Region:Global

Author(s):Rebecca

Product Code:KRAA1389

Pages:90

Published On:August 2025

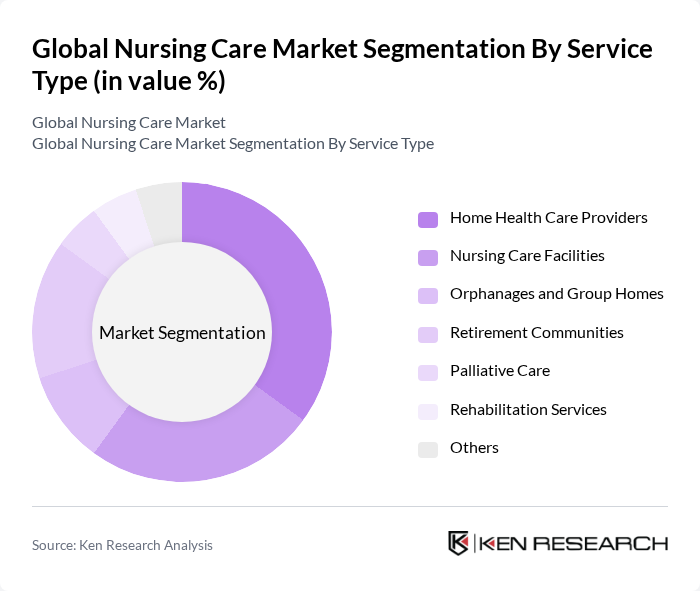

By Service Type:The service type segmentation includes various categories such as Home Health Care Providers, Nursing Care Facilities, Orphanages and Group Homes, Retirement Communities, Palliative Care, Rehabilitation Services, and Others. Among these, Home Health Care Providers are currently leading the market due to the increasing preference for in-home care services, which offer convenience and personalized attention to patients. The trend towards aging in place, the integration of digital health solutions, and the growing number of elderly individuals opting for home care solutions are significant factors driving this segment's growth.

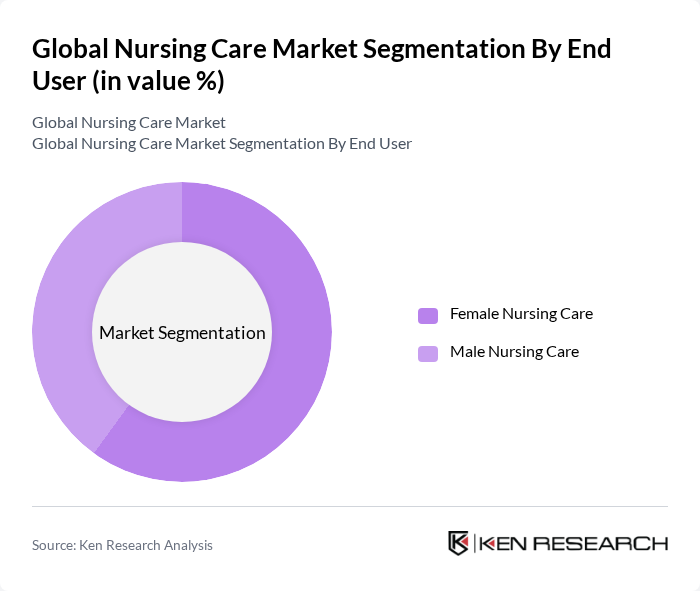

By End User:The end user segmentation includes Female Nursing Care and Male Nursing Care. Female Nursing Care is currently dominating the market, primarily due to the higher prevalence of chronic illnesses among women and their longer life expectancy. Additionally, societal norms and caregiving roles often lead to a greater demand for nursing services tailored to female patients, further solidifying this segment's leadership in the nursing care market.

The Global Nursing Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as HCA Healthcare, Inc., Brookdale Senior Living Inc., Amedisys, Inc., LHC Group, Inc., Kindred Healthcare, LLC, Genesis HealthCare, LLC, Encompass Health Corporation, Visiting Angels, Comfort Keepers, BrightStar Care, Interim HealthCare Inc., Right at Home, Maxim Healthcare Services, Inc., VITAS Healthcare, Sunrise Senior Living Inc., Bayshore HealthCare, CBI Health Group, Trinity Home Health Care, Life Care Centers of America, Emeritus Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of nursing care is poised for transformation, driven by technological innovations and a growing emphasis on patient-centered care. As telehealth services expand, nursing professionals will increasingly leverage digital tools to enhance patient engagement and streamline care delivery. Additionally, the focus on mental health services is expected to grow, reflecting societal shifts towards holistic health approaches. These trends will shape the nursing care landscape, ensuring that services are more accessible and tailored to individual patient needs.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Home Health Care Providers Nursing Care Facilities Orphanages and Group Homes Retirement Communities Palliative Care Rehabilitation Services Others |

| By End User | Female Nursing Care Male Nursing Care |

| By Patient Type | Geriatric Patients Chronic Illness Patients Post-Operative Patients Disabled Patients Pediatric Patients |

| By Healthcare Setting | Inpatient Outpatient Long-term Care Community-based Care |

| By Nursing Specialization | Pediatric Nursing Geriatric Nursing Surgical Nursing Critical Care Nursing Others |

| By Geographic Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| In-home Nursing Care Services | 120 | Nursing Care Managers, Home Health Aides |

| Nursing Homes and Assisted Living Facilities | 90 | Facility Administrators, Care Coordinators |

| Hospital-based Nursing Services | 100 | Clinical Nurse Leaders, Hospital Administrators |

| Telehealth Nursing Services | 60 | Telehealth Coordinators, IT Healthcare Specialists |

| Patient Care Experience Insights | 70 | Patients, Family Caregivers, Patient Advocates |

The Global Nursing Care Market is valued at approximately USD 1,400 billion, driven by factors such as an aging population, rising chronic diseases, and increased demand for personalized healthcare services. This valuation is based on a comprehensive five-year historical analysis.