Region:Global

Author(s):Shubham

Product Code:KRAA1908

Pages:89

Published On:August 2025

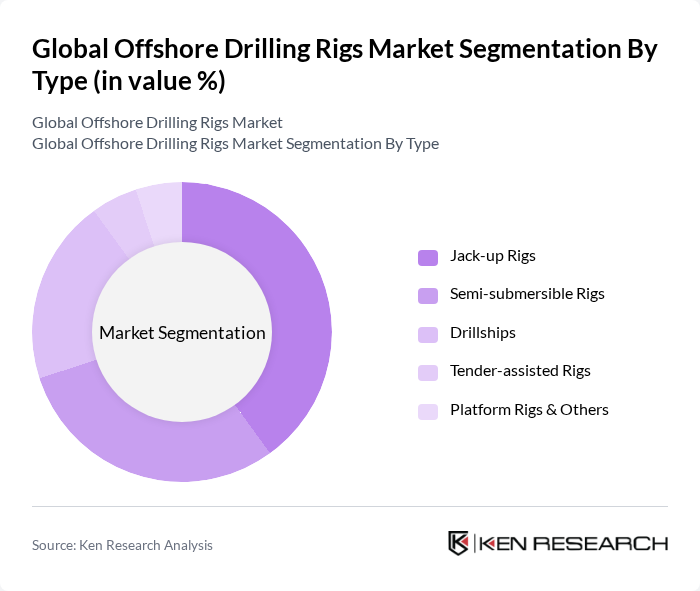

By Type:The market is segmented into various types of rigs, including Jack-up Rigs, Semi-submersible Rigs, Drillships, Tender-assisted Rigs, and Platform Rigs & Others. Among these,Jack-up Rigsare particularly dominant for shallow-water work due to lower operating costs, quicker mobilization, and suitability up to moderate water depths.Semi-submersible Rigscontinue to gain traction in mid-to-deepwater settings for their stability and station-keeping in harsher environments.Drillshipssee growing demand as operators pursue deeper-water prospects requiring high-spec DP vessels with dual-activity capability.Tender-assistedandPlatform Rigsaddress specific field redevelopment and platform-based drilling programs, especially in Southeast Asia and the Middle East .

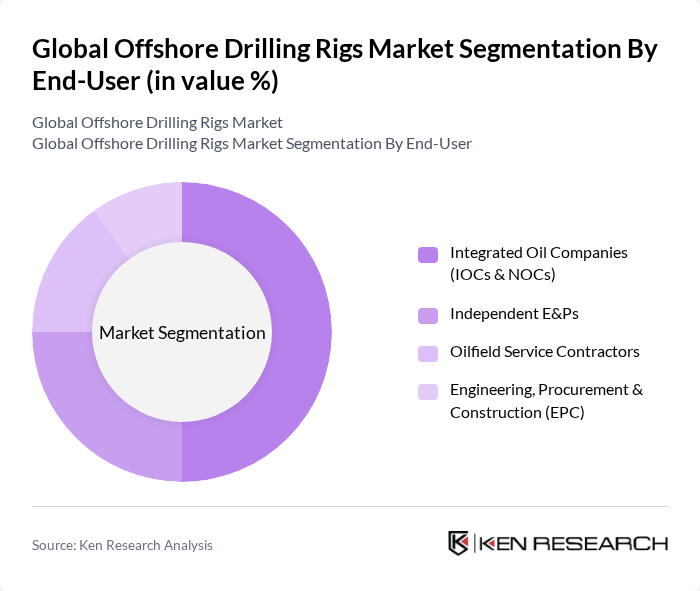

By End-User:The market is segmented by end-users, including Integrated Oil Companies (IOCs & NOCs), Independent Exploration & Production companies (E&Ps), Oilfield Service Contractors, and Engineering, Procurement & Construction (EPC) firms.Integrated Oil Companiestypically dominate offshore rig contracting due to balance sheet strength, multi-basin portfolios, and long-cycle project capabilities.Independent E&Psincreasingly participate, particularly in partnership structures or farm-ins to access resources.Oilfield Service Contractorsprovide critical drilling, completions, and subsea services that enable higher rig productivity, whileEPC firmsdeliver project execution for offshore facilities, tiebacks, and brownfield upgrades supporting drilling campaigns .

The Global Offshore Drilling Rigs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Transocean Ltd., Valaris Limited, Noble Corporation plc, Seadrill Limited, Diamond Offshore Drilling, Inc., Borr Drilling Limited, Shelf Drilling, Ltd., COSL Drilling (China Oilfield Services Limited), Maersk Drilling (now part of Noble Corporation), Stena Drilling Ltd., Vantage Drilling International, ADES Holding Company, Saipem S.p.A. (Offshore Drilling), KCA Deutag (Bentec, Offshore Services), Parker Drilling Company (Parker Wellbore) contribute to innovation, geographic expansion, and service delivery in this space .

The offshore drilling market is poised for transformation as companies increasingly adopt digital technologies and sustainable practices. In future, the integration of automation and data analytics is expected to enhance operational efficiency, reducing costs and improving safety. Furthermore, the shift towards renewable energy sources will drive innovation in hybrid offshore platforms, allowing for a more diversified energy portfolio. This evolution will create a more resilient and adaptable offshore drilling sector, capable of meeting future energy demands sustainably.

| Segment | Sub-Segments |

|---|---|

| By Type | Jack-up Rigs Semi-submersible Rigs Drillships Tender-assisted Rigs Platform Rigs & Others |

| By End-User | Integrated Oil Companies (IOCs & NOCs) Independent E&Ps Oilfield Service Contractors Engineering, Procurement & Construction (EPC) |

| By Region | North America (U.S., Canada, Mexico) Europe (North Sea, Mediterranean) Asia-Pacific (South China Sea, Australia, India) Middle East & Africa (Gulf, West Africa) Latin America (Brazil, Guyana, Others) |

| By Water Depth | Shallow Water (?125m) Deepwater (125–1,500m) Ultra-Deepwater (>1,500m) |

| By Contract Type | Day-rate Contracts Integrated Drilling Services (IDS) Performance-based/Hybrid |

| By Rig Capability | Harsh-Environment Rigs High-Specification Rigs (7th Gen, DP3) Standard-Specification Rigs |

| By Service Scope | Drilling & Well Services Maintenance, Repair & Overhaul (MRO) Engineering & Project Management Rig Mobilization & Logistics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Deepwater Drilling Operations | 120 | Project Managers, Operations Directors |

| Jack-up Rig Utilization | 90 | Rig Managers, Field Engineers |

| Market Trends in Drilling Technology | 80 | R&D Managers, Technology Officers |

| Regulatory Impact on Offshore Drilling | 60 | Compliance Officers, Environmental Managers |

| Investment Trends in Offshore Drilling | 100 | Financial Analysts, Investment Managers |

The Global Offshore Drilling Rigs Market is valued at approximately USD 99 billion, reflecting a strong rebound in offshore activity driven by improved utilization and dayrates amid tighter oil markets.