Region:Global

Author(s):Dev

Product Code:KRAA1656

Pages:94

Published On:August 2025

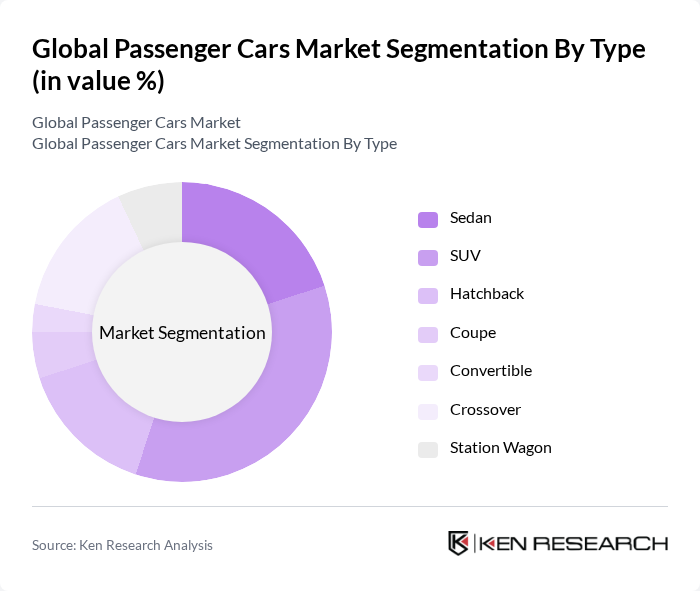

By Type:The passenger cars market is segmented into various types, including Sedan, SUV, Hatchback, Coupe, Convertible, Crossover, and Station Wagon. SUVs and crossovers have gained significant popularity globally due to interior space, versatility, higher seating position, and advanced safety/driver-assistance features; these body styles continue to take share from traditional sedans in many markets. In contrast, in several cost?sensitive and urban markets, compact hatchbacks retain strong appeal for affordability and maneuverability.

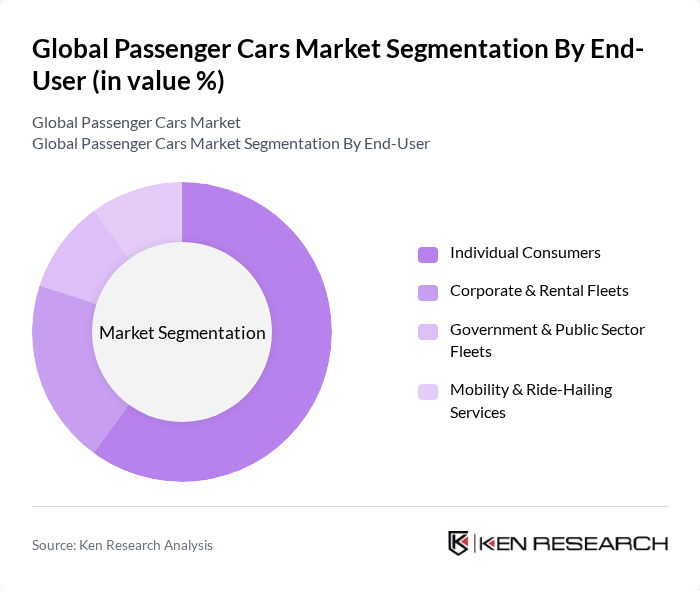

By End-User:The market is also segmented based on end-users, including Individual Consumers, Corporate & Rental Fleets, Government & Public Sector Fleets, and Mobility & Ride-Hailing Services. Individual consumers remain the largest end?user segment globally, supported by demand for personal mobility, improving credit access in emerging markets, and rising preference for tech-rich vehicles. Corporate, leasing, and rental fleets are material purchasers across Europe and North America, while mobility platforms and ride?hailing operators contribute incremental demand in dense urban centers.

The Global Passenger Cars Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Volkswagen Group, Hyundai Motor Group, General Motors Company, Ford Motor Company, Honda Motor Co., Ltd., Nissan Motor Co., Ltd., Stellantis N.V., BMW Group (Bayerische Motoren Werke AG), Mercedes?Benz Group AG, Renault Group, Geely Automobile Holdings Ltd. (incl. Volvo Car AB), Tata Motors Limited (incl. Jaguar Land Rover Automotive plc), SAIC Motor Corporation Limited, Tesla, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the passenger car market is poised for transformation, driven by the ongoing shift towards electrification and connectivity. As governments push for greener transportation solutions, the adoption of electric vehicles is expected to accelerate, with sales projected to reach 30 million units in future. Additionally, advancements in connectivity features will enhance user experience, making vehicles more integrated with digital ecosystems. These trends will shape the market landscape, fostering innovation and competition among manufacturers.

| Segment | Sub-Segments |

|---|---|

| By Type | Sedan SUV Hatchback Coupe Convertible Crossover Station Wagon |

| By End-User | Individual Consumers Corporate & Rental Fleets Government & Public Sector Fleets Mobility & Ride-Hailing Services |

| By Fuel/Drivetrain | Gasoline (Petrol) Diesel Battery Electric Vehicle (BEV) Hybrid Electric Vehicle (HEV) Plug-in Hybrid Electric Vehicle (PHEV) Compressed Natural Gas (CNG) & Others |

| By Price Band | Entry/Economy Mid-Range/Volume Premium/Luxury |

| By Sales Channel | Franchised Dealerships Direct-to-Consumer (OEM Online/Stores) Online Aggregators & Marketplaces |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology Feature Set | Advanced Driver Assistance Systems (ADAS: L1–L2+) Infotainment & Connected Services Vehicle Connectivity (Telematics, OTA) Autonomous Capability (Piloted/Hands-free Features) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Car Manufacturers | 120 | Product Managers, Marketing Directors |

| Automotive Dealerships | 100 | Sales Managers, Customer Experience Managers |

| Consumer Insights | 140 | Car Buyers, Automotive Enthusiasts |

| Automotive Aftermarket Services | 80 | Service Managers, Parts Distributors |

| Electric Vehicle Segment | 70 | EV Product Specialists, Sustainability Managers |

The Global Passenger Cars Market is valued at approximately USD 3.3 trillion, driven by increasing personal mobility demand, the adoption of advanced driver-assistance systems, and a shift towards electrification, particularly in emerging markets like Asia Pacific and Latin America.