Region:Global

Author(s):Dev

Product Code:KRAD0592

Pages:84

Published On:August 2025

By Type:The orphan drugs market can be segmented into various types, including Biologicals, Small Molecules, Gene Therapies, Cell Therapies, Enzyme Replacement Therapies, RNA-based Therapies, and Others. Among these, Biologicals are currently leading the market due to their effectiveness in treating complex rare diseases and the growing trend towards personalized and targeted therapies, including monoclonal antibodies and recombinant proteins used across hematology, immunology, and rare oncology .

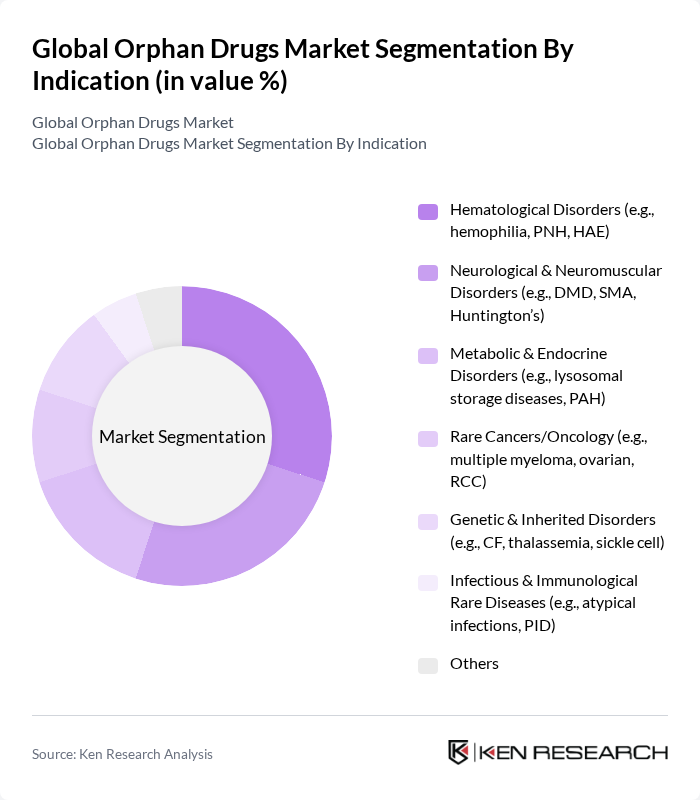

By Indication:The orphan drugs market is also categorized by indications, including Hematological Disorders, Neurological & Neuromuscular Disorders, Metabolic & Endocrine Disorders, Rare Cancers/Oncology, Genetic & Inherited Disorders, Infectious & Immunological Rare Diseases, and Others. Hematological Disorders remain a leading indication due to the strong pipeline and approvals in hemophilia, paroxysmal nocturnal hemoglobinuria, hereditary angioedema, and related conditions, supported by biologics and RNA-based modalities .

The Global Orphan Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis AG, Sanofi S.A., Pfizer Inc., F. Hoffmann-La Roche Ltd, Amgen Inc., Vertex Pharmaceuticals Incorporated, Alexion Pharmaceuticals, Inc. (AstraZeneca Rare Disease), Takeda Pharmaceutical Company Limited, BioMarin Pharmaceutical Inc., Regeneron Pharmaceuticals, Inc., GSK plc, AbbVie Inc., Eli Lilly and Company, Incyte Corporation, Ultragenyx Pharmaceutical Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The orphan drugs market is poised for significant transformation, driven by technological advancements and evolving patient needs. As the focus shifts towards personalized medicine, companies are increasingly investing in gene therapies and innovative treatment modalities. Additionally, the rise of digital health solutions is expected to enhance patient engagement and data collection, facilitating better outcomes. With regulatory bodies continuing to support orphan drug development, the market is likely to witness a surge in new therapies, addressing the unmet needs of rare disease patients in the None region.

| Segment | Sub-Segments |

|---|---|

| By Type | Biologicals (e.g., monoclonal antibodies, recombinant proteins) Small Molecules Gene Therapies (AAV, lentiviral, in vivo/ex vivo) Cell Therapies (CAR-T, stem cell–based) Enzyme Replacement Therapies RNA-based Therapies (siRNA, ASOs, mRNA) Others (vaccines, radiopharmaceuticals) |

| By Indication | Hematological Disorders (e.g., hemophilia, PNH, HAE) Neurological & Neuromuscular Disorders (e.g., DMD, SMA, Huntington’s) Metabolic & Endocrine Disorders (e.g., lysosomal storage diseases, PAH) Rare Cancers/Oncology (e.g., multiple myeloma, ovarian, RCC) Genetic & Inherited Disorders (e.g., CF, thalassemia, sickle cell) Infectious & Immunological Rare Diseases (e.g., atypical infections, PID) Others |

| By Route of Administration | Oral Injectable Intravenous Subcutaneous Intrathecal/Intracerebroventricular Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Specialty Pharmacies Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Patient Population | Pediatric Adult Geriatric Ultra-rare/Very small populations |

| By Pricing & Access Model | Premium Pricing Value-based & Outcomes-based Agreements Managed Entry/Conditional Reimbursement Risk-sharing & Installment/Annuity Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Orphan Drugs | 120 | Oncologists, Clinical Researchers |

| Neurological Rare Diseases | 100 | Neurologists, Rare Disease Specialists |

| Genetic Disorders Treatment | 80 | Geneticists, Pharmacologists |

| Pediatric Rare Diseases | 70 | Pediatricians, Child Health Advocates |

| Market Access and Reimbursement | 90 | Health Economists, Policy Makers |

The Global Orphan Drugs Market is valued at approximately USD 200 billion, driven by the increasing prevalence of rare diseases, advancements in biotechnology, and supportive government policies that incentivize orphan drug development.