Region:Global

Author(s):Shubham

Product Code:KRAC0575

Pages:86

Published On:August 2025

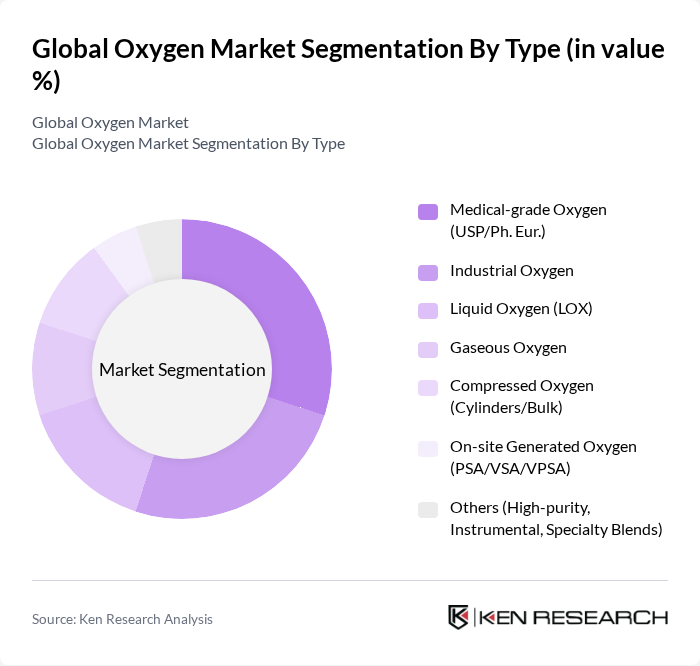

By Type:The oxygen market can be segmented into various types, including medical-grade oxygen, industrial oxygen, liquid oxygen (LOX), gaseous oxygen, compressed oxygen, on-site generated oxygen, and others. Each type serves distinct applications across healthcare and industrial sectors, with varying demand dynamics. Industrial oxygen and liquid oxygen are widely used in steelmaking and other high?temperature processes; medical-grade oxygen is produced and distributed under stringent quality standards; and on?site generated oxygen (PSA/VSA/VPSA) is increasingly adopted by hospitals and remote industrial sites to improve supply security and reduce logistics dependence .

The medical-grade oxygen segment benefits from heightened respiratory care needs, with the oxygen therapy devices and services market itself sized in the mid?USD 30 billion range, reflecting sustained use in hospitals and homecare and ongoing investment after the pandemic period . Industrial oxygen remains the largest overall demand pool globally—driven by steel, chemicals, and refining—while healthcare demand continues to be structurally significant and resilient .

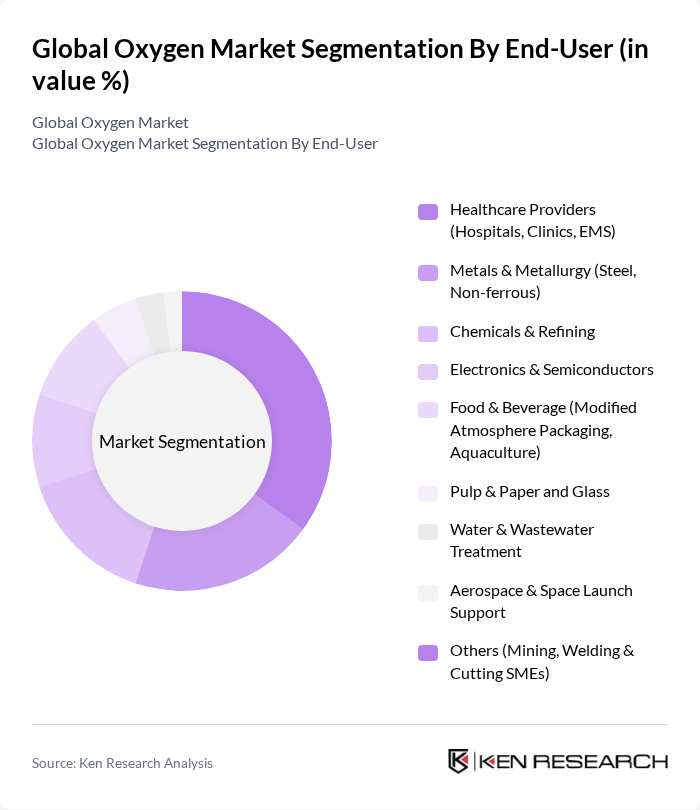

By End-User:The oxygen market can also be segmented by end-user applications, including healthcare providers, metals and metallurgy, chemicals and refining, electronics and semiconductors, food and beverage, pulp and paper, water and wastewater treatment, aerospace, and others. Each end-user segment has unique requirements and growth drivers. Metals and metallurgy rely on oxygen for basic oxygen furnaces and electric arc furnace enrichment; chemicals and refining use oxygen for oxidation processes; healthcare uses medical oxygen for acute and chronic respiratory care; electronics employs high?purity oxygen in fabrication; and water treatment utilizes oxygenation for biological processes .

