Region:Global

Author(s):Shubham

Product Code:KRAA1895

Pages:95

Published On:August 2025

By Type:The online simulation games market is segmented into various types, including Vehicle & Racing Simulation, Flight & Space Simulation, Construction & Management Simulation (CMS), Life & Social Simulation, Sports Simulation, Training & Education Simulation, and Sandbox/Physics & Other Simulation. Vehicle & Racing Simulation has broad appeal from casual to enthusiast players and benefits from improved physics, force feedback, and graphics; VR support has further boosted realism. Flight & Space Simulation has gained renewed traction due to high-fidelity titles and VR integration enhancing immersion.

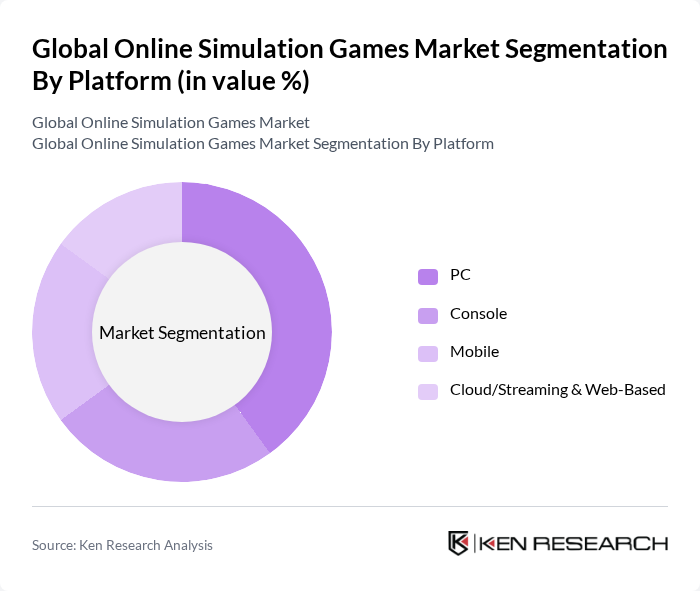

By Platform:The market is also segmented by platform, including PC, Console, Mobile, and Cloud/Streaming & Web-Based. The PC platform remains the most popular due to its superior graphics capabilities and extensive library of simulation games. However, the Mobile segment is rapidly growing, driven by the increasing accessibility of smartphones and the popularity of casual gaming. Cloud gaming is emerging as a significant player, allowing users to access high-quality games without the need for expensive hardware, thus broadening the market reach.

The Global Online Simulation Games Market is characterized by a dynamic mix of regional and international players. Leading participants such as Electronic Arts Inc. (EA) — The Sims, EA Sports FC, Activision Blizzard, Inc. — Blizzard Entertainment (StarCraft II Arcade, Overwatch Workshop), Ubisoft Entertainment S.A. — Anno, The Crew (Ivory Tower), Take-Two Interactive Software, Inc. — Rockstar Games, Private Division (Kerbal Space Program), Paradox Interactive AB — Cities: Skylines, Stellaris, Frontier Developments plc — Elite Dangerous, Planet Coaster, Bohemia Interactive — Arma, DayZ (simulation/mod frameworks), SCS Software — Euro Truck Simulator, American Truck Simulator, KOEI TECMO GAMES CO., LTD. — Winning Post, Nobunaga’s Ambition, NCSOFT Corporation — AION Classic (simulation-adjacent systems), platform capabilities, Valve Corporation — Steam (distribution, mod/workshop ecosystem), Dota 2 workshop tools, Microsoft — Xbox Game Studios (Microsoft Flight Simulator by Asobo Studio), Asobo Studio — Microsoft Flight Simulator (development partner), NetEase Games — Eggy Party, LifeAfter (online systems; sim/social features), Tencent Games — Level Infinite (Arena Breakout; investments in sim studios) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online simulation games market appears promising, driven by technological advancements and evolving consumer preferences. As virtual reality and augmented reality technologies become more mainstream, developers are likely to create more immersive experiences that attract a wider audience. Additionally, the increasing integration of artificial intelligence in game design will enhance user engagement and personalization, further solidifying the market's growth trajectory. The focus on cross-platform compatibility will also facilitate broader access, ensuring sustained interest in simulation games.

| Segment | Sub-Segments |

|---|---|

| By Type | Vehicle & Racing Simulation (e.g., driving, trucking, motorsport) Flight & Space Simulation Construction & Management Simulation (CMS) Life & Social Simulation Sports Simulation Training & Education Simulation Sandbox/Physics & Other Simulation |

| By Platform | PC Console Mobile Cloud/Streaming & Web-Based |

| By Revenue Model | In-App Purchases (F2P microtransactions) Subscription Advertising-Supported Paid/B2P (One-time purchase) |

| By Distribution Channel | Digital Stores/Launchers (e.g., Steam, Epic, PlayStation/Xbox stores) Direct Publisher/Developer Platforms Third-Party Marketplaces |

| By User Demographics | Children (Under 13) Teens (13–17) Adults (18–44) Mature Gamers (45+) |

| By Multiplayer Mode | Massively Multiplayer Online (MMO) Competitive/Ranked Multiplayer Co-op/Social Multiplayer Single-Player with Online Features |

| By Immersion Layer | Non-VR/Standard VR/AR-Enabled |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Casual Gamers | 150 | Individuals aged 18-35, frequent mobile game users |

| Hardcore Gamers | 120 | Individuals aged 18-45, console and PC game enthusiasts |

| Game Developers | 80 | Professionals in game design and development roles |

| Industry Analysts | 60 | Market researchers and analysts specializing in gaming |

| Online Gaming Communities | 90 | Members of online forums and social media groups focused on gaming |

The Global Online Simulation Games Market is valued at approximately USD 9 billion, reflecting significant growth driven by factors such as increased internet access, affordable gaming hardware, and the rising popularity of immersive entertainment experiences.