Region:Global

Author(s):Dev

Product Code:KRAA1492

Pages:83

Published On:August 2025

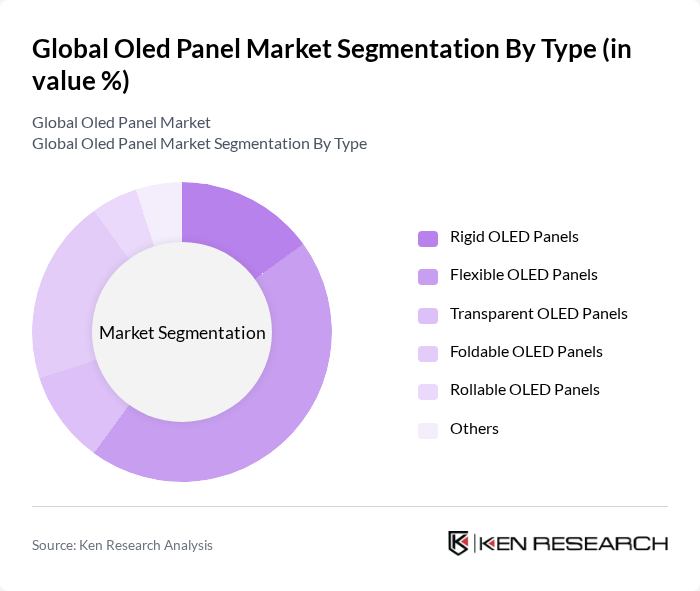

By Type:The OLED panel market is segmented into various types, including Rigid OLED Panels, Flexible OLED Panels, Transparent OLED Panels, Foldable OLED Panels, Rollable OLED Panels, and Others. Among these, Flexible OLED Panels are currently dominating the market due to their versatility and application in a wide range of devices, from smartphones to wearables. The increasing consumer preference for lightweight and curved displays is driving the demand for flexible panels, making them a preferred choice for manufacturers. Foldable OLED panels are also experiencing notable growth, particularly in smartphones and tablets, as manufacturers seek to differentiate products with innovative form factors.

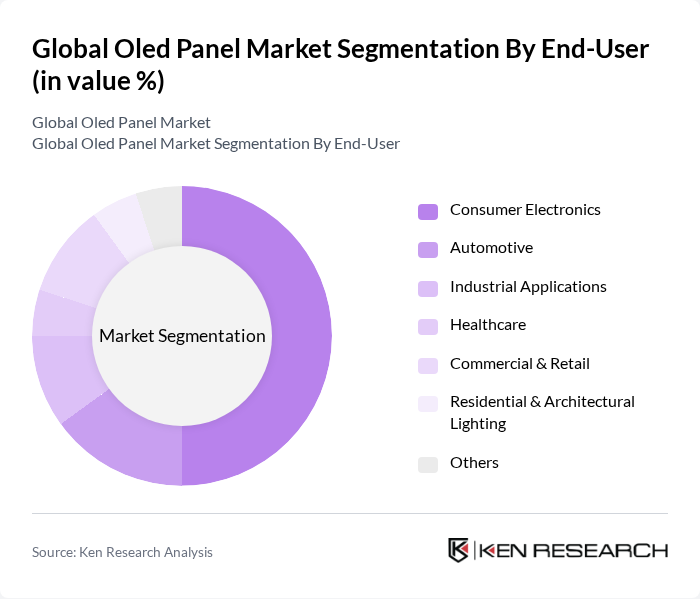

By End-User:The market is further segmented by end-user applications, including Consumer Electronics, Automotive, Industrial Applications, Healthcare, Commercial & Retail, Residential & Architectural Lighting, and Others. The Consumer Electronics segment is leading the market, driven by the rising demand for OLED displays in televisions and smartphones. The trend towards larger screens with better display quality is propelling manufacturers to adopt OLED technology, making it the preferred choice for high-end devices. Automotive displays are also a fast-growing segment, with OLED panels increasingly used for instrument clusters and infotainment systems, reflecting the sector’s shift toward premium and high-resolution displays.

The Global OLED Panel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Display Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., AU Optronics Corp., Japan Display Inc., Sharp Corporation, Tianma Microelectronics Co., Ltd., Visionox Technology Inc., Everdisplay Optronics (Shanghai) Ltd., OLEDWorks LLC, Universal Display Corporation, Konica Minolta, Inc., Idemitsu Kosan Co., Ltd., Merck KGaA, CYNORA GmbH, Sony Corporation, Pioneer Corporation, Raystar Optronics Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the OLED panel market appears promising, driven by ongoing technological advancements and increasing consumer demand for high-quality displays. As manufacturers continue to innovate, the introduction of flexible and transparent OLED panels is expected to open new applications in various sectors, including automotive and smart home devices. Furthermore, the push for sustainable manufacturing practices will likely enhance the appeal of OLED technology, aligning with global trends towards eco-friendly solutions in electronics.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid OLED Panels Flexible OLED Panels Transparent OLED Panels Foldable OLED Panels Rollable OLED Panels Others |

| By End-User | Consumer Electronics Automotive Industrial Applications Healthcare Commercial & Retail Residential & Architectural Lighting Others |

| By Application | Television Displays Smartphone Displays Wearable Devices Digital Signage Tablet & Laptop Displays Automotive Displays Lighting Panels Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Mid-Range Budget Others |

| By Technology | Passive Matrix OLED (PMOLED) Active Matrix OLED (AMOLED) Hybrid OLED Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Television Manufacturers | 100 | Product Development Managers, Supply Chain Directors |

| Smartphone OEMs | 90 | R&D Engineers, Procurement Managers |

| Automotive Display Suppliers | 70 | Design Engineers, Quality Assurance Managers |

| Consumer Electronics Retailers | 80 | Sales Managers, Marketing Directors |

| OLED Material Suppliers | 50 | Business Development Managers, Technical Sales Representatives |

The Global OLED Panel Market is valued at approximately USD 31 billion, driven by increasing demand for high-quality displays in consumer electronics, automotive, and industrial applications. This growth reflects a significant shift towards OLED technology due to its superior color accuracy and energy efficiency.