Region:Global

Author(s):Rebecca

Product Code:KRAD0324

Pages:86

Published On:August 2025

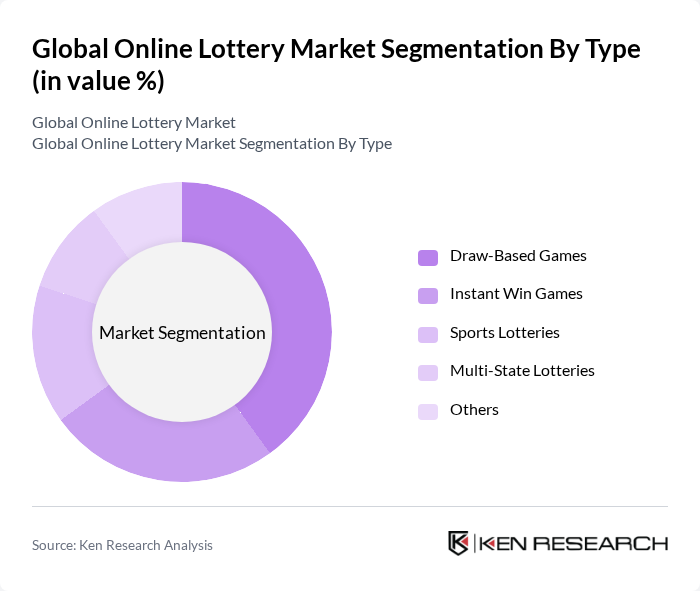

By Type:The online lottery market can be segmented into various types, including Draw-Based Games, Instant Win Games, Sports Lotteries, Multi-State Lotteries, and Others. Among these, Draw-Based Games are particularly popular due to their traditional appeal and the excitement they generate among players. Instant Win Games are also gaining traction, especially among younger demographics who prefer quick and engaging gaming experiences. The market is also seeing a shift from traditional draw-based games to virtual and mobile-based lotteries, reflecting evolving consumer preferences and technological advancements.

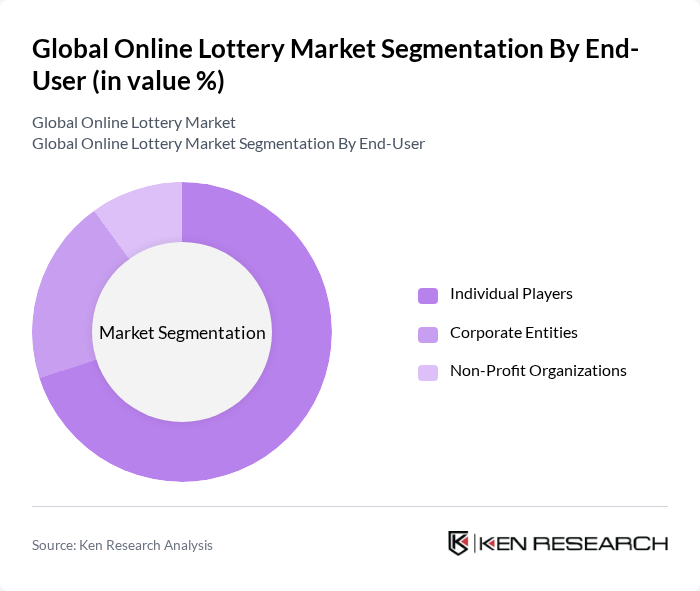

By End-User:The end-user segmentation includes Individual Players, Corporate Entities, and Non-Profit Organizations. Individual Players dominate the market, driven by the increasing number of people participating in online lotteries for entertainment and the potential for significant winnings. Corporate Entities and Non-Profit Organizations also play a role, particularly in fundraising and promotional activities. The market is further influenced by the growing trend of personalization and omnichannel lottery sales, making online platforms attractive to a broader demographic.

The Global Online Lottery Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Lottery Corporation, Camelot Group, Lottoland, Scientific Games Corporation, IGT (International Game Technology), Zeal Network SE, Lotto24 AG, Intralot S.A., Playtech PLC, 888 Holdings PLC, LottoGo (Annexio Limited), Lotto Agent (Agento N.V.), LottoKings, Lotto247 (Play UK Internet N.V.), Lottomatica Group SpA, Jumbo Interactive Ltd., WinTrillions (Legacy Eight Group Ltd.), WeLoveLotto (Ardua Ventures Ltd.), Multilotto, Lotto.com Inc. contribute to innovation, geographic expansion, and service delivery in this space. The market is highly fragmented, with intense competition and ongoing investment in user-friendly digital platforms, mobile applications, and strategic partnerships to enhance market reach.

The online lottery market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As operators increasingly adopt innovative technologies, such as blockchain for transparency and security, user trust is expected to grow. Additionally, the integration of social features and gamification will enhance user engagement. The focus on responsible gaming will also shape future strategies, ensuring sustainable growth while addressing regulatory and ethical considerations in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Draw-Based Games Instant Win Games Sports Lotteries Multi-State Lotteries Others |

| By End-User | Individual Players Corporate Entities Non-Profit Organizations |

| By Sales Channel | Online Platforms (Websites) Mobile Applications Retail Outlets (Hybrid/Omnichannel) |

| By Game Format | Traditional Lottery Online Lottery Hybrid Lottery |

| By Payment Method | Credit/Debit Cards E-Wallets Bank Transfers Cryptocurrencies |

| By Demographics | Age Groups Gender Income Levels |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Lottery Players | 120 | Regular Players, Occasional Players |

| Lottery Operators | 60 | CEOs, Marketing Directors |

| Regulatory Authorities | 40 | Compliance Officers, Policy Makers |

| Technology Providers | 50 | Product Managers, Software Developers |

| Market Analysts | 45 | Industry Analysts, Financial Advisors |

The Global Online Lottery Market is valued at approximately USD 11.5 billion, reflecting significant growth driven by increased smartphone adoption, internet accessibility, and changing consumer preferences towards digital entertainment.