Region:Global

Author(s):Rebecca

Product Code:KRAC0218

Pages:81

Published On:August 2025

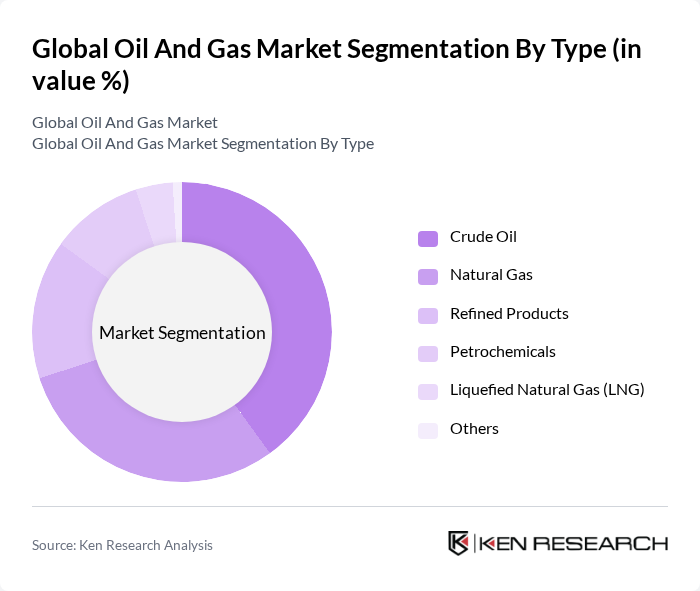

By Type:The market is segmented into Crude Oil, Natural Gas, Refined Products, Petrochemicals, Liquefied Natural Gas (LNG), and Others. Crude Oil and Natural Gas remain the largest contributors, reflecting their essential roles in energy production, transportation, and industrial processes. Demand for refined products and petrochemicals continues to grow, driven by expanding manufacturing, transportation, and consumer goods sectors. LNG is gaining prominence as a transitional fuel for power generation and industrial use, supported by investments in liquefaction and regasification infrastructure.

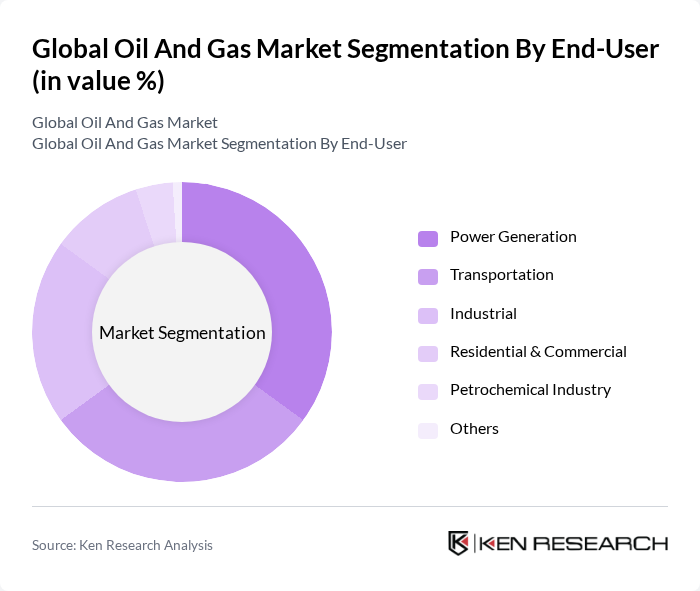

By End-User:The market is categorized by end-users, including Power Generation, Transportation, Industrial, Residential & Commercial, Petrochemical Industry, and Others. Power Generation and Transportation are the dominant segments due to the critical role of oil and gas in electricity production and mobility. The industrial sector is also a major consumer, utilizing oil and gas for manufacturing, process heating, and feedstock. Residential and commercial demand is driven by heating, cooking, and energy needs, while the petrochemical industry relies on hydrocarbons for raw material supply.

The Global Oil And Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil, Shell plc, BP plc, Chevron Corporation, TotalEnergies SE, ConocoPhillips, Eni S.p.A., Equinor ASA, Occidental Petroleum Corporation, Repsol S.A., CNOOC Limited, Petroliam Nasional Berhad (PETRONAS), Gazprom PJSC, Lukoil PJSC, and Saudi Arabian Oil Company (Saudi Aramco) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oil and gas market is poised for transformation, driven by a combination of technological advancements and shifting consumer preferences. As the industry adapts to increasing environmental regulations, companies are likely to invest more in cleaner extraction technologies and sustainable practices. Additionally, the growth of natural gas as a transition fuel will play a crucial role in meeting energy demands while addressing climate change concerns. Strategic partnerships will also emerge as key to navigating this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Oil Natural Gas Refined Products Petrochemicals Liquefied Natural Gas (LNG) Others |

| By End-User | Power Generation Transportation Industrial Residential & Commercial Petrochemical Industry Others |

| By Application | Exploration Production Refining Storage & Transportation Distribution Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Production | 100 | Field Engineers, Production Managers |

| Midstream Transportation | 60 | Logistics Coordinators, Pipeline Operators |

| Downstream Refining | 80 | Refinery Managers, Quality Control Analysts |

| Oil and Gas Market Analysis | 50 | Market Analysts, Financial Advisors |

| Renewable Energy Integration | 40 | Sustainability Officers, Energy Transition Specialists |

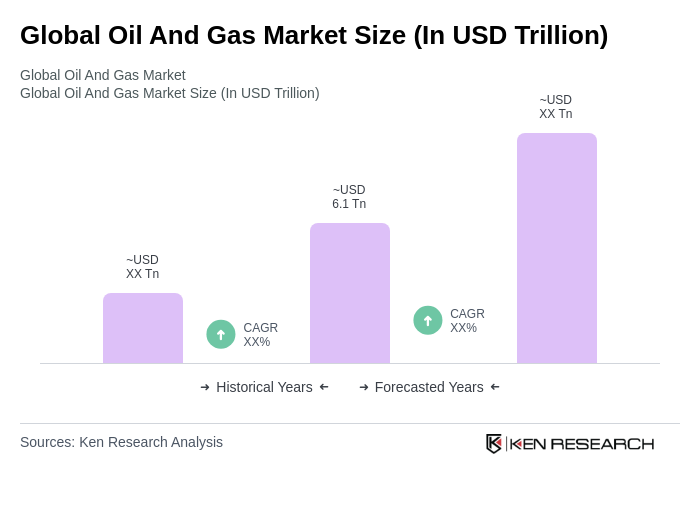

The Global Oil and Gas Market is valued at approximately USD 6.1 trillion, driven by increasing energy demand, geopolitical dynamics, and advancements in extraction technologies. This substantial market size reflects the critical role of oil and gas in the global economy.