Region:Global

Author(s):Dev

Product Code:KRAD0381

Pages:86

Published On:August 2025

By Type:The organic food and beverages market is segmented into various types, including organic fruits & vegetables, organic dairy, organic meat, poultry & seafood, organic bakery, cereals & grains, organic snacks & confectionery, organic baby food, organic beverages, and others. Among these, organic fruits & vegetables are leading the market due to high demand for fresh produce and health benefits associated with organic farming practices. Consumers are increasingly opting for organic fruits and vegetables as they are perceived to be healthier and free from harmful pesticides.

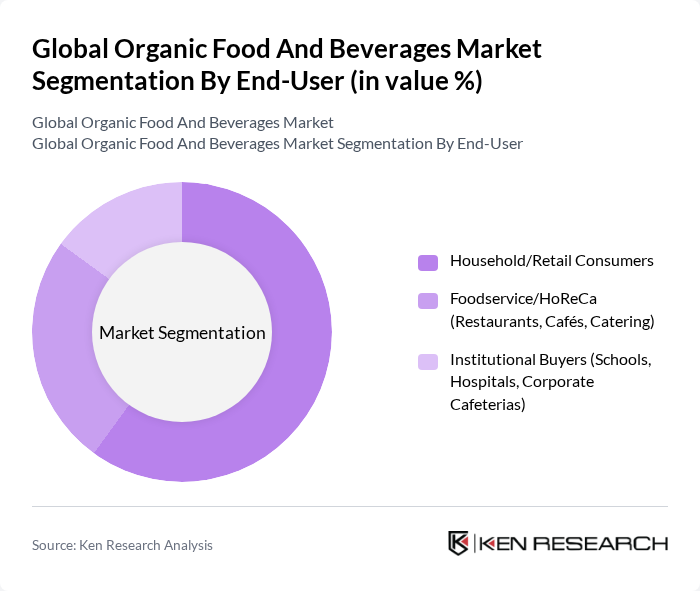

By End-User:The end-user segmentation includes household/retail consumers, foodservice/HoReCa (restaurants, cafés, catering), and institutional buyers (schools, hospitals, corporate cafeterias). The household/retail consumer segment is the largest, driven by the increasing trend of health-conscious eating and the growing availability of organic products in supermarkets and online platforms. Consumers are more inclined to purchase organic products for home consumption, leading to a significant market share for this segment.

The Global Organic Food and Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danone S.A. (incl. Horizon Organic, Happy Family Organics), Nestlé S.A. (incl. Garden of Life, Pure Life, organic lines), General Mills, Inc. (incl. Annie's, Cascadian Farm, Muir Glen), The Hain Celestial Group, Inc. (incl. Earth's Best, Celestial Seasonings), Unilever PLC (organic offerings within Pukka Herbs, etc.), Organic Valley (Cropp Cooperative), Stonyfield Farm, Inc. (Stonyfield Organic), Nature's Path Foods, Inc., Amy's Kitchen, Inc., Applegate Farms, LLC, Eden Foods, Inc., Sprouts Farmers Market, Inc., Whole Foods Market, Inc. (Amazon.com, Inc.), Yogi Tea GmbH, SunOpta Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the organic food and beverages market appears promising, driven by increasing consumer demand for health-oriented and sustainable products. As e-commerce continues to grow, more consumers will have access to organic options, enhancing market penetration. Additionally, innovations in organic farming techniques are expected to improve yield and reduce costs, making organic products more competitive. The expansion into emerging markets will further bolster growth, as awareness and demand for organic products rise globally.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Fruits & Vegetables Organic Dairy (Milk, Yogurt, Cheese, Eggs) Organic Meat, Poultry & Seafood Organic Bakery, Cereals & Grains Organic Snacks & Confectionery Organic Baby Food Organic Beverages (Non-dairy, Coffee & Tea, Juices, Alcoholic) Others (Sauces, Condiments, Ready Meals) |

| By End-User | Household/Retail Consumers Foodservice/HoReCa (Restaurants, Cafés, Catering) Institutional Buyers (Schools, Hospitals, Corporate Cafeterias) |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Specialty & Natural/Organic Stores Convenience & Independent Grocery Direct-to-Consumer (Farmers’ Markets, CSA, Brand DTC) |

| By Packaging Type | Bottles Cartons/Tetra Pak Pouches Cans Glass Jars Compostable/Biodegradable Packaging |

| By Price Range | Premium Mid-Range Budget/Value |

| By Organic Certification Type | USDA Organic EU Organic JAS (Japan) Organic Canada Organic Other Certifications (Soil Association, Australian Certified Organic, etc.) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organic Food Retailers | 120 | Store Managers, Purchasing Managers |

| Organic Beverage Manufacturers | 90 | Production Managers, Quality Assurance Managers |

| Health Food Consumers | 150 | Health-conscious Shoppers, Dietitians |

| Organic Farmers | 80 | Farm Owners, Agricultural Consultants |

| Food Industry Experts | 60 | Market Analysts, Food Scientists |

The Global Organic Food and Beverages Market is valued at approximately USD 280 billion, reflecting a significant increase in consumer demand for organic products driven by health awareness and sustainable agricultural practices.