in selective internal radiation therapy for liver tumors, and emerging alpha-emitters such as Actinium-225 (Ac-225) are gaining attention for targeted alpha therapy. These usages and trends are consistent with expanding clinical evidence and production initiatives in nuclear medicine .

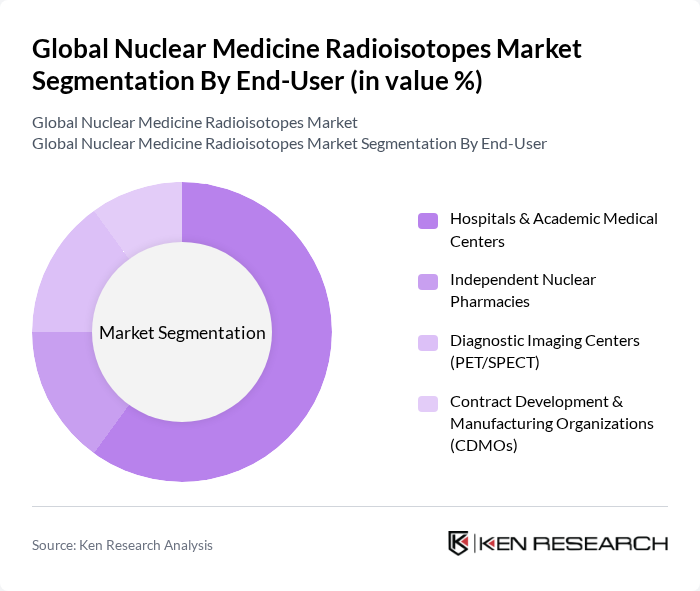

By End-User:The end-user segment includes hospitals, independent nuclear pharmacies, diagnostic imaging centers, and contract development and manufacturing organizations (CDMOs). Hospitals and academic medical centers are the leading end-users, driven by a high volume of PET/SPECT procedures and adoption of radioligand therapies. Independent nuclear pharmacies and cyclotron networks support timely distribution and unit-dose preparation, while diagnostic imaging centers continue to expand PET capacity. CDMOs are increasingly involved in GMP production and late-stage manufacturing for therapeutic isotopes, reflecting growing outsourcing in the radiopharmaceutical supply chain .

The Global Nuclear Medicine Radioisotopes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Curium, Lantheus Holdings, Inc., GE HealthCare, Siemens Healthineers, Cardinal Health, Inc. (Nuclear & Precision Health Solutions), NorthStar Medical Radioisotopes, LLC, Bracco Imaging S.p.A., Telix Pharmaceuticals Limited, Novartis AG (Advanced Accelerator Applications), IBA Radiopharma Solutions, Eckert & Ziegler Strahlen- und Medizintechnik AG, BWX Technologies, Inc., TerraPower Isotopes, LLC, ITM Isotope Technologies Munich SE, Norgine B.V. (formerly Mallinckrodt’s radiopharmaceutical brands) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nuclear medicine radioisotopes market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As personalized medicine continues to gain traction, the integration of AI in diagnostic processes is expected to enhance the efficiency and accuracy of radioisotope applications. Furthermore, the expansion of the radiopharmaceuticals market will likely create new avenues for growth, positioning the sector for significant developments in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Technetium-99m (Tc-99m) Iodine-131 (I-131) Fluorine-18 (F-18) Gallium-68 (Ga-68) Lutetium-177 (Lu-177) Yttrium-90 (Y-90) Actinium-225 (Ac-225) and Alpha-emitters Others (e.g., Iodine-123, Thallium-201, Rubidium-82) |

| By End-User | Hospitals & Academic Medical Centers Independent Nuclear Pharmacies Diagnostic Imaging Centers (PET/SPECT) Contract Development & Manufacturing Organizations (CDMOs) |

| By Application | Diagnostic Imaging (SPECT) Diagnostic Imaging (PET) Targeted Radiotherapy (RLT/PRRT/PSMA) Endocrinology (e.g., thyroid disorders) Cardiology Neurology |

| By Distribution Channel | Direct Supply (from producers to sites) Nuclear Pharmacy Networks Hospital In-house Radiopharmacies |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Production Method | Reactor-produced (e.g., Mo-99/Tc-99m) Cyclotron-produced (e.g., F-18, Ga-68) Generator-produced (e.g., Mo-99/Tc-99m, Ge-68/Ga-68) Accelerator/Linear Accelerator-produced (e.g., n.c.a. Lu-177, Ac-225) |

| By Therapeutic Modality | Beta-emitters Alpha-emitters Brachytherapy Sources |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Nuclear Medicine Departments | 120 | Chief Radiologists, Nuclear Medicine Technologists |

| Radiopharmaceutical Manufacturers | 90 | Product Managers, Regulatory Affairs Specialists |

| Healthcare Policy Experts | 60 | Health Economists, Policy Advisors |

| Research Institutions in Nuclear Medicine | 50 | Research Scientists, Clinical Trial Coordinators |

| Medical Equipment Suppliers | 80 | Sales Directors, Technical Support Managers |

The Global Nuclear Medicine Radioisotopes Market is valued at approximately USD 7.8 billion, reflecting sustained demand for both diagnostic and therapeutic radioisotopes based on a five-year historical analysis.