Region:Global

Author(s):Dev

Product Code:KRAC0561

Pages:97

Published On:August 2025

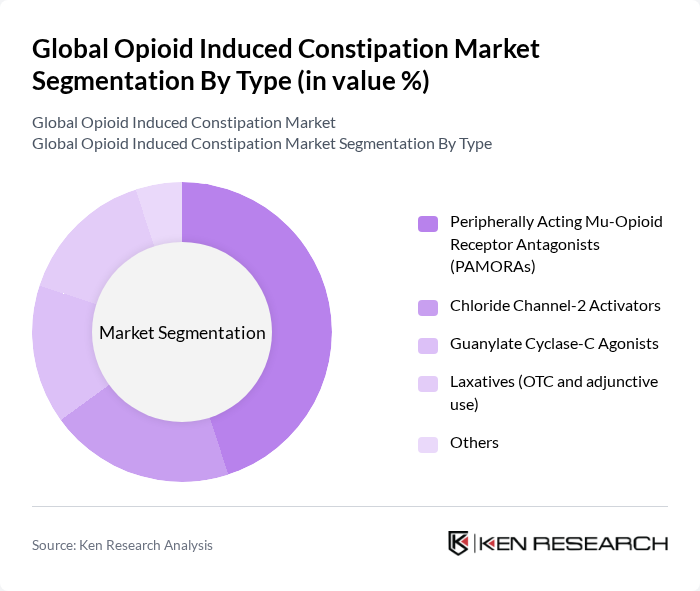

By Type:The market is segmented into various types of treatments for opioid-induced constipation, including Peripherally Acting Mu-Opioid Receptor Antagonists (PAMORAs), Chloride Channel-2 Activators, Guanylate Cyclase-C Agonists, Laxatives (OTC and adjunctive use), and Others. Among these, PAMORAs are currently the leading sub-segment due to their targeted action and effectiveness in alleviating constipation without affecting pain relief. The increasing adoption of these therapies in clinical settings is driving their dominance.

By End-User:The market is segmented by end-users, including Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Specialty Clinics. Hospital Pharmacies dominate this segment due to their critical role in managing complex patient cases, particularly those involving chronic pain and opioid use. The increasing number of patients requiring specialized care in hospitals is driving the demand for effective OIC treatments.

The Global Opioid Induced Constipation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Takeda Pharmaceutical Company Limited (Amitiza/linaclotide partnerships historically; OIC presence via lubiprostone legacy rights in some markets), Bausch Health Companies Inc. (Salix Pharmaceuticals) — Relistor (methylnaltrexone), AstraZeneca PLC — Movantik/Moventig (naloxegol), Kyowa Kirin Co., Ltd. — Moventig (select EU rights) and GI portfolio, Shionogi & Co., Ltd. — Symproic (naldemedine), Mallinckrodt Pharmaceuticals — Entereg (alvimopan; hospital-only in U.S.), Nektar Therapeutics — naloxegol originator technology licensing, Pfizer Inc. — GI collaborations and legacy OIC co-promotions in select markets, Ironwood Pharmaceuticals, Inc. — GI franchise participant (constipation therapeutics landscape), AbbVie Inc. (including Allergan legacy) — GI portfolio and distribution capabilities, Hikma Pharmaceuticals PLC — Generics and hospital channel presence relevant to OIC adjuncts, Lupin Limited — Generics in GI and pain adjunct categories, Sun Pharmaceutical Industries Ltd. — Generics/brands in GI and pain management, Zydus Lifesciences Limited, Viatris Inc. — Global generics distribution, including GI therapies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the opioid-induced constipation market appears promising, driven by ongoing innovations and a shift towards more patient-centric approaches. As healthcare providers increasingly recognize the importance of managing OIC, the integration of digital health solutions and personalized medicine is expected to enhance treatment adherence. Furthermore, the expansion of educational initiatives will empower patients to seek timely interventions, ultimately improving their quality of life. The market is poised for growth as stakeholders adapt to evolving patient needs and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Peripherally Acting Mu-Opioid Receptor Antagonists (PAMORAs) Chloride Channel-2 Activators Guanylate Cyclase-C Agonists Laxatives (OTC and adjunctive use) Others |

| By End-User | Hospital Pharmacies Retail Pharmacies Online Pharmacies Specialty Clinics |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Direct-to-Patient Programs |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Cancer-Pain Patients Non-Cancer Chronic-Pain Patients Geriatric Patients (65+) |

| By Treatment Duration | Short-term Treatment Long-term Maintenance |

| By Route of Administration | Oral Parenteral |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers (Gastroenterologists) | 90 | Gastroenterologists, Pain Management Specialists |

| Pharmacists | 80 | Community Pharmacists, Hospital Pharmacists |

| Patients with Opioid-Induced Constipation | 120 | Patients currently on opioid therapy |

| Healthcare Administrators | 70 | Hospital Administrators, Clinic Managers |

| Regulatory Experts | 50 | Health Policy Analysts, Regulatory Affairs Specialists |

The Global Opioid Induced Constipation Market is valued at approximately USD 3 billion, reflecting a significant demand driven by the high prevalence of opioid prescriptions and the need for effective treatment options for opioid-induced constipation (OIC).