Region:Global

Author(s):Rebecca

Product Code:KRAA2419

Pages:84

Published On:August 2025

By Type:The market is segmented into various types of storage tanks, each serving specific needs and applications. The primary types include Fixed Roof Tanks, Floating Roof Tanks, Spherical Tanks, Bullet Tanks, and Others (e.g., Open Top Tanks, Horizontal Tanks). Each type has unique characteristics that cater to different storage requirements, influencing their market share and growth .

The Floating Roof Tanks segment is currently dominating the market due to their ability to minimize evaporation losses and reduce environmental impact. These tanks are particularly favored in regions with high temperature variations, as they provide better safety and efficiency in storing volatile liquids. The increasing focus on environmental regulations and the need for cost-effective storage solutions are driving the adoption of floating roof designs, making them a preferred choice among oil producers and storage companies .

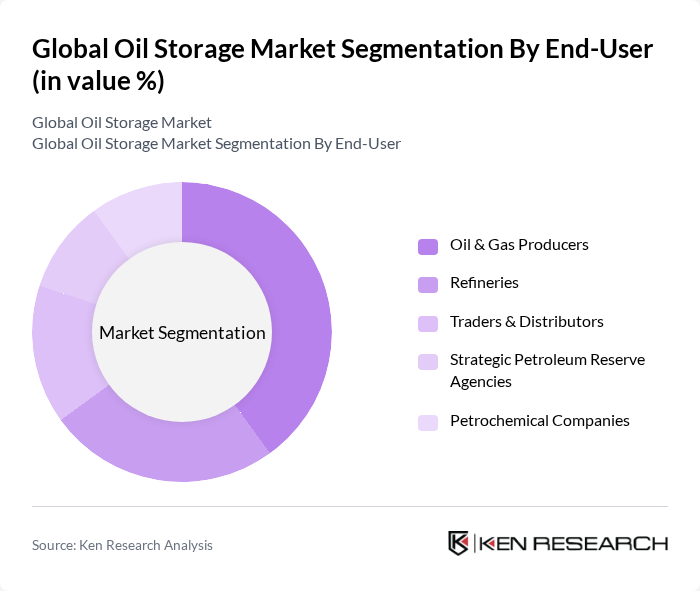

By End-User:The market is segmented based on end-users, including Oil & Gas Producers, Refineries, Traders & Distributors, Strategic Petroleum Reserve Agencies, and Petrochemical Companies. Each end-user category has distinct requirements and influences the demand for oil storage solutions .

The Oil & Gas Producers segment leads the market due to their substantial storage needs for crude oil and natural gas. These producers require large-scale storage facilities to manage production fluctuations and ensure a steady supply to refineries and distributors. The ongoing exploration and production activities, particularly in shale oil regions, further enhance the demand for storage solutions tailored to the oil and gas sector .

The Global Oil Storage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Royal Vopak N.V., Kinder Morgan, Inc., Magellan Midstream Partners, L.P., Buckeye Partners, L.P., Oiltanking GmbH, Zenith Energy Ltd., NuStar Energy L.P., China National Petroleum Corporation (CNPC), Indian Strategic Petroleum Reserves Limited (ISPRL), Targa Resources Corp., Shell plc, TotalEnergies SE, BP p.l.c., Chevron Corporation, Enbridge Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oil storage market is poised for transformation, driven by the integration of digital technologies and a shift towards sustainable practices. As companies adopt IoT and AI for operational efficiency, the focus on safety and environmental compliance will intensify. Additionally, the ongoing consolidation in the industry may lead to stronger entities capable of navigating market volatility, ensuring resilience. This evolving landscape will create opportunities for innovative storage solutions and strategic partnerships, positioning the market for sustainable growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Roof Tanks Floating Roof Tanks Spherical Tanks Bullet Tanks Others (e.g., Open Top Tanks, Horizontal Tanks) |

| By End-User | Oil & Gas Producers Refineries Traders & Distributors Strategic Petroleum Reserve Agencies Petrochemical Companies |

| By Application | Crude Oil Storage Refined Petroleum Products Storage Strategic Reserves Biofuels & Alternative Fuels Storage Others |

| By Distribution Mode | Pipeline-connected Storage Rail-connected Storage Barge/Ship-connected Storage Truck-connected Storage |

| By Storage Capacity | Up to 50,000 m³ ,001–250,000 m³ Above 250,000 m³ |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Investment Source | Private Investments Public Funding Foreign Direct Investment (FDI) Joint Ventures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Global Oil Storage Operators | 100 | Facility Managers, Operations Directors |

| Logistics and Supply Chain Experts | 60 | Supply Chain Managers, Logistics Coordinators |

| Regulatory and Compliance Officers | 50 | Compliance Managers, Regulatory Affairs Specialists |

| Energy Market Analysts | 40 | Market Analysts, Economic Advisors |

| Environmental and Sustainability Consultants | 40 | Sustainability Managers, Environmental Analysts |

The Global Oil Storage Market is valued at approximately USD 20 billion, driven by increasing energy demand, expansion of refining capacities, and the need for strategic reserves to ensure energy security. This valuation is based on a five-year historical analysis.