The healthcare providers segment remains essential given the scale of oxygen therapy usage in inpatient and home settings, with suppliers and hospitals investing in bulk tanks, pipelines, and concentrators to improve resilience; concurrently, metals and metallurgy constitutes the largest industrial consumer, where oxygen boosts furnace efficiency and throughput .

The Global Oxygen Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Liquide S.A., Linde plc, Air Products and Chemicals, Inc., Messer Group GmbH, Taiyo Nippon Sanso Corporation, Matheson Tri-Gas, Inc. (MATHESON), Nippon Gases Europe, Airgas, Inc. (an Air Liquide company), Gulf Cryo, INOX Air Products Pvt. Ltd., Iwatani Corporation, Southern Industrial Gas Sdn. Bhd., Yingde Gases Group Company Limited, SOL Group (Società Ossigeno Liquido S.p.A.), PT Samator Indo Gas Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oxygen market appears promising, driven by the increasing integration of advanced technologies and a growing focus on sustainability. As healthcare demands rise, particularly in home care settings, the market is likely to see innovations in oxygen delivery systems. Additionally, the shift towards sustainable production methods will enhance operational efficiencies, making oxygen more accessible. The expansion into emerging markets will further bolster growth, creating a dynamic landscape for industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Medical-grade Oxygen (USP/Ph. Eur.) Industrial Oxygen Liquid Oxygen (LOX) Gaseous Oxygen Compressed Oxygen (Cylinders/Bulk) On-site Generated Oxygen (PSA/VSA/VPSA) Others (High-purity, Instrumental, Specialty Blends) |

| By End-User | Healthcare Providers (Hospitals, Clinics, EMS) Metals & Metallurgy (Steel, Non-ferrous) Chemicals & Refining Electronics & Semiconductors Food & Beverage (Modified Atmosphere Packaging, Aquaculture) Pulp & Paper and Glass Water & Wastewater Treatment Aerospace & Space Launch Support Others (Mining, Welding & Cutting SMEs) |

| By Application | Respiratory Therapy & Anesthesia Combustion Enhancement & Oxy-fuel Cutting/Welding Steelmaking (BOF/EAF) and Direct Reduction Chemical Synthesis & Oxidation Environmental Applications (Ozone generation, Aeration) Cryogenic Propellant Oxidizer (LOX for Aerospace) R&D and Laboratory Use Others |

| By Distribution Channel | On-site Pipeline Supply (Large tonnage) Bulk Liquid Delivery (Tankers/ISO tanks) Packaged Gas (Cylinders/Bundles) Equipment & Homecare Providers (Concentrators/LOX systems) Distributors/Dealers E-commerce/Direct Ordering Portals Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Pricing Strategy | Contract/Tonnage Pricing (Pipeline/Bulk) Cylinder/Packaged Gas Pricing Value-based Pricing (Purity, Reliability, Service SLAs) Dynamic/Fuel Surcharge-linked Pricing Others |

| By Regulatory Compliance | ISO 7396, ISO 20486, ISO 8573, ISO 14175 FDA/EMA/Pharmacopoeia Standards for Medical Oxygen Environmental Regulations (GHG, energy efficiency) Occupational Safety Standards (OSHA, ATEX, ADR) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Oxygen Supply | 120 | Hospital Administrators, Medical Equipment Suppliers |

| Industrial Gas Applications | 100 | Manufacturing Managers, Process Engineers |

| Aquaculture Oxygen Usage | 80 | Aquaculture Farm Operators, Environmental Scientists |

| Metallurgical Oxygen Demand | 70 | Metallurgists, Production Supervisors |

| Research and Development in Oxygen Technologies | 60 | R&D Managers, Innovation Directors |

The Global Oxygen Market is valued at approximately USD 46 billion, reflecting its significant role in both industrial and medical applications. This valuation is supported by various industry analyses that indicate a consistent market size in the mid-USD 40 billion range.