Region:Global

Author(s):Dev

Product Code:KRAC2770

Pages:86

Published On:October 2025

By Type:The outdoor furniture market is segmented into various types, including seating, tables, loungers, umbrellas, fire pits, accessories, and others. Among these,seating optionssuch as chairs, sofas, and benches dominate the market due to their essential role in outdoor spaces, catering to both residential and commercial needs. The trend towards outdoor living, multifunctional furniture, and the desire for comfort and style have led to increased demand for ergonomic and aesthetically pleasing seating solutions .

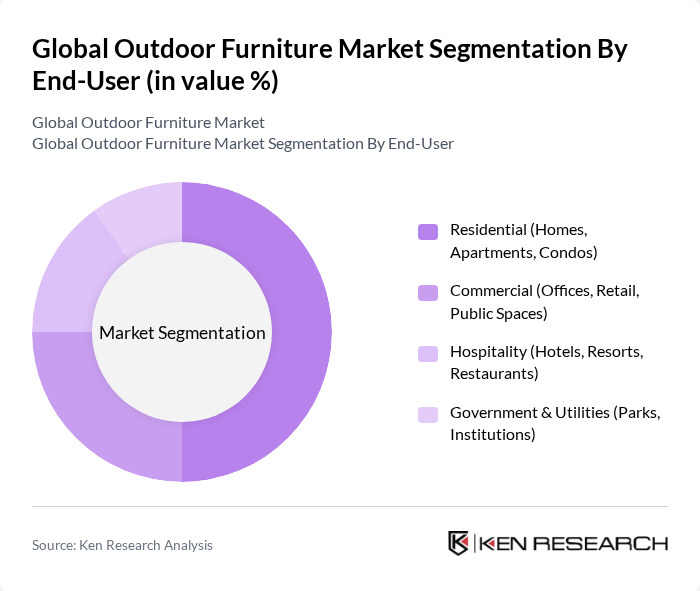

By End-User:The market is also segmented by end-user categories, including residential, commercial, hospitality, and government utilities. Theresidential segmentis the largest, driven by homeowners investing in outdoor spaces for relaxation, entertainment, and hybrid work environments. The growing trend of outdoor living, the desire for aesthetically pleasing environments, and the influence of social media on home improvement contribute significantly to this segment's dominance .

The Global Outdoor Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Brown Jordan, Agio International, POLYWOOD, Keter Group, Lifetime Products, Trex Company, Inc., Gloster Furniture GmbH, Homecrest Outdoor Living, Tropitone Furniture Company, Inc., Hanamint Corporation, Castelle (formerly Pride Family Brands), Woodard Furniture, Sunbrella (Glen Raven, Inc.), Lloyd Flanders Industries, Inc., Fermob, Royal Botania, Kingsley Bate, Kettler, Ethan Allen, and Herman Miller contribute to innovation, geographic expansion, and service delivery in this space.

The future of the outdoor furniture market in future appears promising, driven by evolving consumer preferences and technological advancements. As outdoor living becomes increasingly integrated into lifestyle choices, manufacturers are expected to focus on multifunctional and smart furniture solutions. Additionally, the rise of e-commerce platforms will facilitate broader market access, enabling consumers to explore diverse product offerings. This dynamic environment will likely foster innovation and sustainability, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Seating (Chairs, Sofas, Benches) Tables (Dining, Coffee, Side) Loungers & Daybeds Umbrellas and Shade Structures Fire Pits, Heaters & Outdoor Cooking Accessories (Cushions, Covers, Storage) Others (Swings, Hammocks, Planters) |

| By End-User | Residential (Homes, Apartments, Condos) Commercial (Offices, Retail, Public Spaces) Hospitality (Hotels, Resorts, Restaurants) Government & Utilities (Parks, Institutions) |

| By Material | Wood (Teak, Eucalyptus, Acacia) Metal (Aluminum, Steel, Wrought Iron) Plastic & Resin Fabric (Textiles, Upholstery) Composite & Synthetic Materials (WPC, Rattan, HDPE) Others (Glass, Stone, Concrete) |

| By Style | Modern Traditional Rustic Contemporary Others |

| By Distribution Channel | Online Retail (E-commerce, D2C) Offline Retail (Showrooms, Specialty Stores) Direct Sales (Manufacturer to Customer) Wholesale & B2B Others (Catalog, Pop-up Events) |

| By Price Range | Budget Mid-Range Premium & Luxury |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Outdoor Furniture Purchases | 100 | Homeowners, Interior Designers |

| Commercial Outdoor Furniture Usage | 80 | Facility Managers, Restaurant Owners |

| Trends in Sustainable Outdoor Furniture | 60 | Sustainability Officers, Product Developers |

| Consumer Preferences in Outdoor Living Spaces | 90 | General Consumers, Market Analysts |

| Impact of E-commerce on Outdoor Furniture Sales | 70 | E-commerce Managers, Digital Marketing Specialists |

The Global Outdoor Furniture Market is valued at approximately USD 53 billion, reflecting a significant growth trend driven by increasing consumer interest in outdoor living spaces and home improvement projects.