Region:Global

Author(s):Geetanshi

Product Code:KRAB0073

Pages:84

Published On:August 2025

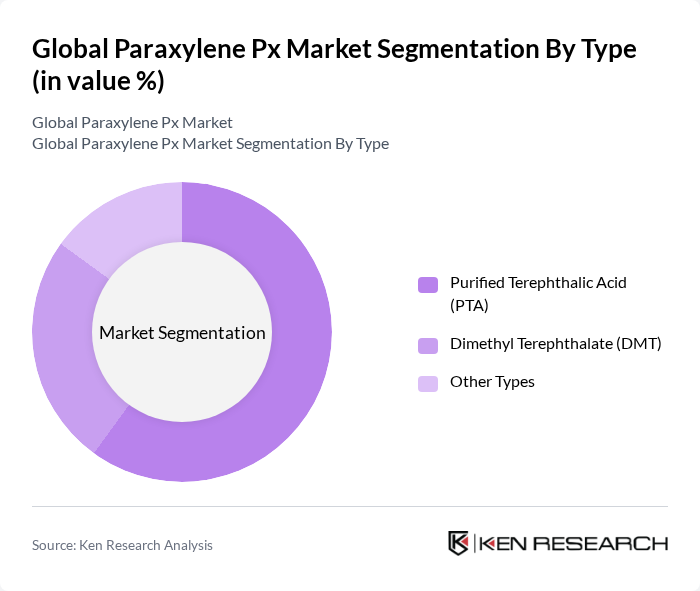

By Type:The market is segmented into three main types: Purified Terephthalic Acid (PTA), Dimethyl Terephthalate (DMT), and Other Types. Among these, Purified Terephthalic Acid (PTA) is the leading sub-segment, primarily due to its extensive use in the production of polyester fibers and resins. The growing demand for PET bottles and textiles has significantly boosted PTA consumption, making it a critical component in the paraxylene market.

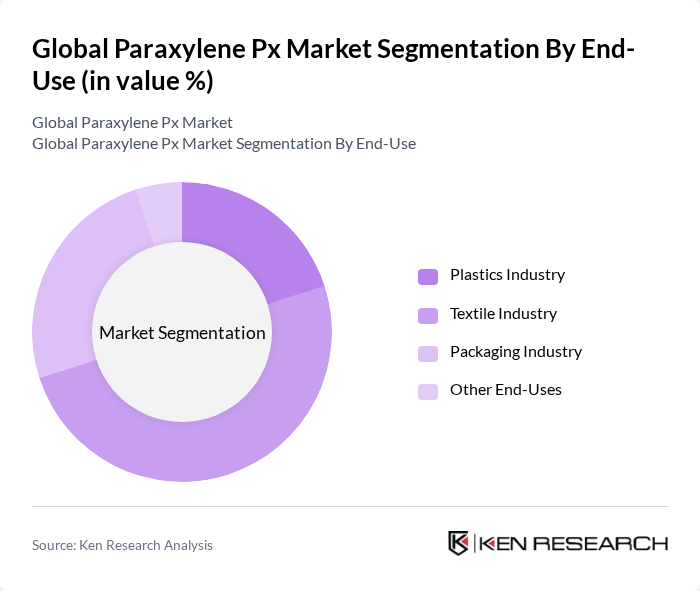

By End-Use:The market is categorized into four end-use segments: Plastics Industry, Textile Industry, Packaging Industry, and Other End-Uses. The Textile Industry is the dominant segment, driven by the high demand for polyester fibers in clothing and home textiles. The increasing trend towards sustainable fashion and the use of recycled materials have further enhanced the growth of this segment, making it a key player in the paraxylene market.

The Global Paraxylene Px Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Reliance Industries Limited, Sinopec Limited, BP PLC, INEOS Group Limited, Lotte Chemical Corporation, Mitsubishi Chemical Corporation, Formosa Plastics Corporation, Alpek S.A.B. de C.V., Haldia Petrochemicals Limited, JBF Industries Limited, Indorama Ventures Public Company Limited, LG Chem Ltd., SABIC (Saudi Basic Industries Corporation), China National Petroleum Corporation (CNPC), Braskem S.A., ENEOS Corporation, Fujian Refining & Petrochemical Company Limited, Mangalore Refinery & Petrochemicals Ltd., Mitsubishi Gas Chemical Company Inc., National Petrochemical Company (NPC), PT Pertamina (Persero), SK Incheon Petrochem Co. Ltd., Toray International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the paraxylene market appears promising, driven by increasing sustainability initiatives and technological advancements. As industries shift towards greener practices, the demand for bio-based paraxylene is expected to rise, aligning with global sustainability goals. Additionally, emerging markets in Asia and Africa present significant growth opportunities, as urbanization and industrialization accelerate. Companies that invest in innovative production technologies will likely gain a competitive edge, positioning themselves favorably in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Purified Terephthalic Acid (PTA) Dimethyl Terephthalate (DMT) Other Types |

| By End-Use | Plastics Industry Textile Industry Packaging Industry Other End-Uses |

| By Application | Polyester Fiber Production PET Resin Production Coatings and Adhesives Other Applications |

| By Distribution Channel | Direct Sales Distributor Sales Online Sales |

| By Region | North America (United States, Canada, Mexico) Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Egypt, Rest of MEA) |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Product Form | Liquid Paraxylene Solid Paraxylene Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Paraxylene Production Facilities | 100 | Plant Managers, Production Supervisors |

| End-User Industries (Textiles, Plastics) | 90 | Procurement Managers, Product Development Heads |

| Logistics and Supply Chain | 60 | Logistics Coordinators, Supply Chain Analysts |

| Market Analysts and Consultants | 50 | Market Research Analysts, Industry Consultants |

| Regulatory Bodies and Associations | 40 | Regulatory Affairs Managers, Policy Advisors |

The Global Paraxylene Px Market is valued at approximately USD 83 billion, driven by the increasing demand for polyester and PET products across various industries, including textiles, packaging, and automotive.