Region:Global

Author(s):Dev

Product Code:KRAC0365

Pages:83

Published On:August 2025

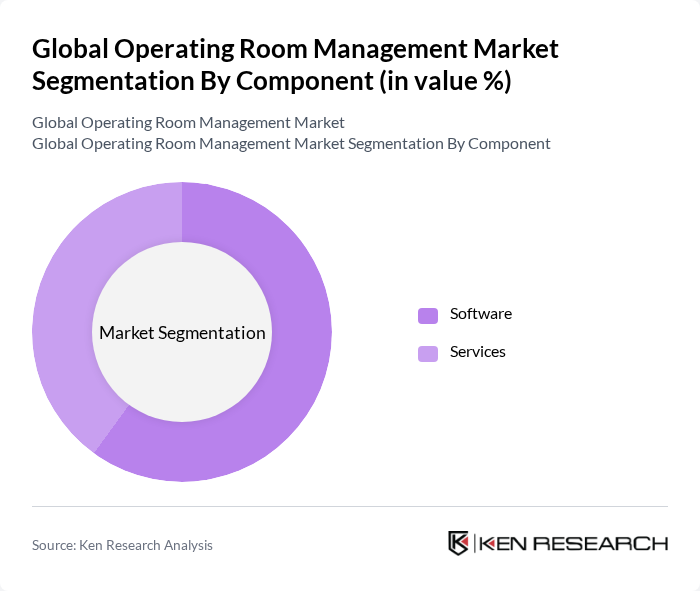

By Component:The market is segmented into Software and Services. The Software segment includes applications such as scheduling, workflow management, and data analytics designed to enhance operational efficiency and patient outcomes. The Services segment encompasses consulting, implementation, integration, and support services that facilitate the adoption and optimization of these technologies .

By Solution:The market is further divided into Data Management and Communication Solutions, Anesthesia Information Management Systems, Operating Room Supply Management Solutions, Operating Room Scheduling Solutions, Performance Management Solutions, and Other Solutions. Each solution addresses specific operational challenges faced by healthcare facilities, such as optimizing workflow, improving communication, managing supplies, scheduling procedures, and enhancing overall performance through analytics and reporting .

The Global Operating Room Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Siemens Healthineers, GE HealthCare, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Philips Healthcare, Oracle (Cerner Corporation), Epic Systems Corporation, Becton, Dickinson and Company (BD), Getinge AB, Brainlab AG, Steris Corporation, Surgical Information Systems, Veradigm (Allscripts Healthcare, LLC), Picis Clinical Solutions Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the operating room management market appears promising, driven by technological advancements and a shift towards value-based care. As healthcare providers increasingly prioritize patient outcomes, the integration of AI and machine learning into OR management systems is expected to enhance decision-making and operational efficiency. Furthermore, the growing trend of telemedicine will facilitate remote surgical planning, allowing for better resource allocation and improved patient care, ultimately shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Services |

| By Solution | Data Management and Communication Solutions Anesthesia Information Management Systems Operating Room Supply Management Solutions Operating Room Scheduling Solutions Performance Management Solutions Other Solutions |

| By Delivery Mode | On-Premise Solutions Cloud-Based Solutions |

| By End-User | Hospitals Ambulatory Surgery Centers Other End Users |

| By Geography | North America Europe Asia-Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Operating Room Management | 120 | Operating Room Managers, Surgical Coordinators |

| Ambulatory Surgical Centers | 90 | Facility Administrators, Clinical Directors |

| Healthcare Technology Providers | 60 | Product Managers, Sales Executives |

| Healthcare Policy Makers | 40 | Health Economists, Regulatory Affairs Specialists |

| Surgeons and Anesthesiologists | 70 | Surgeons, Anesthesia Providers |

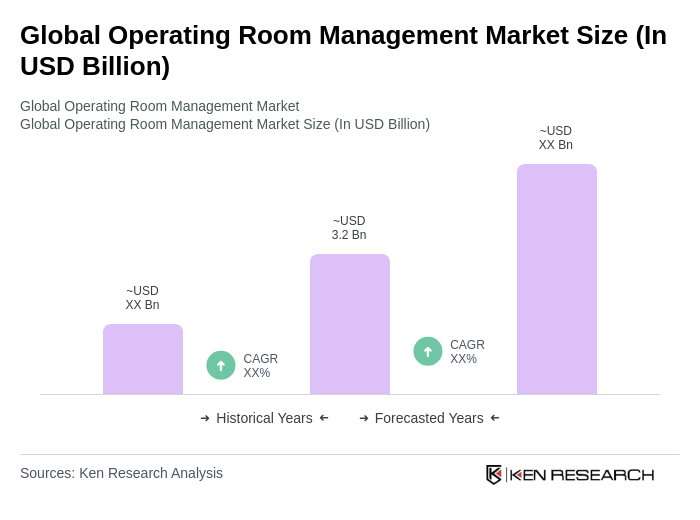

The Global Operating Room Management Market is valued at approximately USD 3.2 billion, driven by the increasing demand for efficient surgical procedures and advancements in medical technology, including artificial intelligence and data analytics.