Region:Global

Author(s):Dev

Product Code:KRAC0454

Pages:95

Published On:August 2025

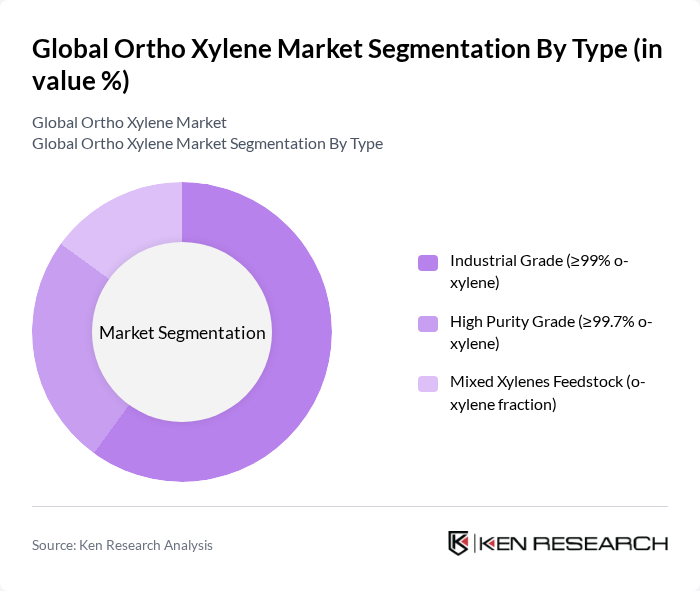

By Type:The ortho xylene market can be segmented into three main types: Industrial Grade (?99% o-xylene), High Purity Grade (?99.7% o-xylene), and Mixed Xylenes Feedstock (o-xylene fraction). Among these, the Industrial Grade segment is the most dominant due to its widespread use in various applications, including the production of phthalic anhydride and other chemicals. The High Purity Grade is gaining traction in specialized applications, while Mixed Xylenes Feedstock serves as a crucial input for further processing in the chemical industry .

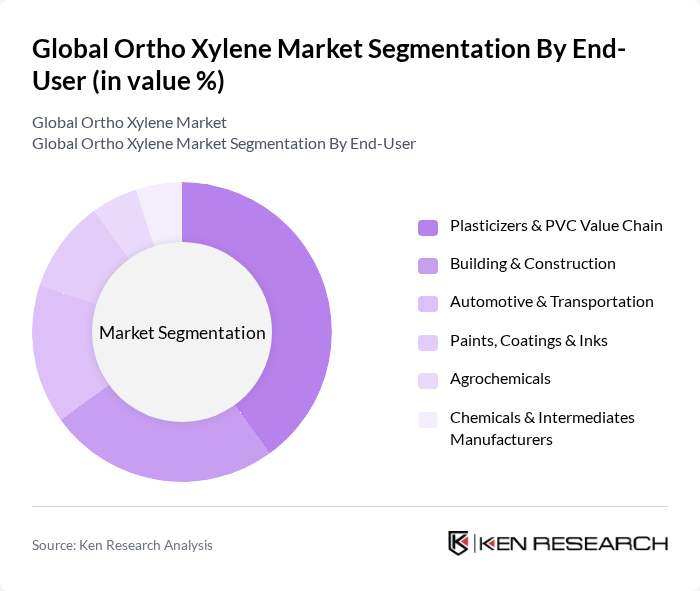

By End-User:The ortho xylene market is segmented by end-user industries, including Plasticizers & PVC Value Chain, Building & Construction, Automotive & Transportation, Paints, Coatings & Inks, Agrochemicals, and Chemicals & Intermediates Manufacturers. The Plasticizers & PVC Value Chain segment holds the largest share, driven by the increasing demand for flexible PVC products in construction and automotive applications. The Building & Construction sector is also significant, as ortho xylene is used in various coatings and adhesives .

The Global Ortho Xylene Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Shell Chemicals, BASF SE, China Petroleum & Chemical Corporation (Sinopec), Reliance Industries Limited, Formosa Chemicals & Fibre Corp., LG Chem Ltd., JXTG Nippon Oil & Energy (ENEOS Corporation), Mitsubishi Gas Chemical Company, Inc., LyondellBasell Industries N.V., TotalEnergies SE, SK Geo Centric Co., Ltd. (SK Innovation), PKN ORLEN S.A. (ORLEN Unipetrol), Covestro AG, Indorama Ventures Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space .

The ortho xylene market is poised for significant transformation as sustainability becomes a central focus for industries. With increasing investments in research and development, companies are likely to innovate more eco-friendly production methods. Additionally, the rise of bio-based ortho xylene could reshape market dynamics, appealing to environmentally conscious consumers. As emerging markets continue to expand, the demand for ortho xylene in various applications is expected to grow, presenting new avenues for market players to explore and capitalize on.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade (?99% o-xylene) High Purity Grade (?99.7% o-xylene) Mixed Xylenes Feedstock (o-xylene fraction) |

| By End-User | Plasticizers & PVC Value Chain Building & Construction Automotive & Transportation Paints, Coatings & Inks Agrochemicals Chemicals & Intermediates Manufacturers |

| By Application | Phthalic Anhydride (primary) Plasticizers (DOP, DBP and others) Alkyd Resins & Unsaturated Polyester Resins Dyes & Pigments Flame Retardants & Lube Oil Additives Solvents & Blending |

| By Distribution Channel | Direct Offtake (Producers to Large Buyers) Distributors/Traders Contract/Toll Manufacturing |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Basis | Formula/Index-Linked (naphtha, MX benchmarks) Spot Pricing Contract Pricing |

| By Others | Specialty Grades for Electronics/Cleanroom Use R&D and Pilot-Scale Consumption Custom Blends and Downstream Derivatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plastics Manufacturing Sector | 100 | Production Managers, Quality Control Supervisors |

| Coatings and Paints Industry | 80 | Product Development Managers, Technical Directors |

| Adhesives and Sealants Market | 70 | Procurement Managers, R&D Specialists |

| Pharmaceuticals and Agrochemicals | 60 | Regulatory Affairs Managers, Product Managers |

| Environmental and Safety Compliance | 50 | Safety Officers, Environmental Managers |

The Global Ortho Xylene Market is valued at approximately USD 4.2 billion, based on a five-year historical analysis. This valuation reflects the significant demand for ortho xylene, primarily as a feedstock for phthalic anhydride used in various chemical applications.