Region:Global

Author(s):Shubham

Product Code:KRAC0882

Pages:94

Published On:August 2025

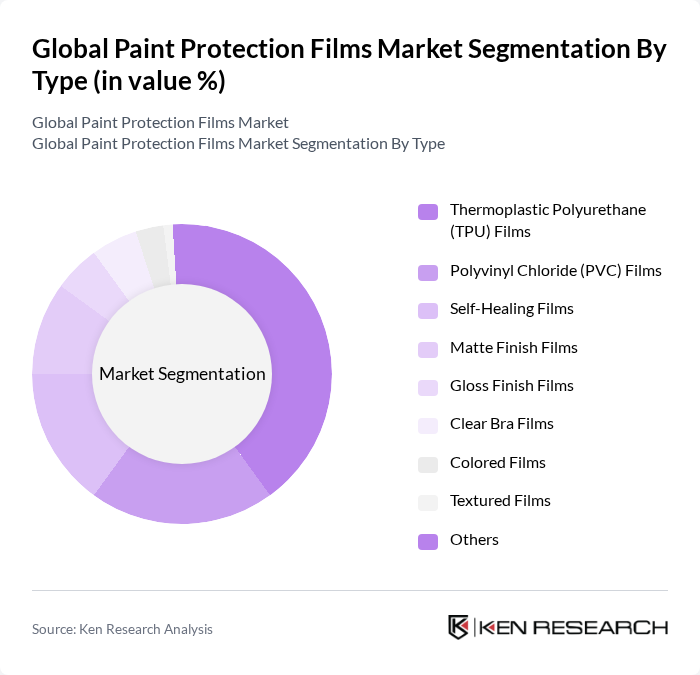

By Type:The market is segmented into various types of paint protection films, including Thermoplastic Polyurethane (TPU) Films, Polyvinyl Chloride (PVC) Films, Self-Healing Films, Matte Finish Films, Gloss Finish Films, Clear Bra Films, Colored Films, Textured Films, and Others. Among these, Thermoplastic Polyurethane (TPU) Films are leading the market due to their superior durability, flexibility, and self-healing properties, making them highly preferred for automotive applications. The increasing trend of vehicle customization and protection against scratches and environmental damage further drives the demand for TPU films. Self-healing films, enabled by advanced polymer technology, are gaining traction for their ability to repair minor scratches and maintain a pristine appearance .

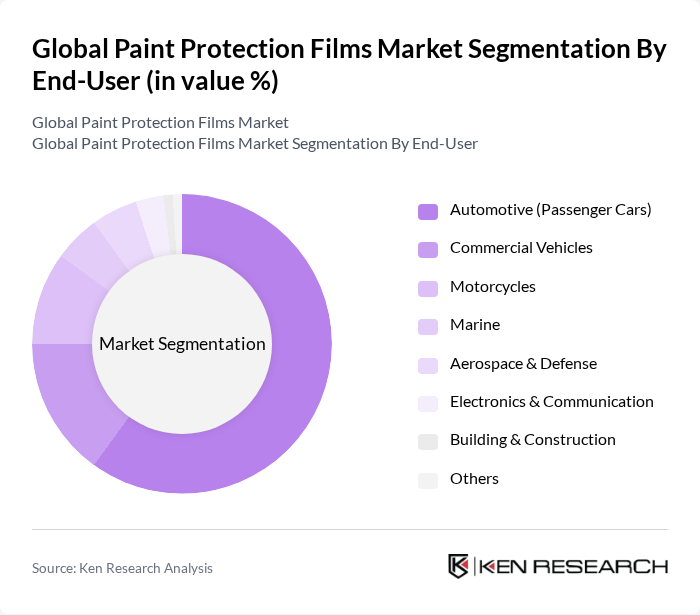

By End-User:The end-user segmentation includes Automotive (Passenger Cars), Commercial Vehicles, Motorcycles, Marine, Aerospace & Defense, Electronics & Communication, Building & Construction, and Others. The automotive sector, particularly passenger cars, dominates the market due to the increasing consumer preference for vehicle protection and aesthetics. The rise in disposable income and the growing trend of vehicle customization are significant factors contributing to the demand in this segment. Commercial vehicles and motorcycles are also adopting paint protection films to extend vehicle lifespan and reduce maintenance costs. The marine and aerospace sectors utilize these films for corrosion resistance and surface protection .

The Global Paint Protection Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Eastman Chemical Company (SunTek, Llumar), XPEL Technologies Corp., Avery Dennison Corporation, Saint-Gobain SA, Hexis S.A., STEK Automotive, PremiumShield Limited, VViViD Vinyls, Paint Protection Film Co., ClearShield, Guardian Paint Protection, KAVACA (by Ceramic Pro), RShield, Tesa SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the paint protection films market appears promising, driven by increasing consumer awareness and technological advancements. As more consumers recognize the long-term benefits of protecting their vehicles, demand is expected to rise significantly. Additionally, the integration of eco-friendly materials and smart technologies will likely enhance product appeal. Companies that adapt to these trends and invest in consumer education will be well-positioned to capture market share in the evolving landscape of automotive care.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermoplastic Polyurethane (TPU) Films Polyvinyl Chloride (PVC) Films Self-Healing Films Matte Finish Films Gloss Finish Films Clear Bra Films Colored Films Textured Films Others |

| By End-User | Automotive (Passenger Cars) Commercial Vehicles Motorcycles Marine Aerospace & Defense Electronics & Communication Building & Construction Others |

| By Application | Exterior Protection (Body Panels, Bumpers, Hoods, Mirrors) Interior Protection (Dashboards, Consoles) Surface Protection (Screens, Touch Panels) Decorative Applications Others |

| By Distribution Channel | Online Retail Offline Retail (Specialty Stores, Automotive Dealerships) Direct Sales Distributors/Installers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Premium Mid-range Budget |

| By Brand | OEM Brands Aftermarket Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Paint Protection Film Installers | 150 | Installation Technicians, Shop Owners |

| Automotive Retailers and Distributors | 100 | Sales Managers, Product Buyers |

| End-Users (Vehicle Owners) | 150 | Car Enthusiasts, General Consumers |

| Automotive Aftermarket Professionals | 80 | Detailing Experts, Service Managers |

| Industry Experts and Analysts | 40 | Market Analysts, Research Consultants |

The Global Paint Protection Films Market is valued at approximately USD 560 million, driven by increasing demand for vehicle protection solutions and rising consumer awareness regarding vehicle aesthetics and longevity.