Region:Global

Author(s):Rebecca

Product Code:KRAD0192

Pages:91

Published On:August 2025

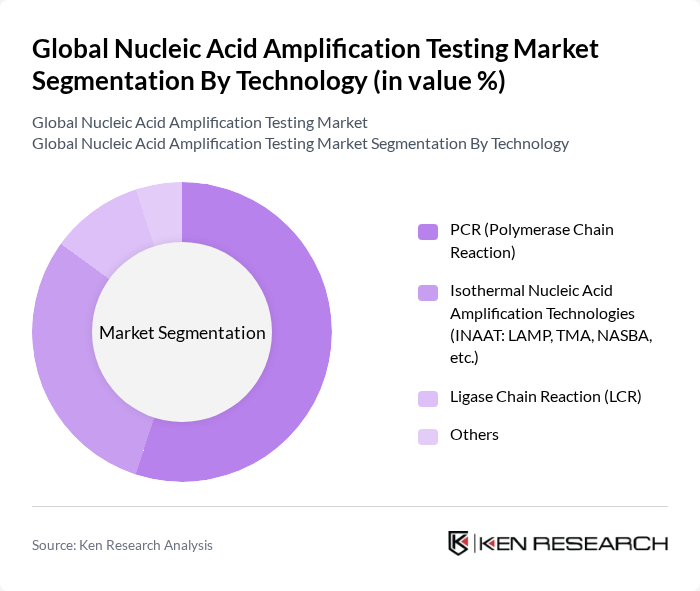

By Technology:The technology segment includes various methods used in nucleic acid amplification testing. The primary subsegments are PCR (Polymerase Chain Reaction), Isothermal Nucleic Acid Amplification Technologies (INAAT), Ligase Chain Reaction (LCR), and others. PCR remains the most widely used technology due to its high sensitivity and specificity, making it the preferred choice in clinical diagnostics. Isothermal methods, such as LAMP and TMA, are gaining traction for their simplicity, rapid turnaround, and suitability for point-of-care applications. LCR is utilized in specialized applications requiring high precision .

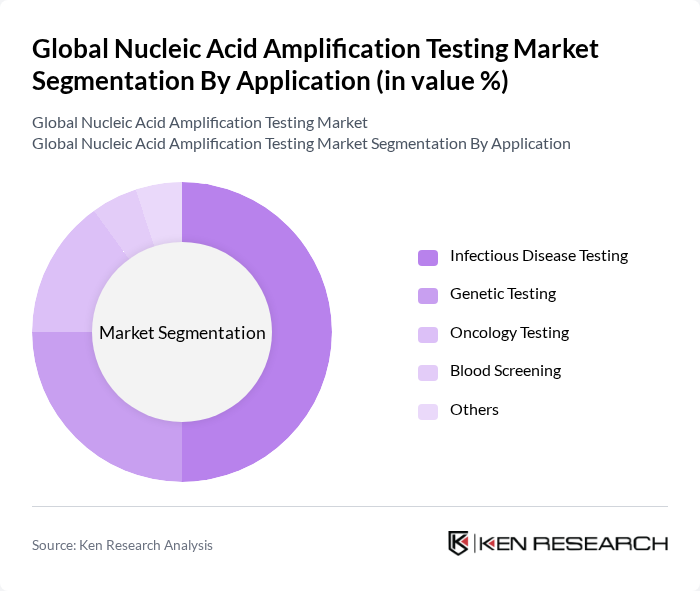

By Application:The application segment encompasses various fields where nucleic acid amplification testing is utilized. Key subsegments include Infectious Disease Testing, Genetic Testing, Oncology Testing, Blood Screening, and others. Infectious disease testing dominates the market due to the rising incidence of viral and bacterial infections, including emerging and re-emerging pathogens. Genetic testing is also expanding rapidly, driven by growing awareness of hereditary diseases, the adoption of personalized medicine, and increased screening for genetic disorders .

The Global Nucleic Acid Amplification Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Roche Diagnostics (F. Hoffmann-La Roche Ltd), Abbott Laboratories, QIAGEN N.V., Bio-Rad Laboratories, Inc., Hologic, Inc., Cepheid, Inc. (Danaher Corporation), Agilent Technologies, Inc., Siemens Healthineers AG, PerkinElmer, Inc., BGI Genomics Co., Ltd., LGC Limited, Genomatix Software GmbH, Mylab Discovery Solutions Pvt. Ltd., Eiken Chemical Co., Ltd., Becton, Dickinson and Company (BD), Danaher Corporation, bioMérieux SA, Illumina, Inc., Seegene Inc., Novartis AG, Merck & Co., Inc., Sysmex Corporation, Grifols, S.A., QuidelOrtho Corporation, SHERLOCK Biosciences, Meridian Bioscience, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the nucleic acid amplification testing market appears promising, driven by technological advancements and increasing healthcare investments. As healthcare systems globally prioritize rapid and accurate diagnostics, the integration of artificial intelligence in testing processes is expected to enhance efficiency and accuracy. Furthermore, the shift towards decentralized testing solutions will facilitate broader access to NAAT, particularly in underserved regions, fostering growth and innovation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Technology | PCR (Polymerase Chain Reaction) Isothermal Nucleic Acid Amplification Technologies (INAAT: LAMP, TMA, NASBA, etc.) Ligase Chain Reaction (LCR) Others |

| By Application | Infectious Disease Testing Genetic Testing Oncology Testing Blood Screening Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Blood Banks Others |

| By Sample Type | Blood Samples Saliva Samples Tissue Samples Urine Samples Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 100 | Laboratory Managers, Molecular Diagnostics Specialists |

| Healthcare Providers | 80 | Physicians, Pathologists, Infectious Disease Experts |

| Research Institutions | 60 | Research Scientists, Academic Professors |

| Regulatory Bodies | 40 | Regulatory Affairs Managers, Compliance Officers |

| Manufacturers of Testing Kits | 50 | Product Development Managers, Sales Directors |

The Global Nucleic Acid Amplification Testing Market is valued at approximately USD 8.2 billion, driven by the increasing prevalence of infectious diseases, advancements in molecular diagnostics, and the demand for rapid testing solutions.