Region:Global

Author(s):Dev

Product Code:KRAB0421

Pages:86

Published On:August 2025

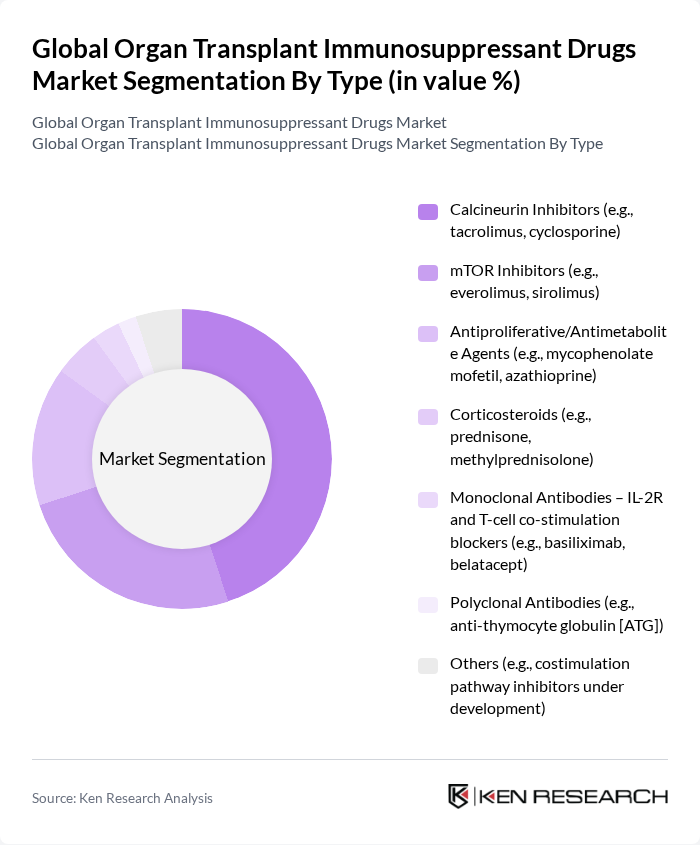

By Type:The market is segmented into various types of immunosuppressant drugs, each serving a unique role in the management of transplant patients. The leading sub-segment is Calcineurin Inhibitors, which remain the backbone of maintenance therapy in kidney and other solid organ transplants, with tacrolimus and cyclosporine widely used to prevent rejection. mTOR Inhibitors and Antiproliferative Agents also hold significant shares as part of combination regimens to balance efficacy and toxicity. The diversity in drug types allows for tailored treatment regimens based on patient risk profiles, organ type, and time since transplant .

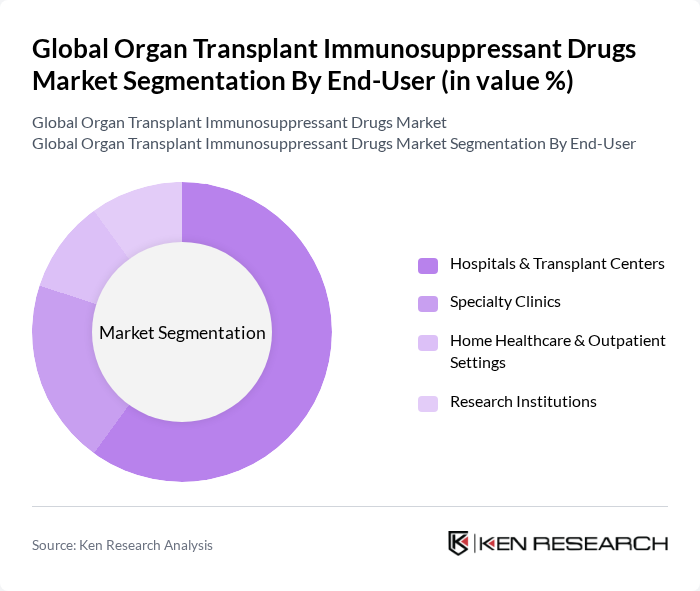

By End-User:The end-user segmentation highlights the various healthcare settings where immunosuppressant drugs are utilized. Hospitals and transplant centers are the primary users, reflecting their central role in performing organ transplants and managing immediate and long-term post-operative care. Specialty clinics and home healthcare settings support chronic maintenance therapy and monitoring, while research institutions advance clinical trials and regimen optimization for improved outcomes and safety .

The Global Organ Transplant Immunosuppressant Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis AG, F. Hoffmann-La Roche Ltd, AbbVie Inc., Astellas Pharma Inc., Bristol Myers Squibb Company, Sanofi S.A., Merck & Co., Inc., Pfizer Inc., Teva Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, Veloxis Pharmaceuticals, Inc., CSL Vifor (Vifor Pharma AG), Sandoz Group AG, Dr. Reddy’s Laboratories Ltd., Sun Pharmaceutical Industries Ltd. contribute to innovation, geographic expansion, and service delivery in this space. Recent trends include incremental innovation in calcineurin inhibitor formulations, use of belatacept in selected kidney transplant populations, and ongoing development of next-generation agents aimed at reducing nephrotoxicity and improving long-term graft survival .

The future of the organ transplant immunosuppressant drugs market appears promising, driven by ongoing advancements in drug formulations and a growing emphasis on personalized medicine. As the healthcare landscape evolves, the integration of telemedicine and digital health solutions is expected to enhance patient management and adherence to treatment protocols. Furthermore, the increasing collaboration between pharmaceutical companies and biotech firms will likely accelerate innovation, leading to more effective therapies and improved patient outcomes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Calcineurin Inhibitors (e.g., tacrolimus, cyclosporine) mTOR Inhibitors (e.g., everolimus, sirolimus) Antiproliferative/Antimetabolite Agents (e.g., mycophenolate mofetil, azathioprine) Corticosteroids (e.g., prednisone, methylprednisolone) Monoclonal Antibodies – IL-2R and T-cell co-stimulation blockers (e.g., basiliximab, belatacept) Polyclonal Antibodies (e.g., anti-thymocyte globulin ) Others (e.g., costimulation pathway inhibitors under development) |

| By End-User | Hospitals & Transplant Centers Specialty Clinics Home Healthcare & Outpatient Settings Research Institutions |

| By Route of Administration | Oral Intravenous Subcutaneous |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies |

| By Patient Demographics | Adult Patients Pediatric Patients |

| By Treatment Regimen | Induction Therapy Maintenance Therapy |

| By Pricing Tier | Premium Mid-range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transplant Surgeons | 100 | Surgeons specializing in kidney, liver, and heart transplants |

| Pharmacy Directors | 80 | Directors from hospitals with transplant programs |

| Clinical Researchers | 60 | Researchers involved in immunosuppressant drug trials |

| Patient Advocacy Groups | 50 | Leaders from organizations supporting transplant patients |

| Healthcare Policy Makers | 40 | Officials involved in healthcare regulations and transplant policies |

The Global Organ Transplant Immunosuppressant Drugs Market is valued at approximately USD 5.5 billion, reflecting steady growth driven by increasing transplant volumes and the ongoing need for maintenance immunosuppression following organ transplants.