Region:Global

Author(s):Dev

Product Code:KRAA1578

Pages:87

Published On:August 2025

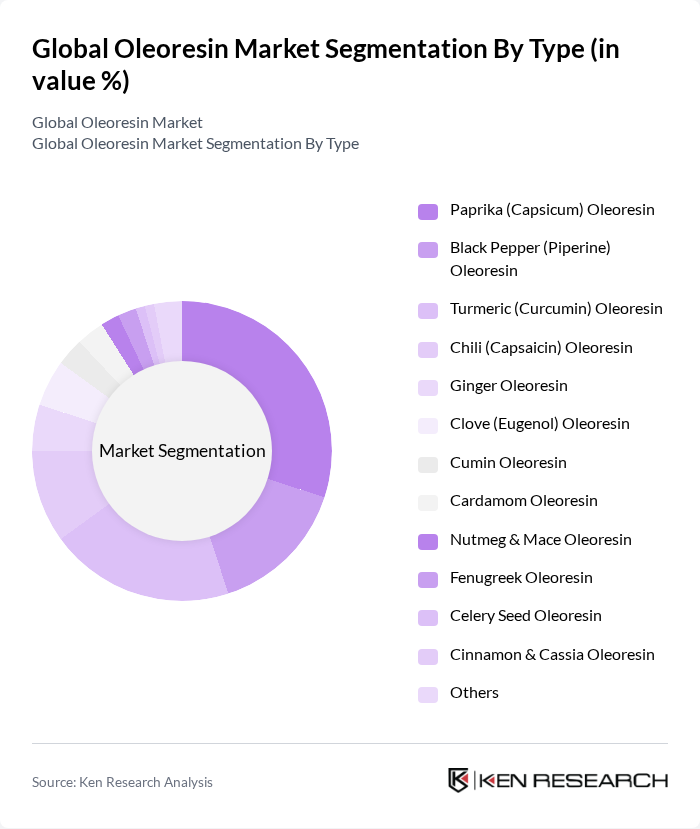

By Type:The oleoresin market is segmented into various types, including Paprika (Capsicum) Oleoresin, Black Pepper (Piperine) Oleoresin, Turmeric (Curcumin) Oleoresin, Chili (Capsaicin) Oleoresin, Ginger Oleoresin, Clove (Eugenol) Oleoresin, Cumin Oleoresin, Cardamom Oleoresin, Nutmeg & Mace Oleoresin, Fenugreek Oleoresin, Celery Seed Oleoresin, Cinnamon & Cassia Oleoresin, and Others. Among these,Paprika Oleoresinis widely used for natural coloring in processed foods, snacks, meat products, and sauces, aligning with clean-label preferences and the growing popularity of ethnic cuisines; turmeric, black pepper, and chili oleoresins are also meaningful categories in food, nutraceutical, and personal care applications .

