Region:Global

Author(s):Dev

Product Code:KRAC0552

Pages:92

Published On:August 2025

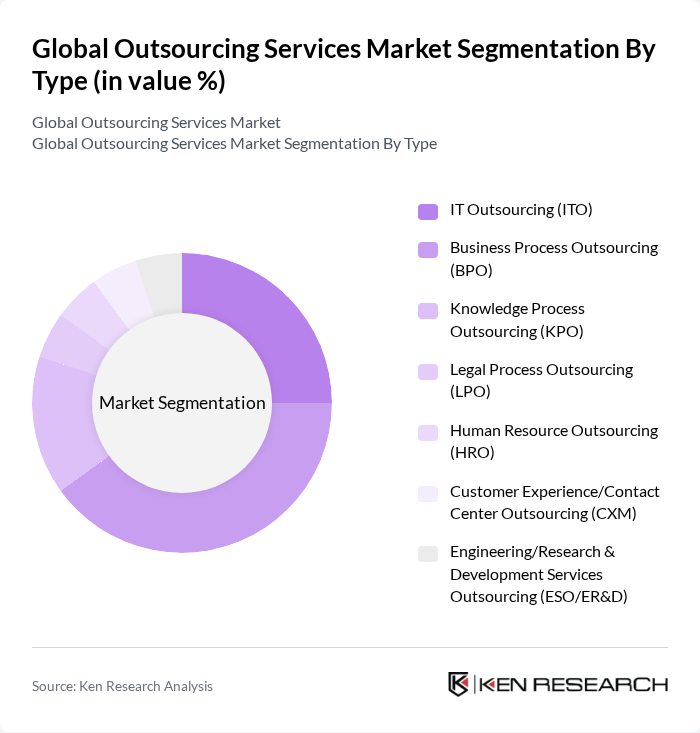

By Type:The outsourcing services market is segmented into various types, including IT Outsourcing (ITO), Business Process Outsourcing (BPO), Knowledge Process Outsourcing (KPO), Legal Process Outsourcing (LPO), Human Resource Outsourcing (HRO), Customer Experience/Contact Center Outsourcing (CXM), and Engineering/Research & Development Services Outsourcing (ESO/ER&D). Among these, BPO has emerged as the leading segment due to its extensive application across industries, particularly in customer service and back-office operations. The demand for BPO services is driven by the need for companies to enhance efficiency and reduce operational costs.

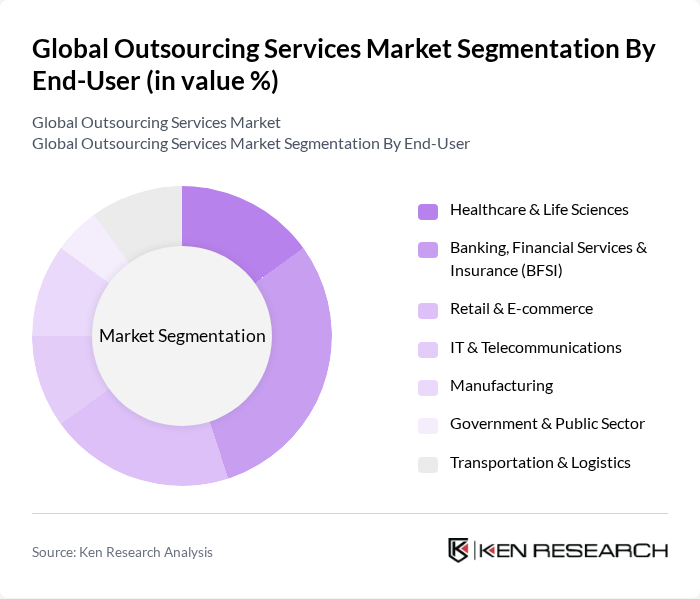

By End-User:The market is also segmented by end-user industries, including Healthcare & Life Sciences, Banking, Financial Services & Insurance (BFSI), Retail & E-commerce, IT & Telecommunications, Manufacturing, Government & Public Sector, and Transportation & Logistics. The BFSI sector is currently the dominant end-user, driven by the need for regulatory compliance, risk management, and customer service enhancement. Financial institutions are increasingly outsourcing functions to improve efficiency and focus on core banking operations.

The Global Outsourcing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, IBM Corporation, Tata Consultancy Services (TCS), Infosys Limited, Wipro Limited, Capgemini, Cognizant Technology Solutions, HCLTech (HCL Technologies), DXC Technology, Genpact, Teleperformance, Foundever (Sitel Group), Alorica, Concentrix, Atento, Tech Mahindra, NTT DATA, EPAM Systems, Capita plc, EXL Service contribute to innovation, geographic expansion, and service delivery in this space.

The future of the outsourcing services market appears promising, driven by technological innovations and evolving business needs. As companies increasingly adopt digital transformation strategies, the demand for outsourcing services is expected to rise. The integration of AI and automation will enhance service delivery, while the focus on sustainability will shape outsourcing practices. Additionally, the expansion into emerging markets will provide new avenues for growth, allowing firms to tap into diverse talent pools and cost-effective solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | IT Outsourcing (ITO) Business Process Outsourcing (BPO) Knowledge Process Outsourcing (KPO) Legal Process Outsourcing (LPO) Human Resource Outsourcing (HRO) Customer Experience/Contact Center Outsourcing (CXM) Engineering/Research & Development Services Outsourcing (ESO/ER&D) |

| By End-User | Healthcare & Life Sciences Banking, Financial Services & Insurance (BFSI) Retail & E-commerce IT & Telecommunications Manufacturing Government & Public Sector Transportation & Logistics |

| By Service Model | Onshore Outsourcing Nearshore Outsourcing Offshore Outsourcing Hybrid/Global Delivery Model |

| By Industry Vertical | Information Technology Healthcare & Life Sciences Retail & E-commerce Manufacturing BFSI Media & Entertainment, Energy & Utilities, and Others |

| By Geographic Scope | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Engagement Model | Project-Based Engagement Dedicated Team/Staff Augmentation Managed Services Outcome-Based/As-a-Service Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Outsourcing Services | 140 | IT Managers, CIOs, Technology Directors |

| Business Process Outsourcing | 120 | Operations Managers, BPO Executives |

| Knowledge Process Outsourcing | 100 | Research Analysts, Knowledge Managers |

| Customer Support Outsourcing | 80 | Customer Service Managers, Call Center Supervisors |

| Finance and Accounting Outsourcing | 90 | Finance Directors, Accounting Managers |

The Global Outsourcing Services Market is valued at approximately USD 1 trillion, driven by the demand for cost-effective solutions and technological advancements. This market has seen significant growth across various sectors, including IT, healthcare, and finance.