Region:Global

Author(s):Geetanshi

Product Code:KRAA2765

Pages:89

Published On:August 2025

By Type:The offshore crane market is segmented into various types, including Knuckle Boom Cranes, Telescopic Boom Cranes, Lattice Boom Cranes, Fixed Cranes, Floating Cranes, and Others. Each type serves specific operational needs and is designed for different lifting capacities and applications. Knuckle boom and telescopic boom cranes are increasingly favored for their versatility and compact design, while floating cranes are essential for heavy-lift operations in offshore wind and oil & gas projects .

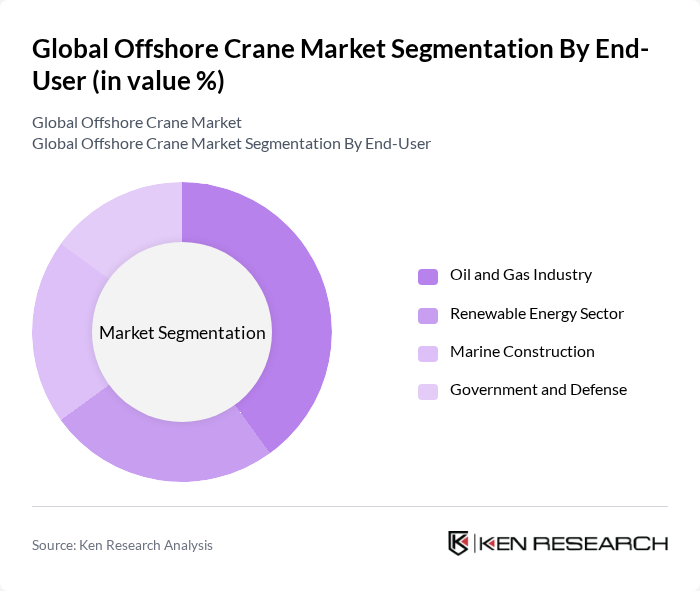

By End-User:The market is further segmented by end-user industries, including the Oil and Gas Industry, Renewable Energy Sector, Marine Construction, and Government and Defense. Each sector has unique requirements for offshore cranes, influencing the demand and growth of specific types. The oil and gas industry remains the largest end-user, but the renewable energy sector—particularly offshore wind—continues to grow rapidly, driving demand for specialized heavy-lift and installation cranes .

The Global Offshore Crane Market is characterized by a dynamic mix of regional and international players. Leading participants such as Liebherr Group, Konecranes PLC, Terex Corporation, Huisman Equipment B.V., Cargotec Corporation (MacGregor), Palfinger AG, SANY Group, Manitowoc Company, Inc., NOV Inc. (National Oilwell Varco), TTS Group ASA, Heila Cranes S.p.A., Seatrax Inc., MacGregor (Cargotec), Palfinger Marine, Huisman Equipment B.V. contribute to innovation, geographic expansion, and service delivery in this space.

The offshore crane market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As the demand for renewable energy sources continues to rise, particularly in offshore wind, companies are likely to invest in innovative crane solutions that enhance efficiency and reduce environmental impact. Additionally, emerging markets in Asia and Africa present new opportunities for growth, as these regions develop their offshore capabilities and infrastructure to meet global energy demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Knuckle Boom Cranes Telescopic Boom Cranes Lattice Boom Cranes Fixed Cranes Floating Cranes Others |

| By End-User | Oil and Gas Industry Renewable Energy Sector Marine Construction Government and Defense |

| By Application | Lifting Operations Installation Services Maintenance and Repair Decommissioning Projects |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Domestic Distribution International Distribution |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Offshore Operations | 100 | Project Managers, Operations Directors |

| Renewable Energy Installations | 60 | Site Managers, Engineering Leads |

| Marine Construction Projects | 50 | Construction Managers, Safety Officers |

| Crane Manufacturing Insights | 40 | Product Development Managers, Sales Executives |

| Maintenance and Repair Services | 40 | Maintenance Supervisors, Technical Directors |

The Global Offshore Crane Market is valued at approximately USD 28.5 billion, driven by increasing demand for offshore oil and gas exploration, expansion of offshore wind energy projects, and advancements in lifting technologies.