Region:Global

Author(s):Dev

Product Code:KRAC0486

Pages:88

Published On:August 2025

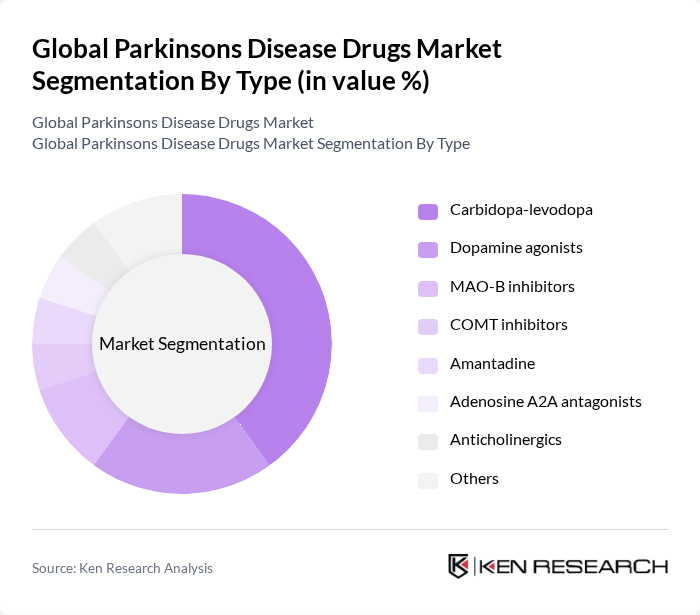

By Type:The market is segmented into various types of drugs used for treating Parkinson's disease. The primary subsegments include Carbidopa-levodopa, Dopamine agonists, MAO-B inhibitors, COMT inhibitors, Amantadine, Adenosine A2A antagonists, Anticholinergics, and Others. Among these, Carbidopa-levodopa remains the most dominant due to its long-standing efficacy and widespread acceptance as the first-line treatment for managing Parkinson's symptoms. The increasing patient population and the need for effective symptom management further bolster its market position.

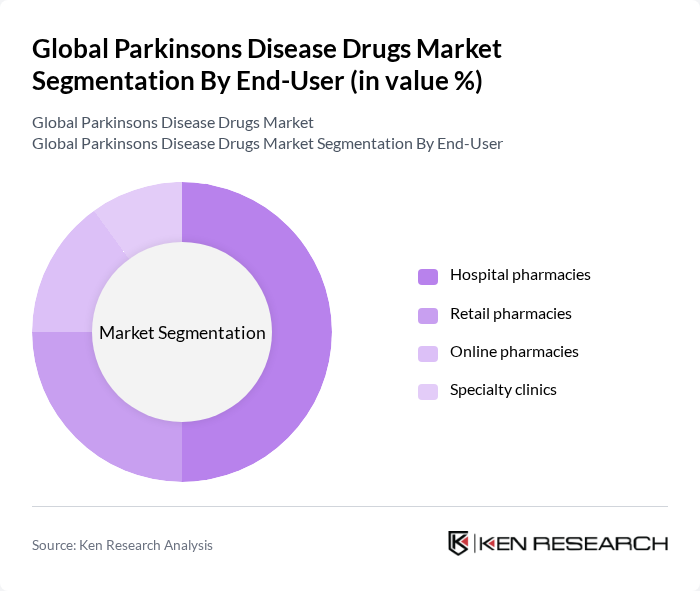

By End-User:The market is segmented based on the end-users of Parkinson's disease drugs, which include Hospital pharmacies, Retail pharmacies, Online pharmacies, and Specialty clinics. Hospital pharmacies dominate this segment due to their ability to provide comprehensive care and access to a wide range of medications. The increasing number of hospital admissions for Parkinson's disease management and the preference for centralized medication dispensing contribute to the growth of this segment.

The Global Parkinson's Disease Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as AbbVie Inc., Amgen Inc., Boehringer Ingelheim International GmbH, Merck & Co., Inc., Novartis AG, Pfizer Inc., F. Hoffmann-La Roche Ltd, Sanofi, Teva Pharmaceutical Industries Ltd., UCB S.A., H. Lundbeck A/S, Kyowa Kirin Co., Ltd., Acorda Therapeutics, Inc., Zambon S.p.A., Biogen Inc., Supernus Pharmaceuticals, Inc., ACADIA Pharmaceuticals Inc., Sunovion Pharmaceuticals Inc., NeuroDerm Ltd. (a Mitsubishi Tanabe Pharma company), Denali Therapeutics Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Parkinson's disease drugs market appears promising, driven by ongoing research and technological advancements. The integration of digital health solutions and telemedicine is expected to enhance patient monitoring and treatment adherence. Additionally, the shift towards combination therapies may improve treatment outcomes. As the market evolves, increased collaboration between pharmaceutical companies and research institutions will likely accelerate the development of innovative therapies, addressing the growing demand for effective Parkinson's disease management.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbidopa-levodopa Dopamine agonists MAO-B inhibitors COMT inhibitors Amantadine Adenosine A2A antagonists Anticholinergics Others |

| By End-User | Hospital pharmacies Retail pharmacies Online pharmacies Specialty clinics |

| By Route of Administration | Oral Transdermal Subcutaneous Infusion Intranasal |

| By Distribution Channel | Hospital pharmacies Retail pharmacies Online pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Type | Early-stage patients Mid-stage patients Late-stage patients |

| By Treatment Type | Symptomatic treatment Disease-modifying treatment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Neurologist Insights | 90 | Neurologists, Movement Disorder Specialists |

| Patient Experience Surveys | 120 | Parkinson's Disease Patients, Caregivers |

| Pharmaceutical Industry Expert Interviews | 60 | R&D Managers, Regulatory Affairs Specialists |

| Healthcare Policy Analysis | 50 | Health Economists, Policy Makers |

| Market Access and Reimbursement Discussions | 70 | Market Access Managers, Payers |

The Global Parkinson's Disease Drugs Market is valued at approximately USD 5.2 billion, reflecting a significant growth driven by the increasing prevalence of Parkinson's disease and advancements in drug formulations and delivery methods.