Region:Global

Author(s):Dev

Product Code:KRAD0457

Pages:97

Published On:August 2025

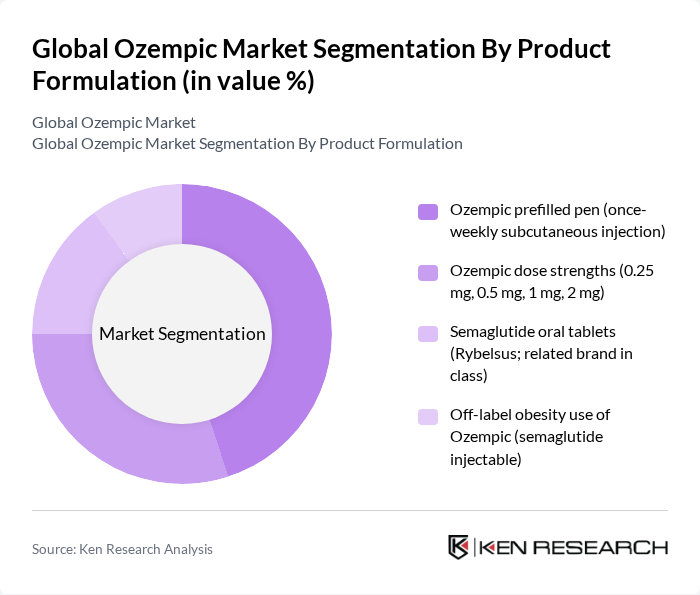

By Product Formulation:This segmentation includes various formulations of Ozempic, which cater to different patient needs and preferences. The subsegments include the Ozempic prefilled pen, various dose strengths, semaglutide oral tablets, and off-label obesity use of Ozempic. The prefilled pen is particularly popular due to its convenience and ease of use, while the oral tablets offer an alternative for patients who prefer not to inject. Evidence shows the market is centered on the injectable Ozempic segment, with related semaglutide products (such as oral Rybelsus) contributing a smaller share, consistent with reported revenue distributions and North America leadership .

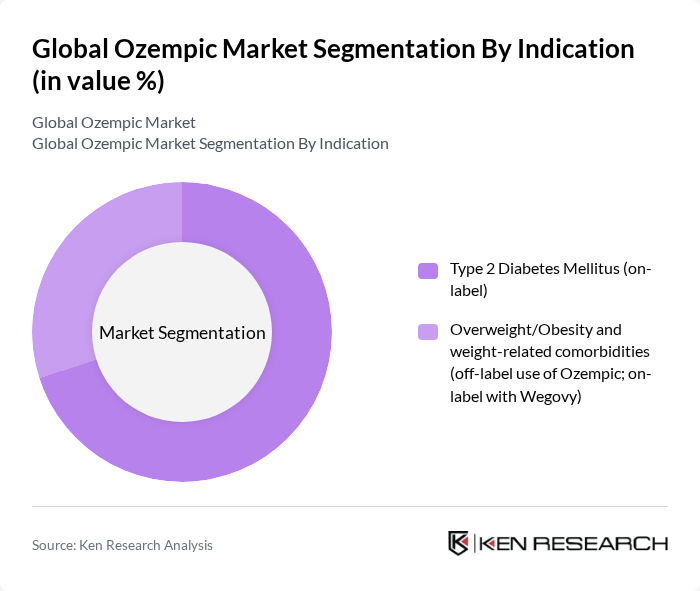

By Indication:This segmentation focuses on the primary medical conditions for which Ozempic is prescribed. The two main indications are Type 2 Diabetes Mellitus and overweight/obesity with related comorbidities. The on-label use for diabetes management remains the dominant indication, while off-label use for weight management is gaining traction as awareness of the drug's efficacy in this area increases. Notably, chronic weight management is on?label for Wegovy (semaglutide) and off?label for Ozempic, which shapes payer coverage and prescribing dynamics across markets .

