Region:Global

Author(s):Rebecca

Product Code:KRAD0182

Pages:95

Published On:August 2025

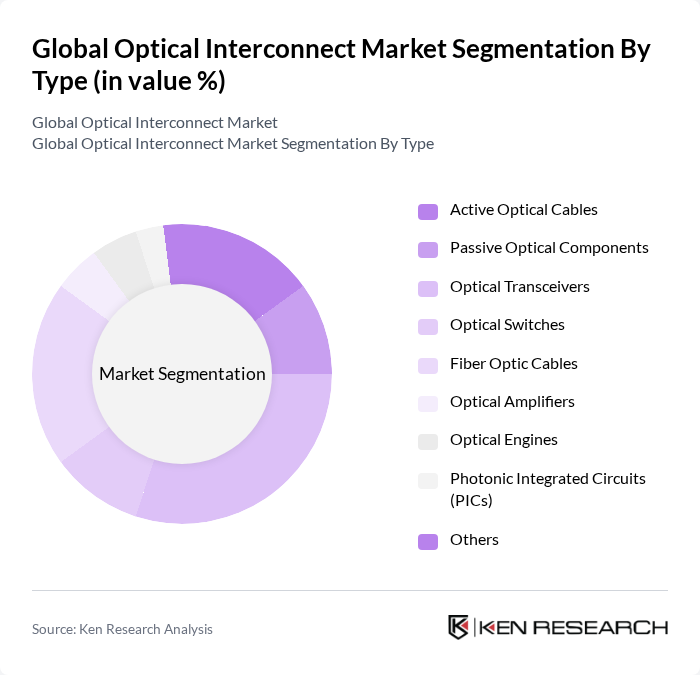

By Type:The market is segmented into various types, including Active Optical Cables, Passive Optical Components, Optical Transceivers, Optical Switches, Fiber Optic Cables, Optical Amplifiers, Optical Engines, Photonic Integrated Circuits (PICs), and Others. Among these,Optical Transceiversare currently leading the market due to their critical role in enabling high-speed data transmission across networks. The increasing demand for high-bandwidth internet, cloud services, and data center expansion has driven the adoption of these components, making them essential for telecommunications, hyperscale data centers, and enterprise network applications.

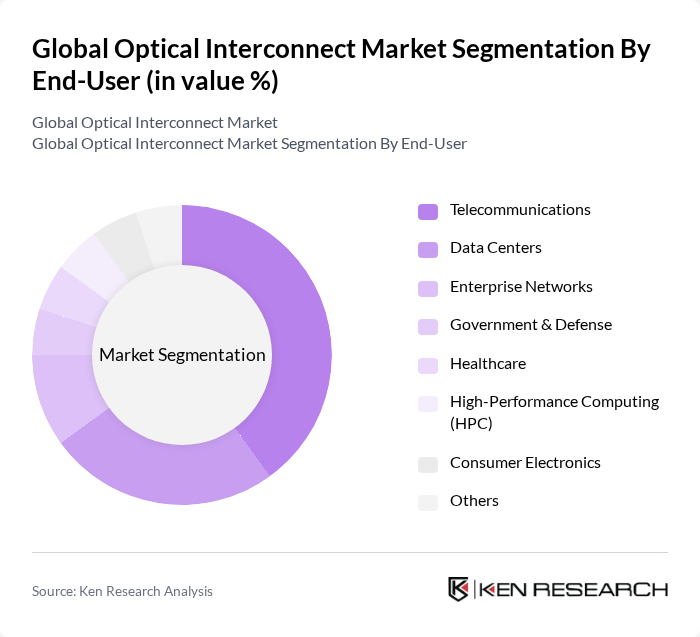

By End-User:The market is segmented by end-users, including Telecommunications, Data Centers, Enterprise Networks, Government & Defense, Healthcare, High-Performance Computing (HPC), Consumer Electronics, and Others.Telecommunicationsis the leading segment, driven by the increasing demand for high-speed internet, mobile data services, and the rapid expansion of 5G networks. The need for enhanced connectivity and low-latency solutions in urban and industrial environments continues to propel growth in this segment. Data centers are also a significant end-user, reflecting the surge in cloud adoption and hyperscale infrastructure investments.

The Global Optical Interconnect Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Juniper Networks, Inc., Intel Corporation, Broadcom Inc., Infinera Corporation, Ciena Corporation, Corning Incorporated, Lumentum Operations LLC, Coherent Corp., ADVA Optical Networking SE, Nokia Corporation, Huawei Technologies Co., Ltd., Fujitsu Limited, Molex LLC, TE Connectivity Ltd., Amphenol Communications Solutions, NVIDIA Corporation, InnoLight Technology, and Sumitomo Electric Industries, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the optical interconnect market appears promising, driven by ongoing advancements in technology and increasing demand for high-speed connectivity. As organizations continue to invest in digital transformation, the integration of optical solutions will become essential for enhancing network performance. Furthermore, the rise of artificial intelligence and machine learning applications will necessitate faster data processing capabilities, further propelling the adoption of optical interconnects across various sectors, including telecommunications and data centers.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Optical Cables Passive Optical Components Optical Transceivers Optical Switches Fiber Optic Cables Optical Amplifiers Optical Engines Photonic Integrated Circuits (PICs) Others |

| By End-User | Telecommunications Data Centers Enterprise Networks Government & Defense Healthcare High-Performance Computing (HPC) Consumer Electronics Others |

| By Application | Data Transmission Video Conferencing Cloud Computing IoT Connectivity High-Performance Computing Artificial Intelligence & Machine Learning Others |

| By Component | Connectors Cables Transceivers Switches Optical Engines Photonic Integrated Circuits (PICs) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Infrastructure | 120 | Network Engineers, Infrastructure Managers |

| Data Center Operations | 90 | Data Center Managers, IT Directors |

| High-Performance Computing | 60 | Research Scientists, HPC Administrators |

| Optical Component Manufacturing | 50 | Product Development Engineers, Quality Assurance Managers |

| Emerging Technologies in Networking | 70 | Technology Analysts, Innovation Managers |

The Global Optical Interconnect Market is valued at approximately USD 14.3 billion, driven by the increasing demand for high-speed data transmission and the expansion of data centers worldwide, particularly due to cloud computing and IoT applications.