Region:Global

Author(s):Dev

Product Code:KRAA1542

Pages:97

Published On:August 2025

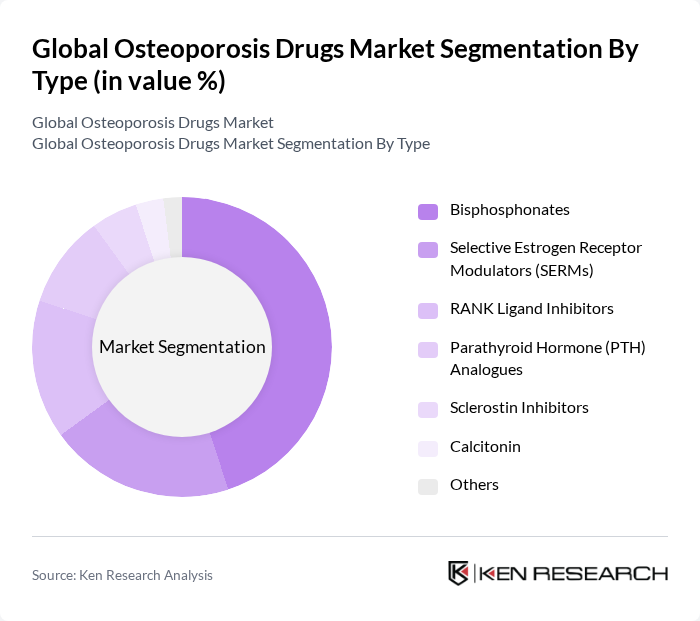

By Type:The market is segmented into various types of osteoporosis drugs, including Bisphosphonates, Selective Estrogen Receptor Modulators (SERMs), RANK Ligand Inhibitors, Parathyroid Hormone (PTH) Analogues, Sclerostin Inhibitors, Calcitonin, and Others. Among these, Bisphosphonates are the most widely used due to their proven efficacy in reducing fracture risk and their long-standing presence in the market. Authoritative market sources consistently report bisphosphonates as holding the largest share within product classes, supported by extensive clinical use and generic availability .

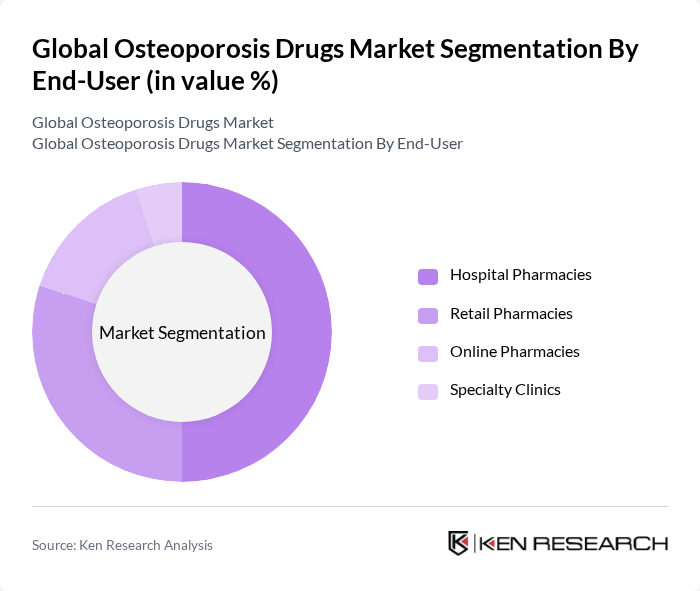

By End-User:The market is segmented by end-users, including Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Specialty Clinics. Hospital Pharmacies dominate the market due to their ability to manage injectable biologics (e.g., denosumab) and oversee complex osteoporosis treatment regimens, with Retail and Online Pharmacies serving large volumes of oral bisphosphonates. Higher fracture-related admissions and coordinated post-fracture care pathways in hospitals further support higher dispensing through hospital channels .

The Global Osteoporosis Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Eli Lilly and Company, Merck & Co., Inc., Novartis AG, Pfizer Inc., Sanofi, Teva Pharmaceutical Industries Ltd., GSK plc, Takeda Pharmaceutical Company Limited, UCB S.A., Radius Health, Inc. (a Gurnet Point Capital company), Ipsen, Organon & Co., Viatris Inc., Dr. Reddy’s Laboratories Ltd. contribute to innovation, geographic expansion, and service delivery in this space. The therapeutic landscape spans antiresorptives (e.g., bisphosphonates, denosumab), anabolics (e.g., teriparatide, abaloparatide), and emerging mechanisms such as sclerostin inhibition, reflecting ongoing R&D investment and lifecycle management strategies across branded and generic portfolios .

The future of the osteoporosis drugs market appears promising, driven by ongoing advancements in drug development and a growing emphasis on personalized medicine. As healthcare providers increasingly adopt digital health solutions, patient engagement and monitoring will improve, enhancing treatment outcomes. Furthermore, the integration of telemedicine is expected to facilitate better management of osteoporosis, particularly in underserved areas, ensuring that more patients receive timely and effective care.

| Segment | Sub-Segments |

|---|---|

| By Type | Bisphosphonates Selective Estrogen Receptor Modulators (SERMs) RANK Ligand Inhibitors Parathyroid Hormone (PTH) Analogues Sclerostin Inhibitors Calcitonin Others |

| By End-User | Hospital Pharmacies Retail Pharmacies Online Pharmacies Specialty Clinics |

| By Route of Administration | Oral Injectable (Subcutaneous/Intravenous) Intranasal |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies |

| By Age Group | Adult (18–64 years) Geriatric (65+ years) |

| By Drug Class | Anti-resorptive Agents (Bisphosphonates, SERMs, RANKL inhibitors, Calcitonin) Anabolic Agents (PTH analogues, Sclerostin inhibitors) Hormone Therapy |

| By Treatment Duration | Short-term Long-term Maintenance Therapy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologist Insights | 100 | Endocrinologists, Osteoporosis Specialists |

| Pharmacist Perspectives | 80 | Community Pharmacists, Hospital Pharmacists |

| Patient Experience Feedback | 150 | Osteoporosis Patients, Caregivers |

| Healthcare Provider Surveys | 120 | General Practitioners, Rheumatologists |

| Market Access Insights | 90 | Market Access Managers, Health Economists |

The Global Osteoporosis Drugs Market is valued at approximately USD 15.3 billion, reflecting a significant demand for pharmacologic management of fracture risk, particularly among postmenopausal women and older adults.