Region:Global

Author(s):Dev

Product Code:KRAA1608

Pages:80

Published On:August 2025

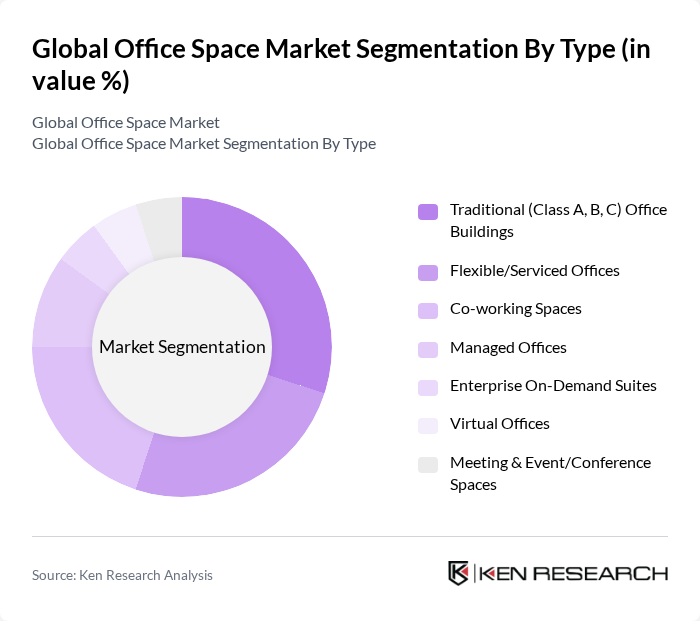

By Type:The office space market can be segmented into various types, including Traditional (Class A, B, C) Office Buildings, Flexible/Serviced Offices, Co-working Spaces, Managed Offices, Enterprise On-Demand Suites, Virtual Offices, and Meeting & Event/Conference Spaces. Each of these sub-segments caters to different business needs, with flexible and coworking formats expanding due to hybrid work adoption, cost optimization, and short-term commitments, while Class A assets continue to command a premium for amenity-rich, energy-efficient buildings .

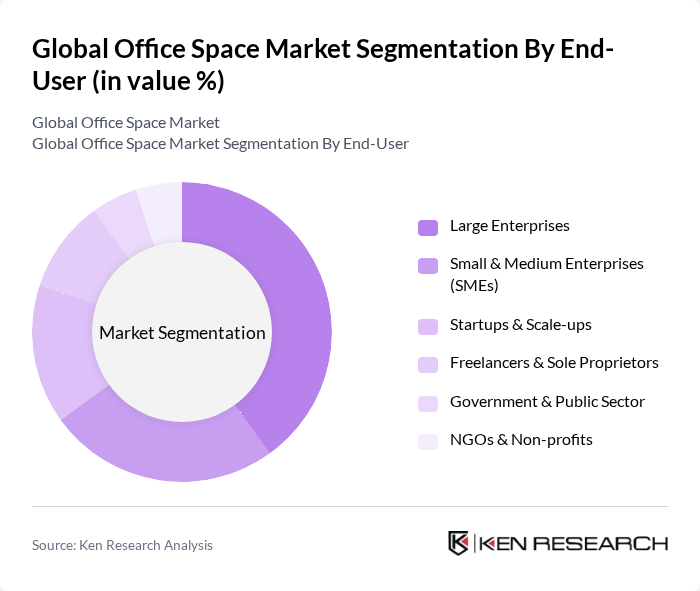

By End-User:The end-user segment of the office space market includes Large Enterprises, Small & Medium Enterprises (SMEs), Startups & Scale-ups, Freelancers & Sole Proprietors, Government & Public Sector, and NGOs & Non-profits. Large enterprises are consolidating footprints into higher-quality spaces and adopting flexible suites; SMEs and startups are driving demand for coworking and serviced models due to scalability and lower capex; and public/NGO occupiers are increasingly incorporating sustainability and wellness standards into procurement criteria .

The Global Office Space Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Group, Inc., Jones Lang LaSalle Incorporated (JLL), IWG plc (Regus, Spaces), WeWork Inc., Cushman & Wakefield plc, Colliers International Group Inc., The Office Group (TOG) & Fora, Industrious National Management Company LLC, Servcorp Limited, Mindspace Ltd., Convene, Office Evolution (a United Franchise Group company), Ucommune International Ltd., Common Desk (an IWG company), The Instant Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the office space market is poised for transformation, driven by the integration of technology and evolving work patterns. As hybrid work models gain traction, companies will increasingly invest in smart office solutions, enhancing employee productivity and satisfaction. Additionally, the focus on sustainability will shape office design, with eco-friendly spaces becoming a priority. The market is expected to adapt to these trends, fostering innovation and collaboration in workspace design and management.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional (Class A, B, C) Office Buildings Flexible/Serviced Offices Co-working Spaces Managed Offices Enterprise On-Demand Suites Virtual Offices Meeting & Event/Conference Spaces |

| By End-User | Large Enterprises Small & Medium Enterprises (SMEs) Startups & Scale-ups Freelancers & Sole Proprietors Government & Public Sector NGOs & Non-profits |

| By Location | Central Business Districts (CBD) Secondary/Urban Fringe Suburban Tier 2/3 Cities Transit-Oriented & Mixed-Use Developments |

| By Lease Type | Long-Term Leases (5–10+ years) Mid-Term Leases (1–5 years) Short-Term & Flexible (Month-to-Month) Management Agreements & Revenue-Share |

| By Service Type | Fully Serviced/Managed Office Services Virtual Office & Mail Handling Meeting Rooms & Offsites Facility Management (FM), IT & Security Workplace Strategy & Fit-out |

| By Industry | Technology & Startups Banking, Financial Services & Insurance (BFSI) Professional Services (Legal, Consulting, Accounting) Healthcare & Life Sciences Media, Advertising & Creative Others |

| By Pricing Model | Fixed Rent (Gross/Net) All-Inclusive Memberships Desk/Room-Level Subscription (Hot desk, Dedicated desk, Private office) Usage-Based (Pay-per-Use for meeting rooms, day passes) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Co-working Space Providers | 90 | Co-working Space Managers, Business Development Executives |

| Corporate Office Space Users | 120 | Corporate Real Estate Managers, Facilities Directors |

| Commercial Real Estate Brokers | 80 | Real Estate Agents, Market Analysts |

| Property Management Firms | 70 | Property Managers, Operations Managers |

| Investors in Office Real Estate | 60 | Real Estate Investors, Financial Analysts |

The Global Office Space Market is valued at approximately USD 3.1 trillion, reflecting a comprehensive analysis of office real estate under management and stock, driven by factors such as urbanization and the demand for flexible workspaces.