Region:Global

Author(s):Dev

Product Code:KRAB0491

Pages:90

Published On:August 2025

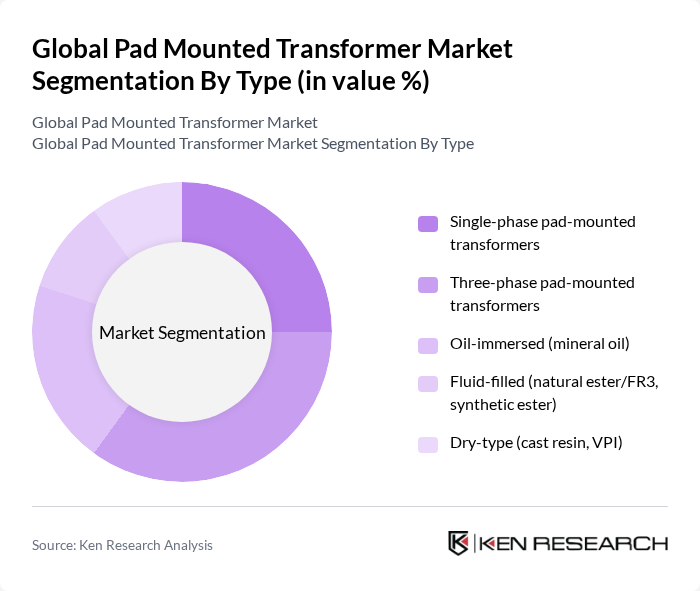

By Type:The market is segmented into various types of pad-mounted transformers, including single-phase and three-phase transformers, as well as oil-immersed, fluid-filled, and dry-type transformers. Each type serves specific applications and customer needs, with varying levels of efficiency and environmental impact. Utilities and commercial campuses typically deploy three-phase units for medium-voltage distribution and larger loads, while single-phase units are common for residential subdivisions; liquid-filled (mineral oil and natural/synthetic esters) dominate due to thermal performance and footprint advantages, with ester fluids gaining share for fire safety and environmental compliance; dry-type pad-mounted remains niche where fluid-free designs are specified .

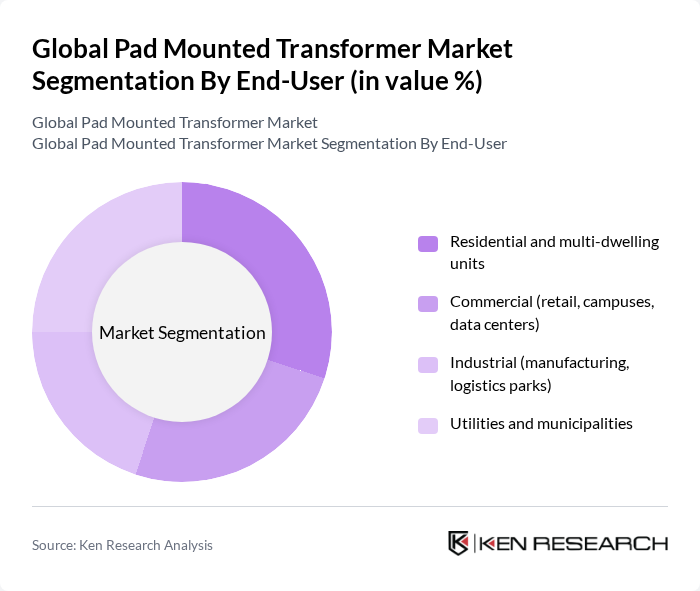

By End-User:The end-user segmentation includes residential and multi-dwelling units, commercial sectors such as retail and data centers, industrial applications, and utilities. Each segment has unique requirements and contributes differently to the overall market dynamics. Utilities drive base demand through grid expansions and replacements; commercial/data center campuses and EV-charging hubs increasingly specify pad-mounted designs for safety, aesthetics, and underground cabling; residential subdivisions and MDUs favor pad-mounted for tamper resistance and compact siting .

The Global Pad Mounted Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric SE, Siemens Energy AG, ABB Ltd., Eaton Corporation plc, General Electric (GE Vernova, Grid Solutions), Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions Corporation, Hitachi Energy Ltd., SGB-SMIT Group, CG Power and Industrial Solutions Limited, Howard Industries, Inc., SPX Technologies, Inc. (SPX Transformer Solutions), Eaton’s Cooper Power Systems (Pad-mounted distribution), ERMCO, Inc. (a subsidiary of AECI), WEG S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the pad mounted transformer market appears promising, driven by the increasing integration of renewable energy sources and advancements in smart grid technologies. As utilities focus on enhancing grid resilience and efficiency, the demand for innovative transformer solutions is expected to rise. Furthermore, the ongoing urbanization and infrastructure development in emerging markets will create additional opportunities for growth, positioning the industry for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-phase pad-mounted transformers Three-phase pad-mounted transformers Oil-immersed (mineral oil) Fluid-filled (natural ester/FR3, synthetic ester) Dry-type (cast resin, VPI) |

| By End-User | Residential and multi-dwelling units Commercial (retail, campuses, data centers) Industrial (manufacturing, logistics parks) Utilities and municipalities |

| By Application | Power distribution and secondary networks Renewable interconnection (solar PV, wind collector systems) Electric vehicle charging infrastructure Underground distribution and urban networks |

| By Power Rating | ?500 kVA –2,500 kVA ,501–5,000 kVA >5,000 kVA |

| By Insulation & Cooling | Mineral oil, ONAN Natural ester (biodegradable), ONAN Synthetic ester/FR fluids, KNAN Dry-type, AN/AF |

| By Configuration | Loop feed Radial feed Compartmentalized tamper-proof Pad-mounted switchgear-integrated |

| By Voltage Class | ?15 kV –25 kV –35 kV >35 kV (special applications) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 120 | Electrical Engineers, Operations Managers |

| Manufacturing Sector | 80 | Procurement Managers, Facility Managers |

| Renewable Energy Projects | 60 | Project Managers, Sustainability Officers |

| Electrical Distribution Networks | 90 | Network Planners, Maintenance Supervisors |

| Research Institutions | 40 | Research Analysts, Academic Professionals |

The Global Pad Mounted Transformer Market is valued at approximately USD 11.012.0 billion, reflecting the demand for modernization of distribution networks and integration of distributed energy across various sectors, including utilities and residential developments.