Global Orthopedic Prosthetics Market Overview

- The Global Orthopedic Prosthetics Market is valued at USD 2.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of orthopedic disorders, advancements in prosthetic technology such as microprocessor-controlled and electric-powered devices, and heightened awareness of rehabilitation solutions. The market is further supported by a growing aging population, a rising incidence of diabetes-related amputations, and an increase in trauma and road accident injuries, all of which necessitate the use of prosthetic devices .

- Key players in this market include the United States, Germany, and Japan, which dominate due to their advanced healthcare infrastructure, significant investment in research and development, and a high rate of adoption of innovative prosthetic technologies. The presence of leading manufacturers and a robust distribution network further enhance their market position, making these countries pivotal in the global orthopedic prosthetics landscape .

- In 2023, the U.S. government implemented the "Veterans’ Health Care and Benefits Improvement Act of 2020" (Public Law No: 116-315), issued by the United States Congress. This act includes provisions to improve access to prosthetic and orthotic devices for veterans, mandating that the Department of Veterans Affairs expand coverage and support for advanced prosthetic technologies, thereby enhancing rehabilitation outcomes and quality of life for eligible individuals. The act requires the VA to ensure timely access, comprehensive coverage, and ongoing evaluation of prosthetic services for veterans .

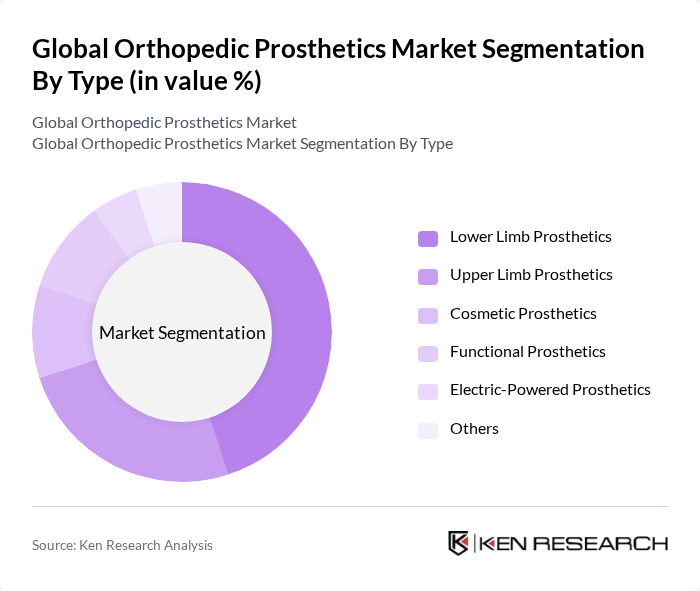

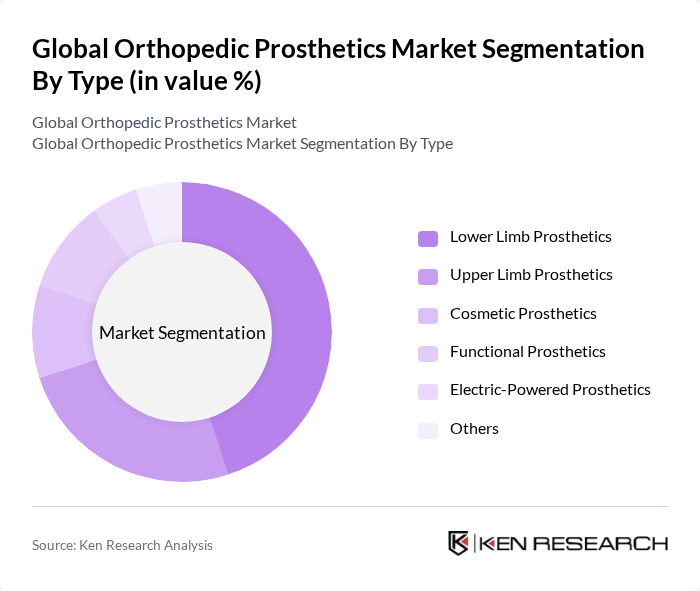

Global Orthopedic Prosthetics Market Segmentation

By Type:The orthopedic prosthetics market is segmented into lower limb prosthetics, upper limb prosthetics, cosmetic prosthetics, functional prosthetics, electric-powered prosthetics, and others. Among these, lower limb prosthetics dominate the market due to the high incidence of lower limb amputations resulting from diabetes, vascular diseases, trauma, and road injuries. The demand for advanced lower limb prosthetics, which offer improved mobility, comfort, and integration of smart technologies, is driving significant growth in this segment .

