Region:Global

Author(s):Shubham

Product Code:KRAB0736

Pages:99

Published On:August 2025

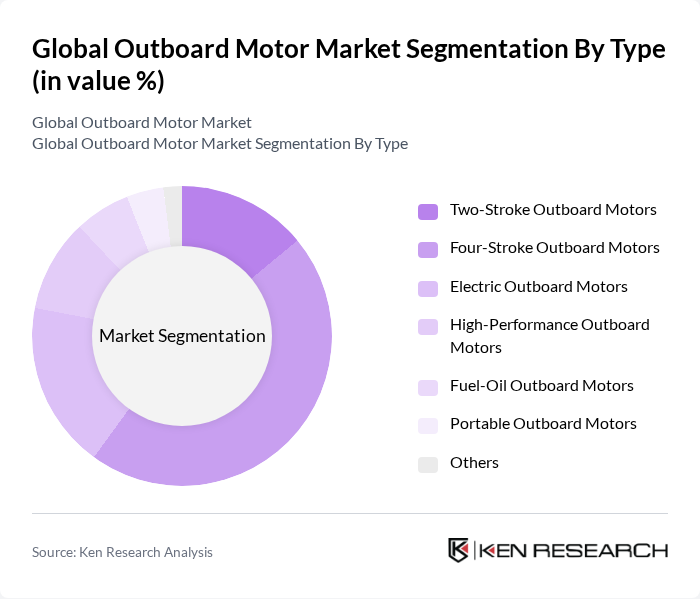

By Type:The outboard motor market is segmented into Two-Stroke Outboard Motors, Four-Stroke Outboard Motors, Electric Outboard Motors, High-Performance Outboard Motors, Fuel-Oil Outboard Motors, Portable Outboard Motors, and Others. Four-Stroke Outboard Motors currently dominate the market, driven by their superior fuel efficiency, reduced emissions, and growing consumer preference for environmentally responsible options. The increasing adoption of electric outboard motors, supported by advances in battery technology and regulatory incentives, is further shaping the market landscape .

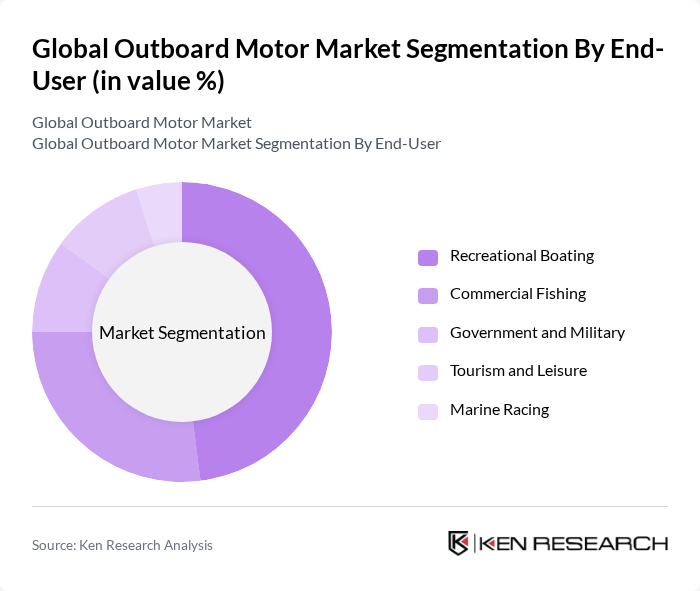

By End-User:The end-user segmentation consists of Recreational Boating, Commercial Fishing, Government and Military, Tourism and Leisure, and Marine Racing. Recreational Boating is the leading segment, fueled by the rising popularity of leisure activities, water sports, and increased disposable income. The commercial fishing sector also represents a significant share, supported by demand for reliable and efficient marine propulsion in professional applications .

The Global Outboard Motor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yamaha Motor Co., Ltd., Honda Motor Co., Ltd., Mercury Marine (Brunswick Corporation), Suzuki Motor Corporation, Evinrude (BRP Inc.), Tohatsu Corporation, Nissan Marine, Selva Marine, Parsun Power Machine Co., Ltd., Torqeedo GmbH, Minn Kota (Johnson Outdoors Inc.), Hidea Power Machinery Co., Ltd., Cox Marine, Crescent Sweden AB, and Lehr Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The outboard motor market is poised for significant transformation as it adapts to evolving consumer preferences and regulatory landscapes. The shift towards eco-friendly technologies is expected to drive innovation, with manufacturers focusing on electric and hybrid models. Additionally, the integration of smart technologies, such as GPS and connectivity features, will enhance user experience. As online sales channels expand, accessibility to outboard motors will improve, further stimulating market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Two-Stroke Outboard Motors Four-Stroke Outboard Motors Electric Outboard Motors High-Performance Outboard Motors Fuel-Oil Outboard Motors Portable Outboard Motors Others |

| By End-User | Recreational Boating Commercial Fishing Government and Military Tourism and Leisure Marine Racing |

| By Application | Fishing Water Sports Transportation Utility Yachting |

| By Distribution Channel | Direct Sales Online Retail Marine Equipment Dealers OEM Sales Others |

| By Engine Power | Below 10 HP 50 HP 100 HP 150 HP Above 150 HP |

| By Fuel Type | Gasoline Diesel Electric Hybrid |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Recreational Boating Market | 100 | Boat Owners, Marine Enthusiasts |

| Commercial Fishing Sector | 80 | Commercial Fishermen, Fleet Managers |

| Marine Equipment Retailers | 60 | Store Managers, Sales Representatives |

| Boat Manufacturing Industry | 50 | Production Managers, Design Engineers |

| Environmental Regulatory Bodies | 40 | Policy Makers, Environmental Consultants |

The Global Outboard Motor Market is valued at approximately USD 10 billion, driven by factors such as the increasing popularity of recreational boating, advancements in technology, and a growing demand for fuel-efficient and environmentally friendly engines.