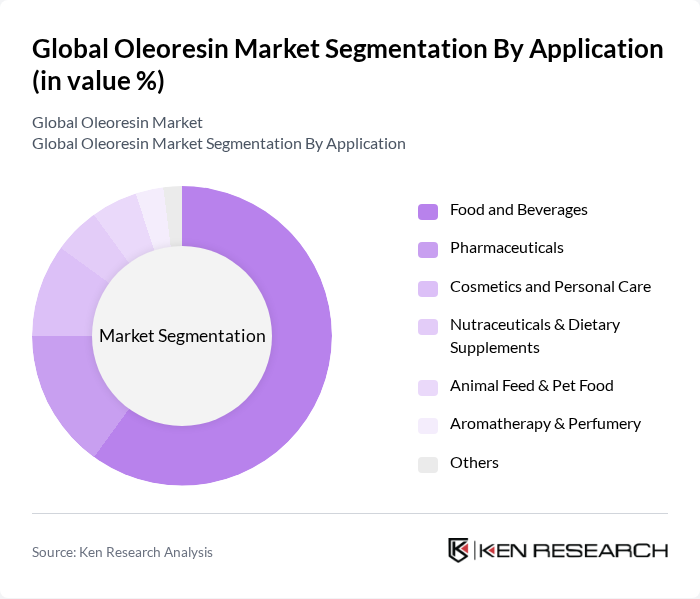

By Application:The oleoresin market is also segmented by application, which includes Food and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Nutraceuticals & Dietary Supplements, Animal Feed & Pet Food, Aromatherapy & Perfumery, and Others. TheFood and Beveragessegment is the largest, supported by demand for natural flavorings and colors, along with cleaner labels in processed foods, snacks, meat products, and sauces; usage is also expanding in nutraceuticals, personal care, and pharma due to functionality and standardizable actives .

The Global Oleoresin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Synthite Industries Pvt. Ltd., Kancor Ingredients Ltd. (Mane Kancor), Ozone Naturals Pvt. Ltd., Plant Lipids (P) Ltd., AVT Natural Products Ltd. (AVT NPL), Universal Oleoresins, Akay Group (Akay Natural Ingredients Pvt. Ltd.), Givaudan S.A., Sensient Technologies Corporation, The McCormick & Company, Inc., Firmenich SA (dsm-firmenich), Symrise AG, Ungerer & Company (part of Givaudan), Indo World Trading Corporation, Paprika Oleo’s India Ltd., Manohar Botanical Extracts Pvt. Ltd., Paras Perfumers, Asian Oleoresin Company, Biolandes SAS, TMV Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the oleoresin market appears promising, driven by increasing consumer demand for natural and organic products. Innovations in extraction technologies are expected to enhance product quality and yield, while the trend towards sustainable sourcing will likely gain momentum. Additionally, as the food and beverage industry continues to expand, the integration of oleoresins into various applications will create new avenues for growth, particularly in emerging markets where consumer preferences are evolving rapidly.

| Segment | Sub-Segments |

|---|---|

| By Type | Paprika (Capsicum) Oleoresin Black Pepper (Piperine) Oleoresin Turmeric (Curcumin) Oleoresin Chili (Capsaicin) Oleoresin Ginger Oleoresin Clove (Eugenol) Oleoresin Cumin Oleoresin Cardamom Oleoresin Nutmeg & Mace Oleoresin Fenugreek Oleoresin Celery Seed Oleoresin Cinnamon & Cassia Oleoresin Others |

| By Application | Food and Beverages (Bakery, Savory, Meat & Poultry, Sauces & Dressings, Snacks) Pharmaceuticals (APIs, Pain Relief Balms, Digestive Aids) Cosmetics and Personal Care (Fragrances, Colorants, Actives) Nutraceuticals & Dietary Supplements Animal Feed & Pet Food Aromatherapy & Perfumery Others |

| By End-User | Food & Beverage Manufacturers Flavor & Fragrance Houses Cosmetic & Personal Care Companies Pharmaceutical & Nutraceutical Firms Animal Nutrition Companies Others |

| By Distribution Channel | Direct (B2B) Sales Distributors & Traders Online B2B Platforms Specialty Ingredient Suppliers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Quality/Certification | Conventional (Standard) Grade Premium Grade Organic Certified (USDA/EU) Clean Label/Allergen-Free/Non-GMO |

| By Extraction Method | Solvent Extraction Supercritical CO? Extraction Resin Adsorption/Other Advanced Methods |

| By Packaging Type | Bottles Drums/IBC Pouches/Sachets Aseptic/Lined Containers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, Quality Assurance Heads |

| Cosmetic and Personal Care Companies | 90 | Formulation Chemists, Brand Managers |

| Pharmaceutical Firms | 60 | Regulatory Affairs Specialists, R&D Directors |

| Flavor and Fragrance Producers | 60 | Flavorists, Supply Chain Managers |

| Agricultural Producers and Exporters | 70 | Procurement Managers, Export Coordinators |

The Global Oleoresin Market is valued at approximately USD 1.5 billion, with estimates ranging between USD 1.5 billion and USD 1.8 billion based on a five-year historical analysis. Europe is identified as the leading regional market.