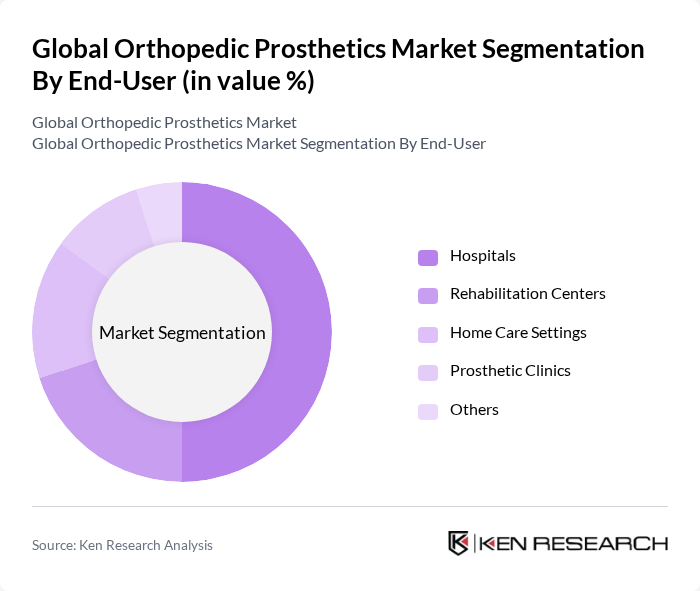

By End-User:The market is also segmented by end-user, which includes hospitals, rehabilitation centers, home care settings, prosthetic clinics, and others. Hospitals are the leading end-user segment, as they provide comprehensive care and rehabilitation services for patients requiring prosthetics. The increasing number of surgical procedures, the need for post-operative care, and the integration of multidisciplinary rehabilitation teams in hospital settings contribute significantly to the demand for orthopedic prosthetics .

Global Orthopedic Prosthetics Market Competitive Landscape

The Global Orthopedic Prosthetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Össur hf, Ottobock SE & Co. KGaA, Hanger, Inc., Blatchford Limited, Stryker Corporation, Zimmer Biomet Holdings, Inc., Medtronic plc, Smith & Nephew plc, Aap Implantate AG, B. Braun Melsungen AG, WillowWood Global LLC, Endolite (Blatchford Group), Freedom Innovations (a part of Ottobock), Proteor SA, Touch Bionics (an Össur company) contribute to innovation, geographic expansion, and service delivery in this space.

Global Orthopedic Prosthetics Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Orthopedic Disorders:The global incidence of orthopedic disorders is projected to reach 1.5 billion cases in future, driven by factors such as sedentary lifestyles and an aging population. According to the World Health Organization, musculoskeletal disorders are among the leading causes of disability worldwide, affecting approximately 20% of adults. This rising prevalence necessitates the demand for orthopedic prosthetics, as patients seek solutions to improve mobility and quality of life.

- Advancements in Prosthetic Technology:The orthopedic prosthetics sector is witnessing rapid technological advancements, with investments in R&D expected to exceed $1.2 billion in future. Innovations such as smart prosthetics equipped with sensors and AI capabilities enhance functionality and user experience. The integration of advanced materials, like carbon fiber and titanium, has also improved durability and performance, making prosthetics more appealing to users and healthcare providers alike.

- Rising Geriatric Population:The global geriatric population is projected to surpass 2 billion in future, significantly impacting the orthopedic prosthetics market. Older adults are more susceptible to orthopedic conditions, leading to increased demand for prosthetic solutions. The United Nations reports that in future, approximately 22% of the population in developed countries will be aged 60 and above, creating a substantial market for orthopedic devices tailored to this demographic's needs.

Market Challenges

- High Cost of Advanced Prosthetics:The cost of advanced orthopedic prosthetics can range from $5,000 to over $100,000, depending on the technology and customization involved. This high price point limits accessibility for many patients, particularly in low-income regions. According to the World Bank, approximately 1.3 billion people live on less than $2 a day, highlighting the financial barriers that prevent access to essential prosthetic devices.

- Limited Access in Developing Regions:In many developing regions, access to orthopedic prosthetics remains severely limited, with only 10% of individuals in need receiving appropriate devices. The World Health Organization estimates that over 30 million people in low-income countries require prosthetic limbs but lack access due to inadequate healthcare infrastructure. This disparity poses a significant challenge for market growth and equitable healthcare delivery.

Global Orthopedic Prosthetics Market Future Outlook

The orthopedic prosthetics market is poised for significant transformation, driven by technological innovations and demographic shifts. As the geriatric population expands and awareness of prosthetic solutions increases, demand will likely surge. Additionally, the integration of AI and robotics into prosthetic design will enhance functionality and user experience. Collaborations with healthcare providers will further facilitate access to advanced prosthetics, ensuring that more patients benefit from these innovations in the coming years.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present a significant opportunity for growth, with an expected increase in healthcare spending projected to reach $1 trillion in future. This growth will facilitate the introduction of affordable prosthetic solutions, addressing the needs of underserved populations and driving market expansion in regions with high demand.

- Development of Customized Prosthetics:The demand for customized prosthetics is on the rise, with the market for personalized devices expected to grow significantly. Advances in 3D printing technology allow for tailored solutions that meet individual patient needs, enhancing comfort and functionality. This trend is anticipated to attract investment and innovation, further expanding market opportunities.