Region:Global

Author(s):Dev

Product Code:KRAD0406

Pages:95

Published On:August 2025

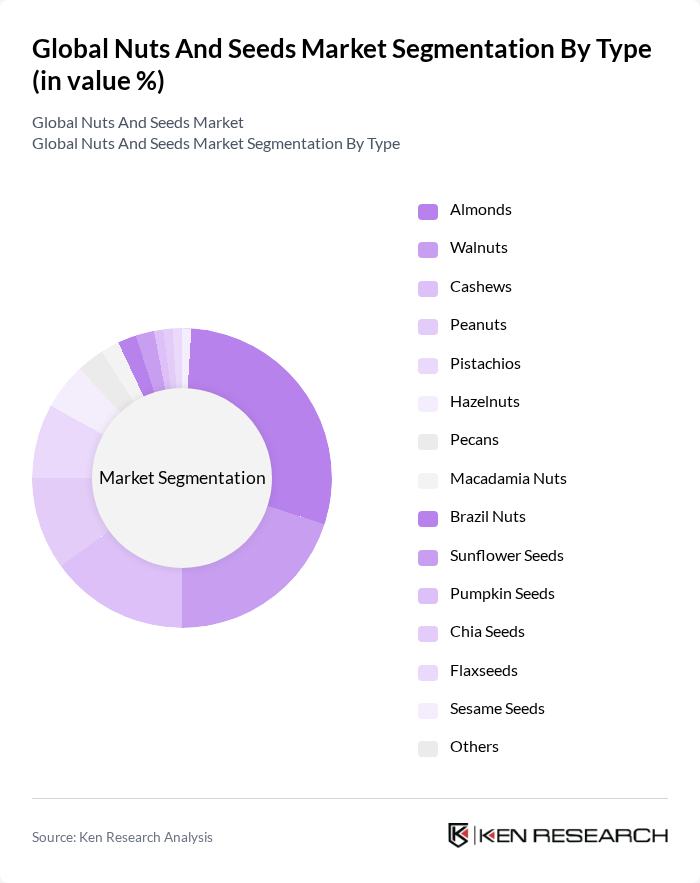

By Type:The nuts and seeds market is segmented into various types, including almonds, walnuts, cashews, peanuts, pistachios, hazelnuts, pecans, macadamia nuts, Brazil nuts, sunflower seeds, pumpkin seeds, chia seeds, flaxseeds, sesame seeds, and others. Among these, almonds and walnuts are particularly dominant due to their widespread use in snacks, baking, and health foods. The increasing trend towards plant-based diets has further boosted the demand for these nuts, making them a staple in many households .

By End-User:The end-user segmentation includes snack foods, bakery & confectionery, cereals & granola bars, nutritional & health foods, dairy alternatives & nut butters, foodservice & culinary applications, cosmetics & personal care, and retail consumers (households). The snack foods segment is particularly dominant, driven by the increasing consumer preference for healthy snacking options. Nuts and seeds are often marketed as convenient, nutritious snacks, which has led to their rising popularity among health-conscious consumers .

The Global Nuts And Seeds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blue Diamond Growers, Wonderful Pistachios & Almonds (The Wonderful Company), Olam Group (ofi – Olam Food Ingredients), Archer Daniels Midland Company (ADM), Select Harvests Limited, Mariani Nut Company, Intersnack Group, Hormel Foods (Planters), PepsiCo, Inc. (Frito-Lay), B&G Foods (Back to Nature), Hain Celestial Group (Garden of Eatin’, MaraNatha), General Mills, Inc. (Nature Valley), Mondelez International (Tate’s, Clif Bar & Co. nut snacks), Nestlé S.A. (nut-based snacks and confectionery), Ferrero Group (Nutella, nut-inclusive snacks), Bunge Limited, Barry Callebaut (nut inclusions and fillings), John B. Sanfilippo & Son, Inc. (Fisher Nuts), Sahale Snacks (J.M. Smucker Co.), Calbee, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the nuts and seeds market appears promising, driven by increasing health awareness and the demand for sustainable products. As consumers prioritize nutrition and convenience, the market is likely to see innovations in product offerings, including organic and fortified options. Additionally, the rise of e-commerce platforms will facilitate broader access to these products, enhancing consumer engagement and driving sales growth. Companies that adapt to these trends will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Almonds Walnuts Cashews Peanuts Pistachios Hazelnuts Pecans Macadamia Nuts Brazil Nuts Sunflower Seeds Pumpkin Seeds Chia Seeds Flaxseeds Sesame Seeds Others |

| By End-User | Snack Foods Bakery & Confectionery Cereals & Granola Bars Nutritional & Health Foods Dairy Alternatives & Nut Butters Foodservice & Culinary Applications Cosmetics & Personal Care Retail Consumers (Households) |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty & Health Stores Convenience Stores Wholesale/Club Stores Direct-to-Consumer (D2C) |

| By Packaging Type | Bulk Packaging Retail Packaging (Pouches, Resealable Bags, Tubs) Single-Serve/On-the-Go Packs Eco-Friendly/Compostable Packaging |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Mid-Range Economy |

| By Nutritional Claim | High Protein High Fiber Low/No Added Sugar Organic/Non-GMO Gluten-Free Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market for Nuts | 150 | Store Managers, Category Buyers |

| Health Food Product Manufacturers | 120 | Product Development Managers, Quality Assurance Officers |

| Export and Import Traders | 80 | Trade Analysts, Logistics Coordinators |

| Consumer Preferences in Nuts and Seeds | 120 | Health-Conscious Consumers, Nutritionists |

| Food Service Industry Insights | 90 | Chefs, Restaurant Owners |

The Global Nuts and Seeds Market is valued at approximately USD 60 billion, reflecting strong consumer demand for nutrient-dense snacks and plant-based foods. This valuation is based on a comprehensive analysis of industry sources focused on nuts and packaged nuts and seeds.