Region:Global

Author(s):Shubham

Product Code:KRAC0784

Pages:89

Published On:August 2025

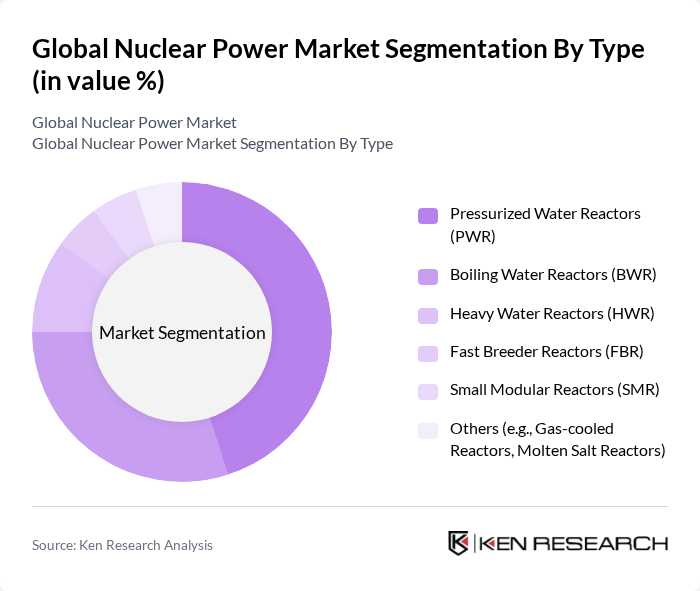

By Type:The nuclear power market can be segmented into various reactor types, each with unique characteristics and applications. The primary types include Pressurized Water Reactors (PWR), Boiling Water Reactors (BWR), Heavy Water Reactors (HWR), Fast Breeder Reactors (FBR), Small Modular Reactors (SMR), and others such as Gas-cooled Reactors and Molten Salt Reactors. Among these,Pressurized Water Reactorsdominate the market due to their widespread use, established safety record, and reliable performance in large-scale electricity generation .

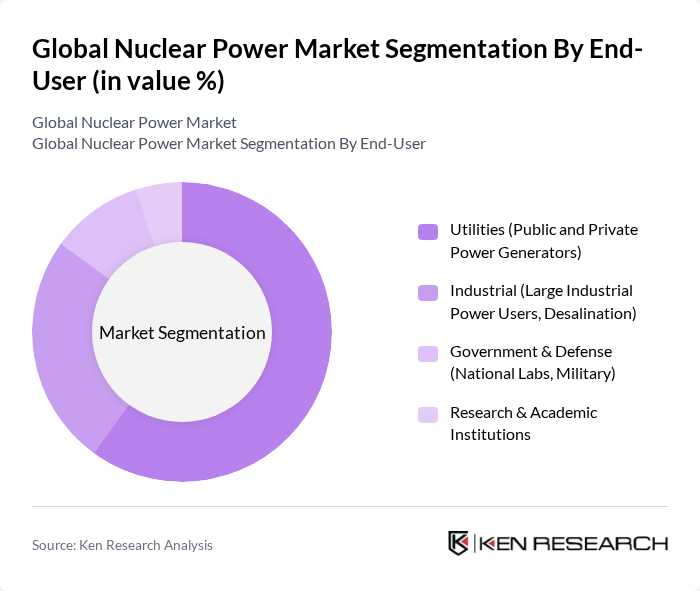

By End-User:The nuclear power market serves various end-users, including utilities, industrial sectors, government and defense, and research and academic institutions.Utilities(public and private) are the primary consumers, using nuclear energy for large-scale electricity generation. The industrial sector is significant in regions where nuclear power supports large industrial loads and desalination. Government and defense sectors utilize nuclear technology for national security, research, and specialized applications .

The Global Nuclear Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as Électricité de France (EDF), Westinghouse Electric Company LLC, Rosatom State Atomic Energy Corporation, General Electric (GE Hitachi Nuclear Energy), Orano SA (formerly Areva SA), China National Nuclear Corporation (CNNC), Korea Electric Power Corporation (KEPCO), Hitachi-GE Nuclear Energy, Ltd., Mitsubishi Heavy Industries, Ltd., Dominion Energy, Inc., Constellation Energy Corporation, Entergy Corporation, DTE Energy Company, PSEG Nuclear LLC, and Bruce Power L.P. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the nuclear power market appears promising, driven by a combination of technological advancements and increasing energy demands. As countries strive to meet climate targets, nuclear energy is likely to play a pivotal role in reducing carbon emissions. The focus on small modular reactors (SMRs) and enhanced safety protocols will further bolster public confidence. Additionally, the integration of digital technologies will streamline operations, making nuclear power more efficient and appealing to investors, ensuring its relevance in the evolving energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Pressurized Water Reactors (PWR) Boiling Water Reactors (BWR) Heavy Water Reactors (HWR) Fast Breeder Reactors (FBR) Small Modular Reactors (SMR) Others (e.g., Gas-cooled Reactors, Molten Salt Reactors) |

| By End-User | Utilities (Public and Private Power Generators) Industrial (Large Industrial Power Users, Desalination) Government & Defense (National Labs, Military) Research & Academic Institutions |

| By Region | North America (U.S., Canada, Mexico) Europe (France, Russia, U.K., Germany, Others) Asia-Pacific (China, India, Japan, South Korea, Others) Latin America (Brazil, Argentina, Others) Middle East & Africa (UAE, South Africa, Others) |

| By Technology | Generation II, III, III+ Reactors Small Modular Reactors (SMRs) Advanced Reactor Technologies (e.g., Fast Reactors, Molten Salt) Nuclear Fuel Cycle Technologies (Enrichment, Reprocessing, Waste Management) Safety and Security Technologies (Digital I&C, Cybersecurity, Passive Safety) |

| By Application | Electricity Generation District Heating & Desalination Research and Development Medical Isotope Production |

| By Investment Source | Private Investments Government Funding International Aid & Multilateral Funding |

| By Policy Support | Tax Incentives Subsidies Research Grants Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nuclear Power Plant Operators | 100 | Plant Managers, Operations Directors |

| Regulatory Bodies | 60 | Policy Makers, Compliance Officers |

| Energy Utilities | 80 | Chief Financial Officers, Strategic Planners |

| Research Institutions | 50 | Energy Researchers, Academic Professors |

| Environmental NGOs | 40 | Sustainability Advocates, Policy Analysts |

The Global Nuclear Power Market is valued at approximately USD 37.5 billion, driven by the increasing demand for clean energy, advancements in reactor technology, and supportive government policies promoting nuclear as a sustainable alternative to fossil fuels.