The Global Ozempic Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novo Nordisk A/S, Eli Lilly and Company, Sanofi S.A., AstraZeneca PLC, Merck & Co., Inc., Boehringer Ingelheim GmbH, Pfizer Inc., Takeda Pharmaceutical Company Limited, Amgen Inc., Bayer AG, Johnson & Johnson, Bristol Myers Squibb Company, GSK plc, Regeneron Pharmaceuticals, Inc., Novartis AG contribute to innovation, geographic expansion, and service delivery in this space. Ozempic (semaglutide) is marketed by Novo Nordisk; market dynamics are influenced by rival incretin portfolios and GLP?1/GIP competitors (e.g., tirzepatide), as reflected in category revenue breakouts and regional leadership data showing North America as the largest market .

The future of the Ozempic market appears promising, driven by increasing healthcare investments and a focus on chronic disease management. As healthcare systems in None evolve, there is a growing emphasis on integrating innovative therapies into treatment protocols. Additionally, the rise of personalized medicine is expected to enhance treatment efficacy, while telehealth services will facilitate better patient engagement and adherence to treatment regimens, ultimately supporting market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Formulation | Ozempic prefilled pen (once-weekly subcutaneous injection) Ozempic dose strengths (0.25 mg, 0.5 mg, 1 mg, 2 mg) Semaglutide oral tablets (Rybelsus; related brand in class) Off-label obesity use of Ozempic (semaglutide injectable) |

| By Indication | Type 2 Diabetes Mellitus (on-label) Overweight/Obesity and weight-related comorbidities (off-label use of Ozempic; on-label with Wegovy) |

| By Distribution Channel | Retail pharmacies Online pharmacies and telehealth platforms Hospital and specialty pharmacies Government tenders and institutional procurement |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Characteristics | Adults (18–64 years) Older adults (65+ years) Patients with cardiovascular risk factors Patients with chronic kidney disease |

| By Treatment Pattern | First-line add-on to metformin Switch/step-up therapy from other GLP-1 RAs Combination with basal insulin Weight management pathway (off-label Ozempic use) |

| By Payer Type | Public reimbursement Private/commercial insurance Out-of-pocket/self-pay |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Endocrinologists | 90 | Endocrinologists, Diabetes Specialists |

| Pharmacists | 80 | Community Pharmacists, Hospital Pharmacists |

| Diabetes Patients | 120 | Current Users of Ozempic, Newly Diagnosed Patients |

| Healthcare Payers | 60 | Payer Analysts, Health Policy Decision-Makers |

| Clinical Researchers | 70 | Clinical Researchers, Clinical Trial Coordinators |

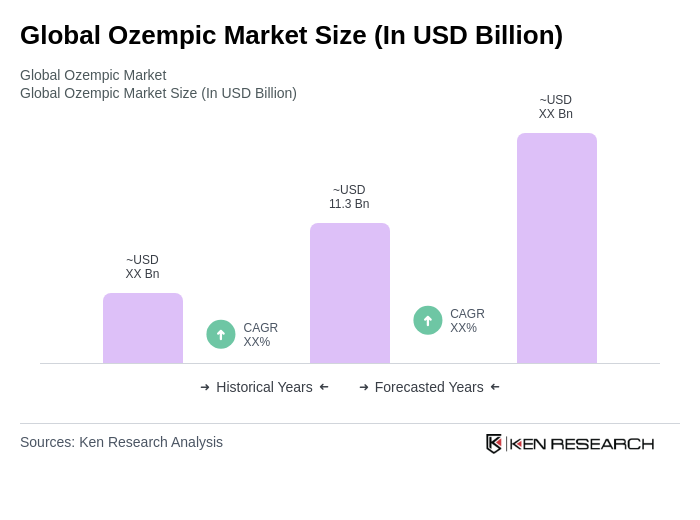

The Global Ozempic Market is valued at approximately USD 11.3 billion, driven by the rising prevalence of type 2 diabetes and obesity, along with increased awareness and adoption of GLP-1 receptor agonists for managing these conditions.