Region:Global

Author(s):Geetanshi

Product Code:KRAA0161

Pages:80

Published On:August 2025

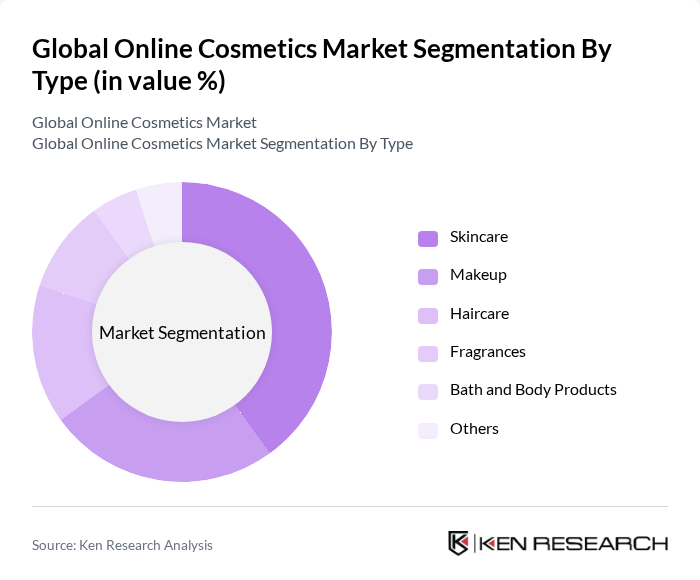

By Type:The online cosmetics market is segmented into various types, including Skincare, Makeup, Haircare, Fragrances, Bath and Body Products, and Others. Among these,Skincare productsdominate the market due to increasing consumer awareness regarding skin health, the rising demand for anti-aging and moisturizing products, and the popularity of natural and organic skincare solutions. Consumers are increasingly conscious of product ingredients, driving demand for clean beauty and sustainable packaging .

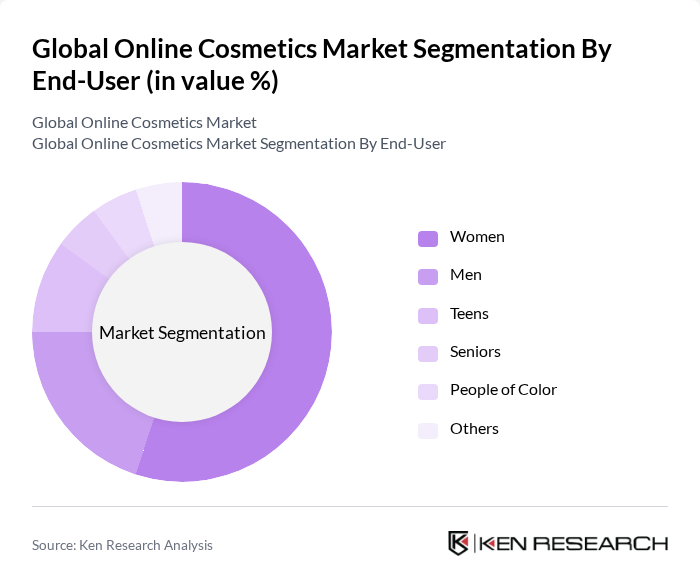

By End-User:The market is also segmented by end-user demographics, including Women, Men, Teens, Seniors, People of Color, and Others. TheWomensegment holds the largest share, driven by the increasing focus on beauty and personal care among women globally. The rise of male grooming products has led to significant growth in the Men segment, reflecting changing societal norms and increasing acceptance of beauty products among men. There is also a notable rise in demand for inclusive cosmetics addressing diverse skin tones and age groups .

The Global Online Cosmetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as L'Oréal, Estée Lauder Companies, Unilever, Procter & Gamble, Coty Inc., Shiseido, Johnson & Johnson, Beiersdorf AG, Revlon, Mary Kay Inc., Sephora (LVMH), Ulta Beauty, Fenty Beauty, Huda Beauty, ColourPop Cosmetics, Glossier, e.l.f. Beauty, Amorepacific, Natura &Co, Amway contribute to innovation, geographic expansion, and service delivery in this space.

The online cosmetics market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As personalization becomes a key focus, brands are expected to leverage data analytics to tailor products to individual needs. Additionally, sustainability will play a crucial role, with eco-friendly packaging and ethical sourcing becoming standard practices. The integration of augmented reality in shopping experiences will enhance consumer engagement, making online shopping more interactive and appealing, thus shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Skincare Makeup Haircare Fragrances Bath and Body Products Others |

| By End-User | Women Men Teens Seniors People of Color Others |

| By Product Category | Luxury Cosmetics Mass Market Cosmetics Professional Cosmetics Vegan & Cruelty-Free Cosmetics Others |

| By Distribution Channel | E-commerce Marketplaces (e.g., Amazon, Alibaba) Brand Websites Social Media Platforms (e.g., Instagram, TikTok Shops) Subscription Boxes Others |

| By Packaging Type | Bottles Tubes Jars Sustainable Packaging Travel-Size & Sample Packaging Others |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients Vegan Ingredients Dermatologically Tested/Hypoallergenic Others |

| By Price Range | Budget Mid-range Premium Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Skincare Purchases | 120 | Skincare Product Users, E-commerce Shoppers |

| Makeup Product Preferences | 100 | Makeup Enthusiasts, Beauty Bloggers |

| Haircare Product Trends | 90 | Haircare Consumers, Salon Professionals |

| Consumer Attitudes Towards Sustainability | 60 | Eco-conscious Shoppers, Brand Advocates |

| Influencer Impact on Purchase Decisions | 70 | Social Media Users, Beauty Influencers |

The Global Online Cosmetics Market is valued at approximately USD 95 billion, reflecting significant growth driven by e-commerce penetration, consumer demand for beauty products, and social media influence on purchasing decisions.