Region:Global

Author(s):Dev

Product Code:KRAD0506

Pages:94

Published On:August 2025

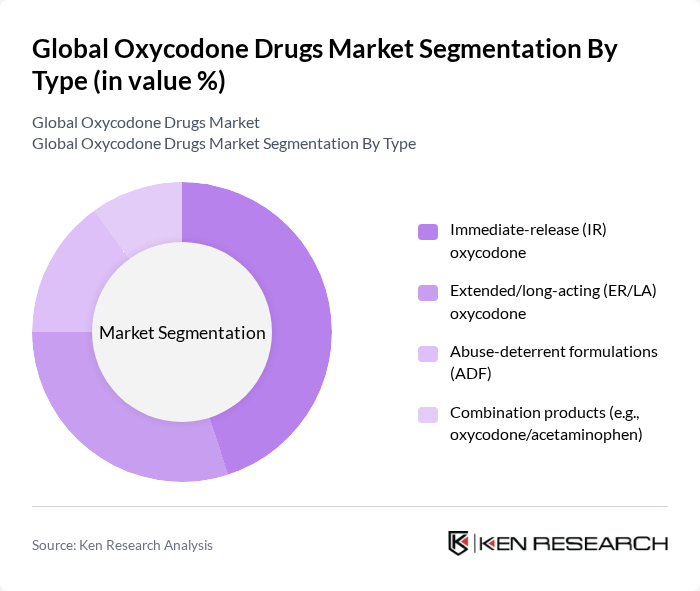

By Type:The market is segmented into various types of oxycodone formulations, including immediate-release (IR), extended/long-acting (ER/LA), abuse-deterrent formulations (ADF), and combination products. Among these, immediate-release oxycodone is widely used for acute pain due to rapid onset, while extended-release formulations are gaining traction for chronic pain by providing prolonged analgesia; manufacturers continue to invest in ER/LA and ADF technologies to balance efficacy with tamper-resistance.

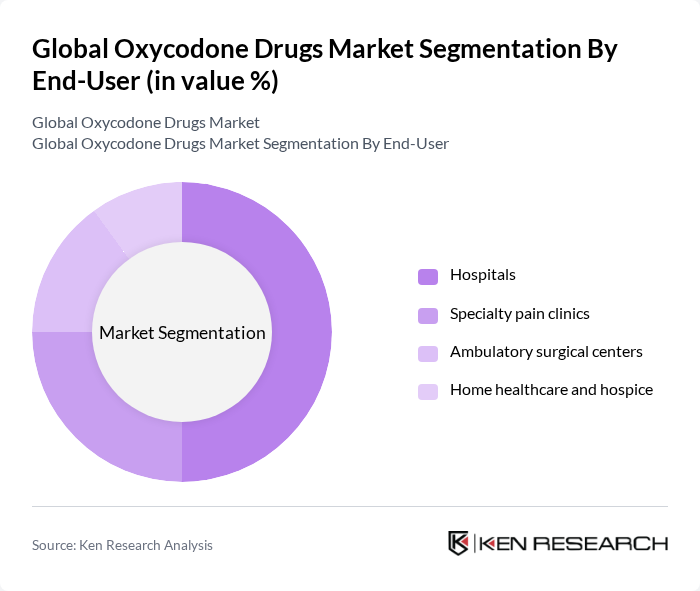

By End-User:The end-user segmentation includes hospitals, specialty pain clinics, ambulatory surgical centers, and home healthcare and hospice services. Hospitals are leading end-users given acute pain management needs and perioperative care, while specialty pain clinics focus on chronic pain pathways; ambulatory surgery centers utilize short-course IR opioids post-procedure, and hospice/home health centers manage palliative pain needs.

The Global Oxycodone Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Purdue Pharma L.P. (including Rhodes Pharmaceuticals L.P.), Johnson & Johnson (Janssen Pharmaceuticals), Teva Pharmaceutical Industries Ltd., Mallinckrodt Pharmaceuticals, Endo International plc (Endo Pharmaceuticals), Hikma Pharmaceuticals PLC, Sandoz Group AG, Pfizer Inc., Viatris Inc. (Mylan), Amneal Pharmaceuticals Inc., Aurobindo Pharma Ltd., Sun Pharmaceutical Industries Ltd., Zydus Lifesciences Ltd. (formerly Zydus Cadila), Cipla Ltd., Alvogen (including Almatica Pharma) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oxycodone market in the future is poised for transformation, driven by advancements in pain management strategies and a growing emphasis on patient-centered care. As healthcare providers increasingly adopt personalized medicine approaches, the demand for tailored pain relief solutions will rise. Additionally, the integration of telemedicine into pain management practices is expected to enhance patient access to oxycodone prescriptions, ensuring that those in need receive timely and effective treatment while addressing safety concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Immediate-release (IR) oxycodone Extended/long-acting (ER/LA) oxycodone Abuse-deterrent formulations (ADF) Combination products (e.g., oxycodone/acetaminophen) |

| By End-User | Hospitals Specialty pain clinics Ambulatory surgical centers Home healthcare and hospice |

| By Distribution Channel | Hospital pharmacies Retail pharmacies Online/mail-order pharmacies Government/Institutional procurement |

| By Formulation | Tablets Capsules Oral solutions/syrups Concentrated oral liquids |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Clinical Application | Chronic non-cancer pain Cancer pain and palliative care Post-operative and acute pain Breakthrough pain |

| By Prescription Status | Branded Generic Authorized generics OTC/Unscheduled (not applicable) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chronic Pain Management Clinics | 120 | Pain Management Specialists, Clinic Administrators |

| Pharmacy Chains | 90 | Pharmacists, Pharmacy Managers |

| Patient Advocacy Groups | 60 | Patient Representatives, Healthcare Advocates |

| Regulatory Bodies | 40 | Policy Makers, Health Regulators |

| Addiction Treatment Centers | 70 | Addiction Counselors, Program Directors |

The Global Oxycodone Drugs Market is valued at approximately USD 5.1 billion. This growth is primarily driven by the increasing prevalence of chronic pain conditions, rising cancer incidence, and the ongoing clinical use of opioids for moderate-to-severe pain management.