Region:Global

Author(s):Geetanshi

Product Code:KRAB0071

Pages:84

Published On:August 2025

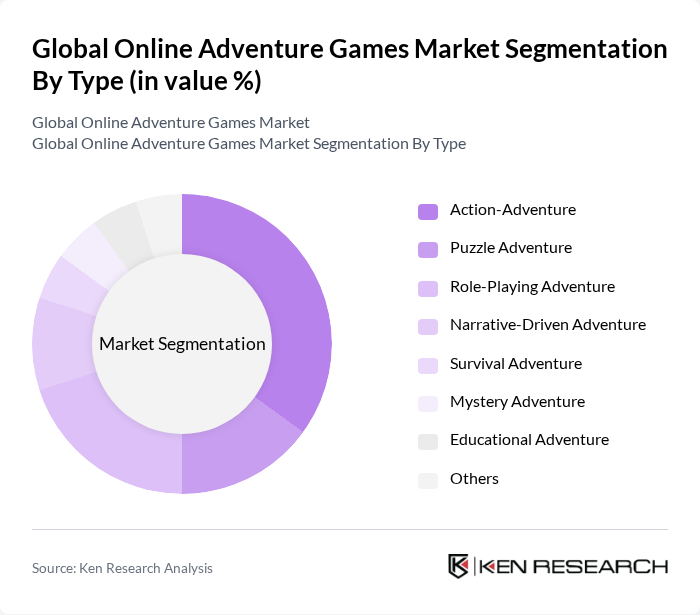

By Type:The online adventure games market is segmented into various types, including Action-Adventure, Puzzle Adventure, Role-Playing Adventure, Narrative-Driven Adventure, Survival Adventure, Mystery Adventure, Educational Adventure, and Others. Among these,Action-Adventure gamesdominate the market due to their engaging gameplay, strong narrative elements, and broad appeal across age groups. The increasing trend of multiplayer modes, live-service updates, and online interactions further enhances the appeal of this sub-segment, making it a favorite among gamers seeking both solo and cooperative experiences .

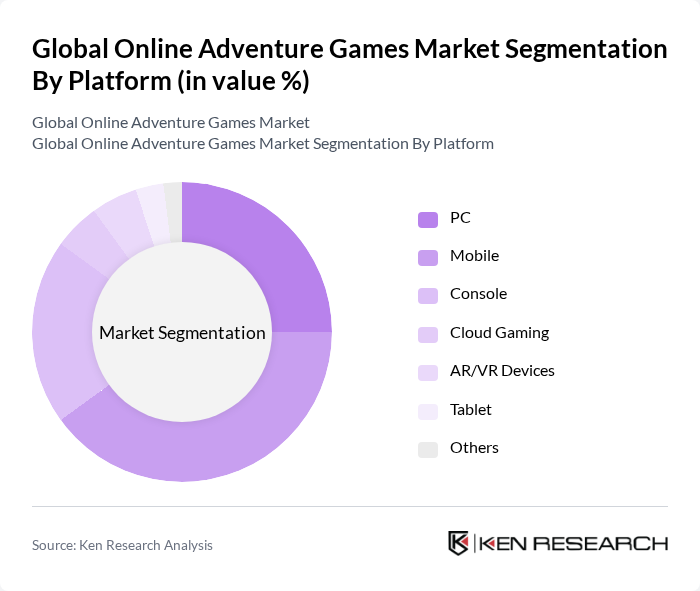

By Platform:The market is also segmented by platform, including PC, Mobile, Console, Cloud Gaming, AR/VR Devices, Tablet, and Others. TheMobile platformis currently leading the market due to the widespread adoption of smartphones, improved mobile internet speeds, and the convenience of gaming on-the-go. This trend is further supported by the development of high-quality mobile games and cross-platform compatibility, which offer experiences comparable to traditional gaming platforms and attract a diverse range of players .

The Global Online Adventure Games Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tencent Holdings Ltd., Activision Blizzard, Inc., Nintendo Co., Ltd., Electronic Arts Inc., Ubisoft Entertainment S.A., Square Enix Holdings Co., Ltd., Bandai Namco Entertainment Inc., Epic Games, Inc., Valve Corporation, Rockstar Games, Inc., Telltale Games, Zynga Inc., Supercell Oy, Niantic, Inc., Rovio Entertainment Corporation, King Digital Entertainment, Bungie, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online adventure games market appears promising, driven by technological advancements and evolving consumer preferences. As the integration of virtual reality (VR) and augmented reality (AR) becomes more prevalent, developers are likely to create more immersive experiences. Additionally, the rise of subscription models is expected to reshape revenue streams, allowing for sustained engagement. With emerging markets gaining internet access, the potential for growth in these regions will further enhance the market landscape, fostering innovation and competition.

| Segment | Sub-Segments |

|---|---|

| By Type | Action-Adventure Puzzle Adventure Role-Playing Adventure Narrative-Driven Adventure Survival Adventure Mystery Adventure Educational Adventure Others |

| By Platform | PC Mobile Console Cloud Gaming AR/VR Devices Tablet Others |

| By Distribution Channel | Digital Downloads Subscription Services Retail Sales In-Game Purchases App Store Purchases Online Platforms Others |

| By User Demographics | Age Group (Children) Age Group (Teenagers 13-18) Age Group (Young Adults 19-30) Age Group (Adults 31-50) Age Group (Older Adults 51+) Gender (Male) Gender (Female) |

| By Game Features | Single-Player Multiplayer Cooperative Play Competitive Play Cross-Platform Play Others |

| By Monetization Model | Free-to-Play Pay-to-Play Freemium Subscription-Based In-game Purchases Others |

| By Game Genre | Fantasy Sci-Fi Historical Horror Mystery Educational Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Casual Gamers | 120 | Players aged 18-35, frequent users of mobile gaming apps |

| Hardcore Gamers | 90 | Players aged 25-45, engaged in PC and console gaming |

| Game Developers | 60 | Professionals in game design, programming, and publishing |

| Gaming Influencers | 50 | Content creators and streamers with a focus on adventure games |

| Industry Analysts | 40 | Experts in gaming market trends and consumer behavior |

The Global Online Adventure Games Market is valued at approximately USD 15 billion, reflecting significant growth driven by the increasing popularity of online gaming, advancements in technology, and the rise of mobile gaming platforms.