Region:Global

Author(s):Shubham

Product Code:KRAA1904

Pages:87

Published On:August 2025

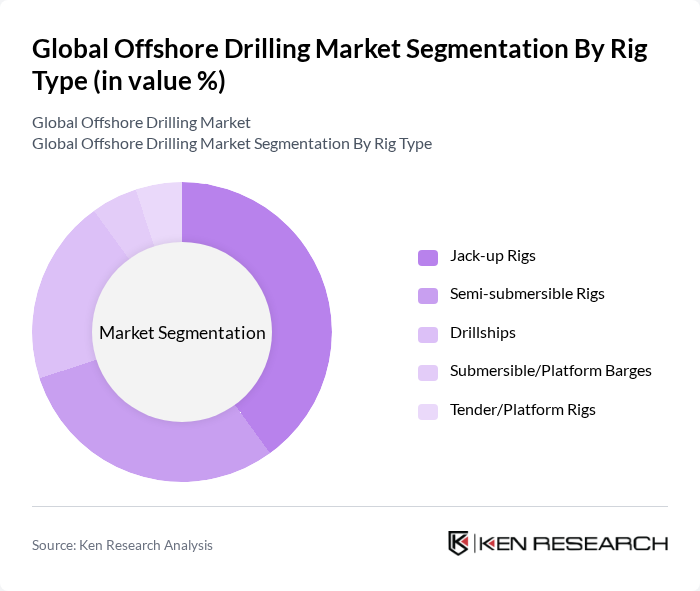

By Rig Type:The rig type segmentation includes various categories such as Jack-up Rigs, Semi-submersible Rigs, Drillships, Submersible/Platform Barges, and Tender/Platform Rigs. Among these, Jack-up Rigs are the most widely used due to their versatility and cost-effectiveness for shallow water drilling. Semi-submersible Rigs are also gaining traction for deeper water operations, while Drillships are preferred for ultra-deepwater drilling due to their advanced capabilities. The demand for these rigs is influenced by the ongoing exploration activities and the need for efficient drilling solutions.

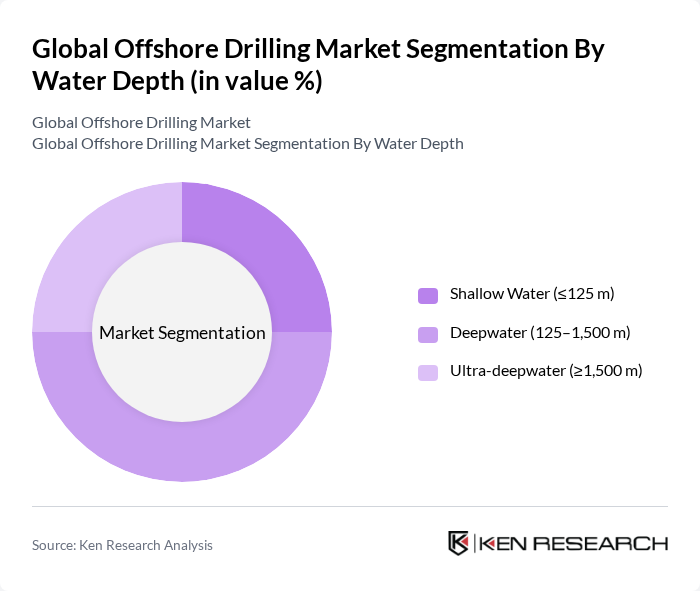

By Water Depth:The water depth segmentation categorizes the market into Shallow Water (?125 m), Deepwater (125–1,500 m), and Ultra-deepwater (?1,500 m). The Deepwater segment is currently leading the market due to the increasing exploration of offshore oil and gas reserves in deeper waters. This trend is driven by technological advancements that allow for more efficient drilling and production in challenging environments. The Ultra-deepwater segment is also witnessing growth as companies seek to tap into untapped reserves.

The Global Offshore Drilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Transocean Ltd., Halliburton Company, SLB (Schlumberger Limited), Noble Corporation plc, Valaris plc, Seadrill Limited, Diamond Offshore Drilling, Inc., The Drilling Company of 1972 A/S (Maersk Drilling legacy), Borr Drilling Limited, COSL – China Oilfield Services Limited, Vantage Drilling International, Shelf Drilling, Ltd., Saipem S.p.A., KCA Deutag, Parker Drilling Company contribute to innovation, geographic expansion, and service delivery in this space.

The offshore drilling market is poised for transformative changes driven by technological advancements and a shift towards sustainable practices. As companies increasingly adopt digitalization and automation, operational efficiencies are expected to improve significantly. Furthermore, the focus on renewable offshore energy sources will likely reshape investment strategies, encouraging diversification. The integration of innovative drilling technologies will enhance safety and reduce environmental impacts, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Rig Type | Jack-up Rigs Semi-submersible Rigs Drillships Submersible/Platform Barges Tender/Platform Rigs |

| By Water Depth | Shallow Water (?125 m) Deepwater (125–1,500 m) Ultra-deepwater (?1,500 m) |

| By Operator Type | International Oil Companies (IOCs) National Oil Companies (NOCs) Independents |

| By Application | Exploration/Appraisal Development/Production Drilling Plug & Abandonment/Decommissioning Well Intervention/Workover |

| By Service Type | Contract Drilling Directional/Measurement/Logging-While-Drilling Integrated Drilling Services (IDS) Rig Maintenance & Life Extension Managed Pressure Drilling & Well Control |

| By Contract Model | Day-rate Contracts Term/Framework Agreements Integrated Project/Turnkey Contracts Performance-based/Hybrid Models |

| By Region | North America (U.S., Canada, Gulf of Mexico) Europe (North Sea, Barents) Asia-Pacific (China, India, Southeast Asia, Australia) Middle East & Africa (Gulf, West & East Africa) Latin America (Brazil, Mexico, Guianas) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Deepwater Drilling Operations | 120 | Project Managers, Operations Directors |

| Shallow Water Drilling Projects | 90 | Field Engineers, Safety Officers |

| Drilling Technology Innovations | 75 | R&D Managers, Technology Officers |

| Environmental Compliance in Drilling | 60 | Environmental Managers, Compliance Officers |

| Market Trends in Offshore Drilling | 95 | Market Analysts, Business Development Managers |

The Global Offshore Drilling Market is valued at approximately USD 40 billion, driven by increasing energy demand and investments in advanced drilling technologies to access deeper reserves. This valuation is based on a comprehensive five-year historical analysis.